MARKET SNAPSHOT:

ASIA ROUNDUP:

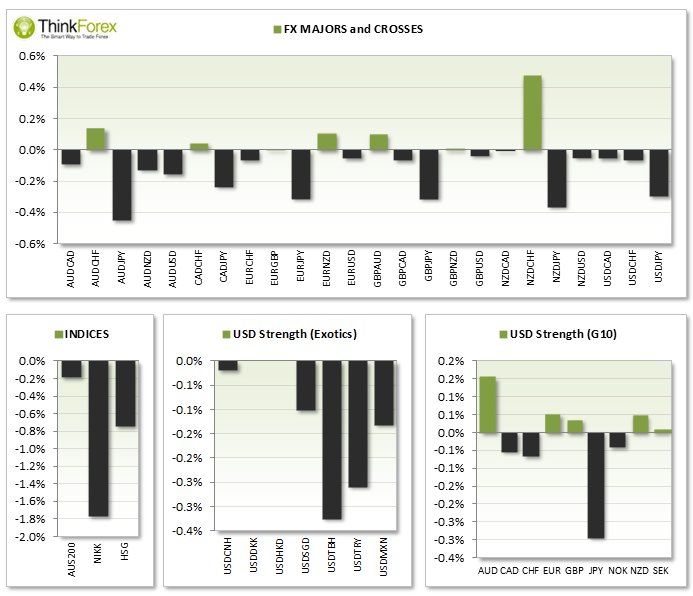

Asia FX trading saw the narrow ranges typically seen on a Monday following an eventful Friday from NYLON. NZDCHF was the biggest mover retracing against Friday's losses to be up 0.5%.

Following from the bearish equities them on Friday saw AUS200, Nikkei 225 and Hang Seng trade lower

The World Bank has forecast growth of 7.1% for Asia in 2014

33% of Small-Medium sized companies in Europe are feeling more confident about the recovery, up from 15% last month

AUD Job advertisments were up 1.4% from last month according to ANZ;

CNY Property companies in China, who are already over stretched, have been investing heavily in banks raising questions regarding their reasoning. It has raised concerns their motive is to gain preferential financing in future.

JPY JPY continued to appreciate during Asia to see ADJPY at a 4-day low and CHFJPY at a 6-day low.

NZD dThe Kiwi Dollar retraced some of the losses from Friday but still appears vulnerable to further losses against JPY and CAD.

UP NEXT:

TECHNICAL ANALYSIS:

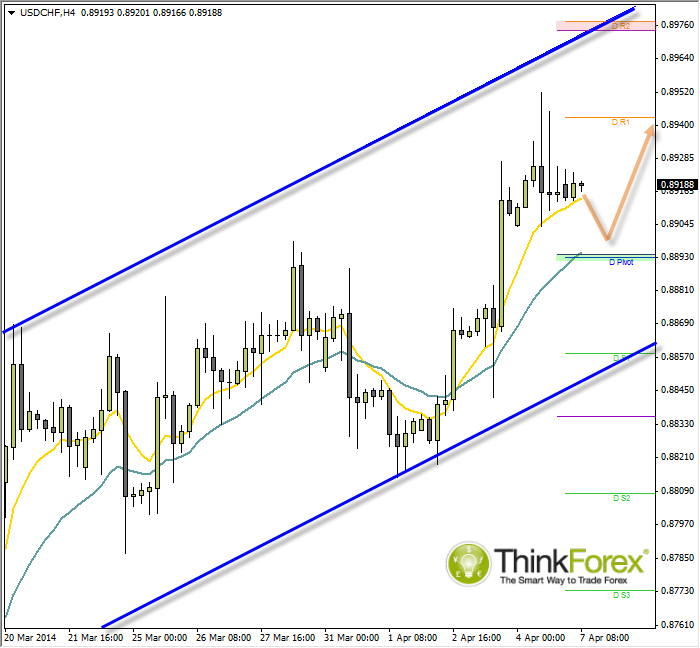

USDCHF: Swiss CPI may breathe some life into the Majors

I'll admit to struggling to find charts of particular interest today. However we do have CHF CPI which may provide some volatility at least as we have no scheduled 'red news' tonight.

We are within an uptrend and within a bullish wedge but for me to be interested in a long position I would like to see a retracement towards the daily Pivot and to see bullish reversal patterns at this support zone before targeting the Daily R1 Pivot.

0.8890-30 support zone comprises of the Daily Pivot; Weekly Pivot; H4 21eMA; - as long as we remain above here throughout today's session I prefer to seek bullish setups.

However if Asia trading is anything to go by then perhaps do not expect any 'home runs' and it is OK to not trade during a session if an opportunity does not present itself.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Ethereum continues hinting at rally following reduced long liquidations

Ethereum has continued showing signs of a potential rally on Tuesday as most coins in the crypto market are also posting gains. This comes amid speculation of a potential decline following FTX ETH sales and normalizing ETH risk reversals.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.