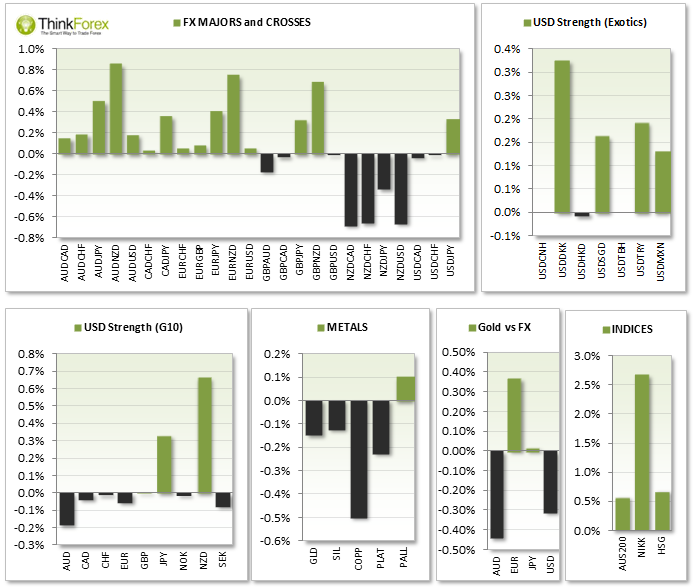

MARKET SNAPSHOT:

ASIA ROUNDUP:

Chinese GDP up 7.4% m/m but has slowed down compared to this time last year of 7.7%; Industrial production fell short at 8.8% vs 9.1% expected; Fixed Asset Investments also fell flat at 17.6% vs 18.1% expected; China Stats Bureau warn we can no longer expect double digit returns for growth and slower growth is down to restructuring.

Japan Economy on steady track Toward 2.0% Inflation

NZD depreciation stole the limelight following poor CPI data and a 5th consecutive day pf dairy prices NZDUSD broke the Feb '13 bullish trendline; NZDCAD also broke a bullish trendline from Dec '13; AUDNZD back up near 8-week highs and reached out 1.09 target which is a likely resistance level

AUS200 continued bullish sentiment early on, albeit dampened following the lead from Wall Street;

BoJ Gov Karudo stated it was "too soon to debate monetary easing exit strategy"

Gold is rumoured to move higher due to shrinking supplies

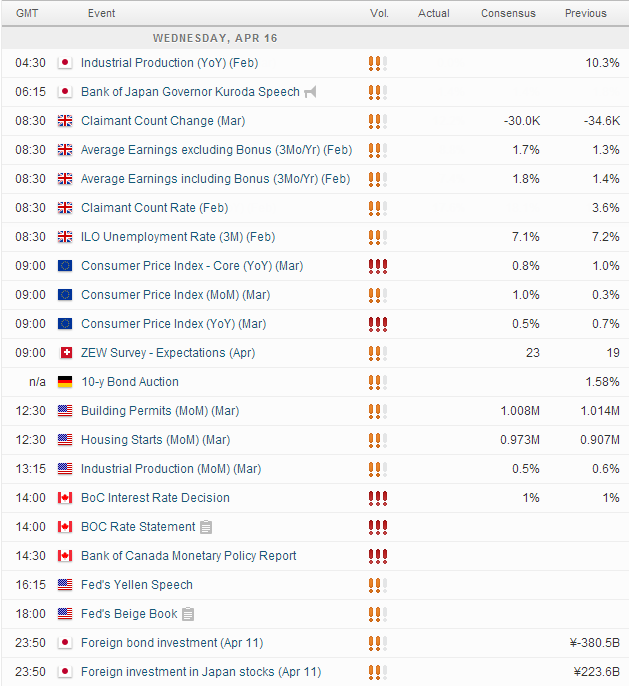

UP NEXT:

CAD interest rate is unlikely to change from 1%, so we are likely to see more volatility from GBP claimant amount and Eurozone CPI data later today.

GBP claimant has declined for 2 consecutive months and at a 3-month low; Forecast at -30k a lower reading is positive for GBP but Cable will also take into consideration Lady Yellen's speech later along with the Beige Book.

US Crude Oil inventories are more related to CAD and GBP than the US

US Building Permits are within a steady uptrend and considered to be a leading indicator for the economy. Therefor a particularly disappointing number could be more bearish for USD than a positive one would be bullish.

