ASIA ROUNDUP:

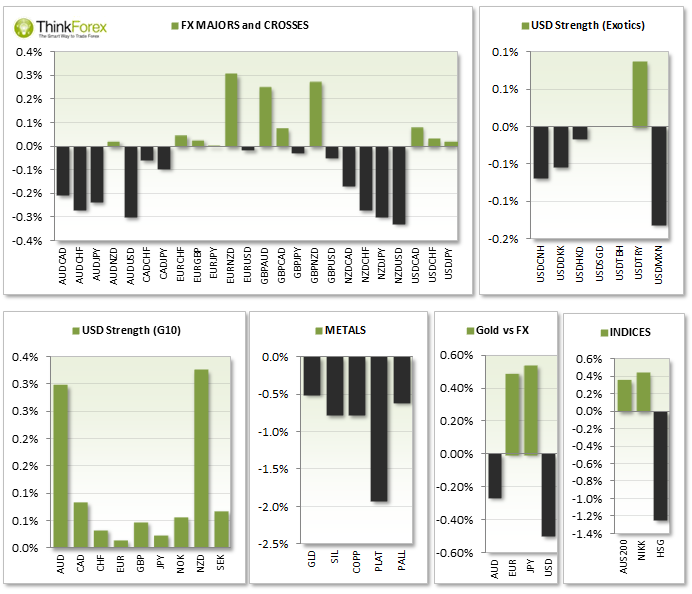

AUS200 gains up 0.6% early trading driven by Finance and Mining.

RBA minutes today reiterated that A$ is still high by historical standards but the cash rates are appropriately set to maintain inflation within target. AUDUSD held firmly onto 5-month highs.

USDCNH approaches 14-month high

Chinese bank stocks dragged Hang Seng down 1.2% as lending estimates fell short and shadow banking finance more than doubles.

BoJ Gov Kuroda met with PM Abe today but didn't provide any clues regarding monetary policies. USDJPY traded sideways and currently near the daily high around 101.20

EURUSD clings onto 1.380 support; A break below targets 1.375

UP NEXT:

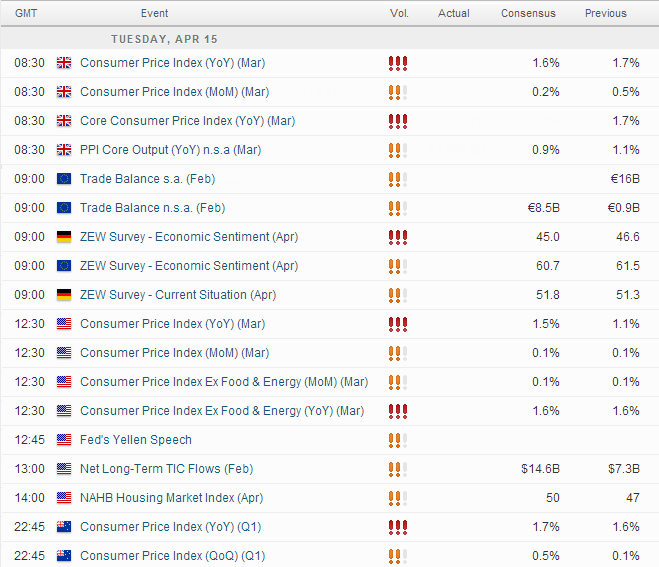

The markets will be closely watching the wording from FED Chair Lady Yellen to see how she corrects her previous speech regarding interest rate rise within 6 months. Since her last talk other board members have played down her comments.

GBP CPI y/y is forecast lower at 1.6% vs 1.7% previously. CPI is within a downtrend so a positive number today (1.7% or above) should generate fresh buyers on Cable which currently sits on 1.67% support

EURUSD has held firmly (only depreciating 0.5% following Draghi's jawboning yesterday) so positive data from EUR and Germany tonight could see it hold above 1.380 support

US Core CPI typically comes in at 0.1% so tradable deviations with more subsequent moves to take not of are 0.2% or -0.1%

CAD Manufacturing Sales m/m is forecast at 1.1% as USDCAD sits just below 1.10 resistance; Positive CAD data and poor US data could fuel another bearish move below 1.10 and target 1.091 swing low

TECHNICAL ANALYSIS:

EURUSD: Clings onto 1.3810 support

At time of writing we rest precariously around the 1.3816-25 support zone awaiting further direction.

The opening gap on Monday has not been closed (unless you count Friday low and MOnday high as the Gap) and the USD Index analysis favours a leg lower, which would see EURUSD target 1.390.

However a break below 1.3820 could well target 1.3750. For now my approach would be to seek bullish setups above 1.3825 and bearish setups below 1.3810

With data out from the Eurozone and US tonight it really could go either way. However we do have clear levels of support and resistance to target on intraday timeframes when the market decides to show its hand.

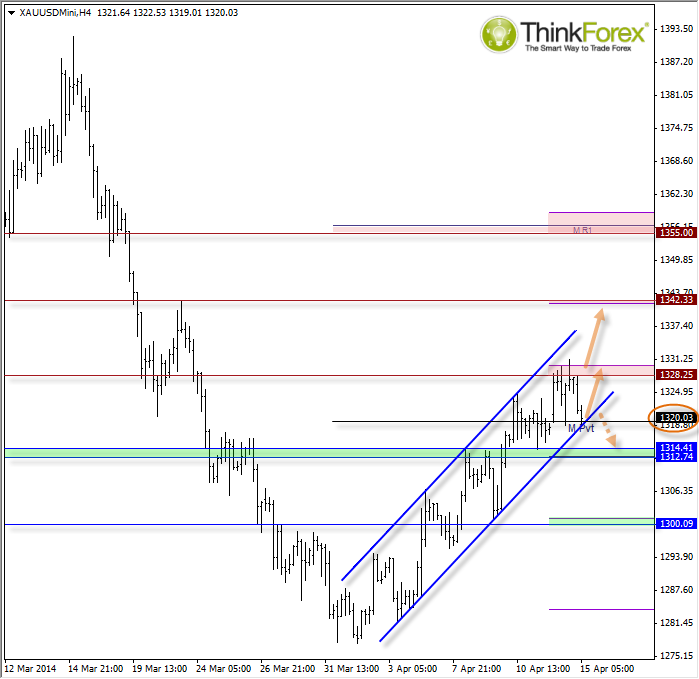

GOLD: Awaiting next catalyst, resting on lower channel

To follow on from yesterday's analysis we have seen #1328 (ish) cap as resistance and a retracement to $1318 achieved. It was by no means a pleasant ride though a price ricochet between these levels, but overall the levels have held quite well.

Today we find ourselves at the lower bullish channel line which could produce both bullish and bearish opportunities.

Due to the bullish channel then any buy setups above $1328 could be considered with initial target back at the $1328 resistance and 2nd target around $1342.

The break of the trendline could be a little trickier to time but initial target would be $1314. Due to the tight target then intraday trading would be the preference (probably below M30).

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.