ASIA ROUNDUP:

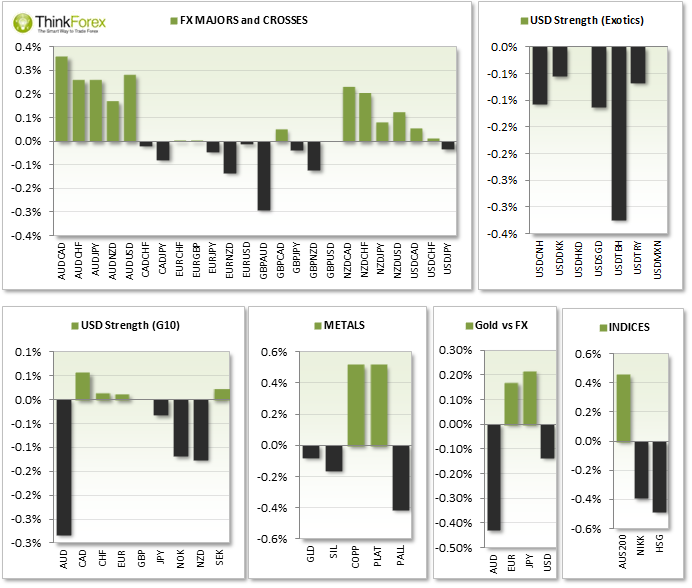

The A$ benefited the most today following today's positive 'Leading Index' release, coming in at 0.3% and the 6th consecutive positive reading.

AUDJPY saw an intraday 8-day high and broke above a descending resistance line.

AUDNZD remains near the 11-week highs and within yesterday's daily range

AUS200 Cash is set to close higher for the 4th consecutive session

Nikkei 225 breaks below yesterday's Shooting Star Reversal candle, which respected the 61.8% retracement.

UP NEXT:

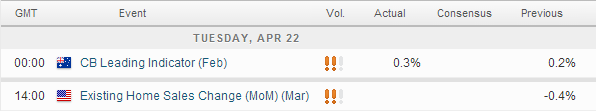

The markets are very quiet today on the news front, as Trader’s return from their 4-day weekend.

US Existing home sales has been declining for 6 months, each below expectations with a further decline expecting in today's release. Whilst it is considered a leading indicator of the economy it doesn't take into consideration sectors such as the construction industry, which would be included in the 'new homes sales'. However with not much news to go on it should at least breathe some life into some of the Majors.

TECHNICAL ANALYSIS:

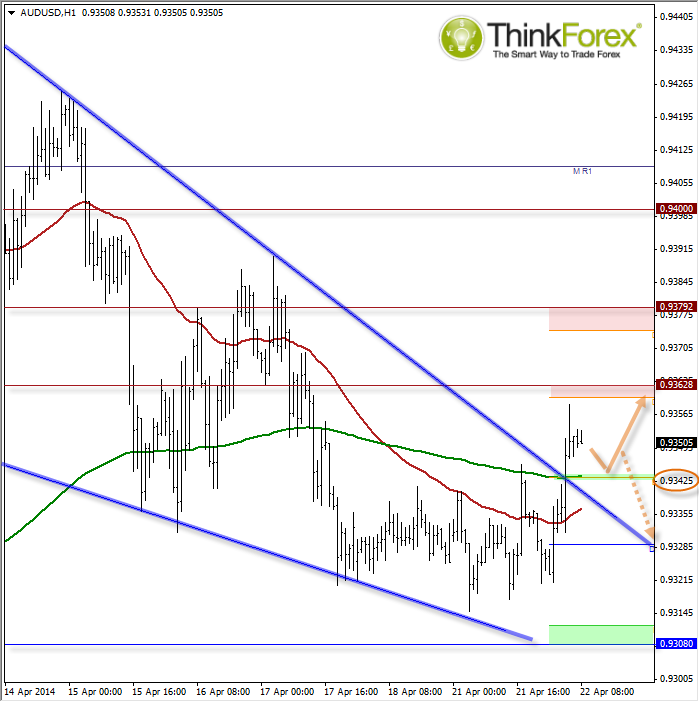

AUDUSD: Breaks out of bullish wedge

Today's bullish sentiment was driven by the positive Leading Index to indicate improving economic conditions for Australia. The intraday chart above shows how 0.9430 was a pivotal area of resistance which may now act as support to provide buying opportunities to trade in line with the bullish wedge pattern.

Scalpers may want to consider short positions as it retraces towards the potential 'buy zone' with a break below 0.9340 opening up the broken trendline as a target.

If bullish opportunities present themselves above 0.9343 then next targets are 0.936 and 0.937.

USDCHF: TPotential bearish wedge

It is labelled 'potential' simply because it has not yet been confirmed. This leaves open the potential for further highs in the meantime.

The markets may be quiet in the lead-up to news from US later so scalpers may want to consider short-positions towards the daily pivot, at which point is bullish setups present themselves then long swing trades could be considered to trade up to 0.8860

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.