Pairs to watch:

USDCHF, USDCAD, EURUSD, GBPUSD, USDJPY, NZDUSD, AUDSD, WTI, XAUUSD

TECHNICAL ANALYSIS:

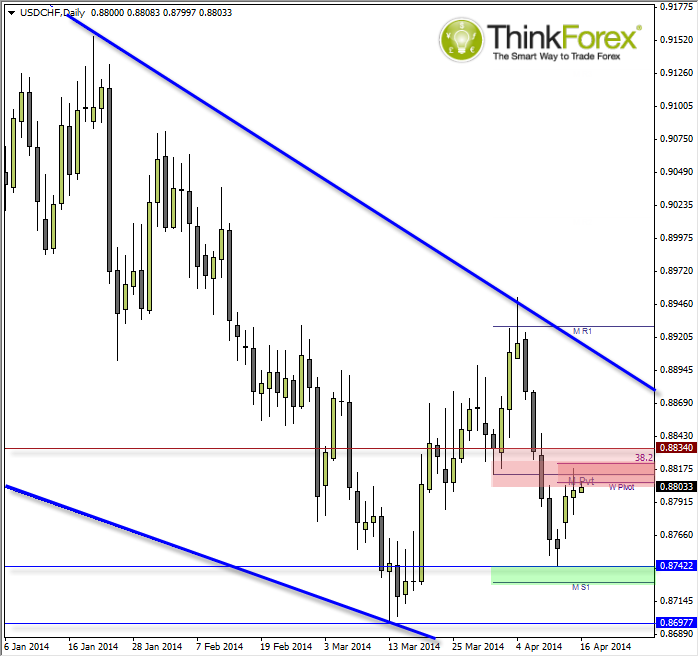

USDCHF: Hesitates at resistance confluence zone

Yesterday's volatility during the 'Nylon' session produced Doji's/Spinning Tops across a few USD pairs. The Swissy is a good example as it is also beneath a resistance zone comprising of Weekly/Monthly pivots and 38.2% retracement.

Zones are never perfect and merely highlight areas in which to monitor (but allow room for market noise). The fact we have an indecision candle adds a little more confidence in the level holding but there are a couple of approaches for a short position.

- Wait for a more decisive bearish candle pattern to form (Shooting Star, Evening Star Reversal, Dark Clod Clover) and enter on the low of the pattern

- Or enter on the low of the Doji

Personally I prefer a little more than just a Doji but there is room for lots of volatility tonight with data coming out from Europe and US, so there is room for further reversal candles to form below resistance before feeling the need to jump in.

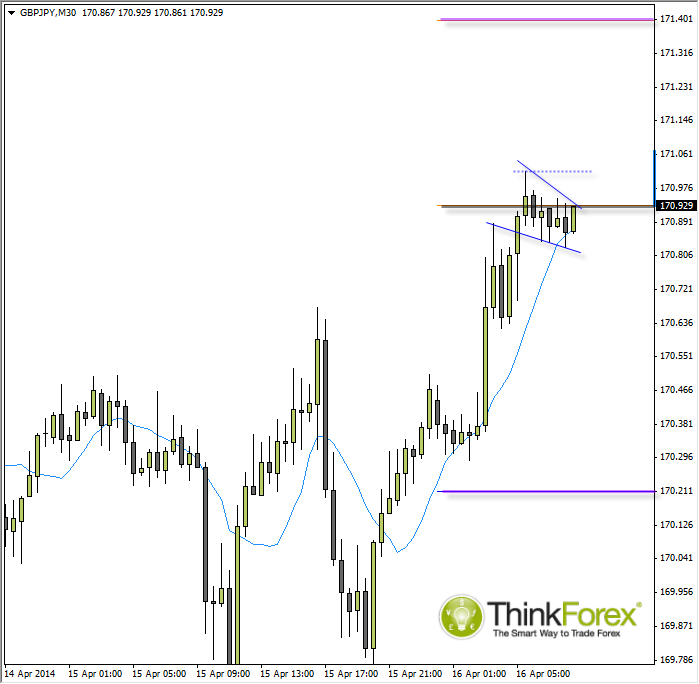

GBPJPY: Intraday Flag forming around daily pivot

As we await London trading to commence price is coiling up around the daily pivot. Price is respecting the 10 period sMA and we await the next catalyst.

With UK data out there is definitely room for some intraday volatility and the bullish bias is simply based on the bullish momentum seen prior to the sideways trading.

A word of caution - London opens are known for their whipsaw before the trends develops, so be aware of this before jumping in and choosing you direction with a tight stop.

A more conservative approach may be to wait for the swing high to be broken before seeking bullish setups on lower timeframes.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.