Market Snapshot:

German's growth has slipped from 0.7% to 0.3% whilst France's economy shrank by 0.1%. Meanwhile Italy is now within it's 9th consecutive quarter within recession, and although Spain too are still within recession their contraction has lost pace.

Things are more rosy in the UK after the Bank of England forecast a 0.9% expansion in the final quarter of 2013. If so then this will be their strongest quarter since the middle of 2010. However UK mortgage lenders have returned to their pre-crisis methods of lending to borrowers with smaller deposits. This in turn raises the fear of repossessions if house prices start to fall.

We are fairly light on news today and will not see a 'red news release' until tomorrow during the RBA Monetary policy meeting minutes.

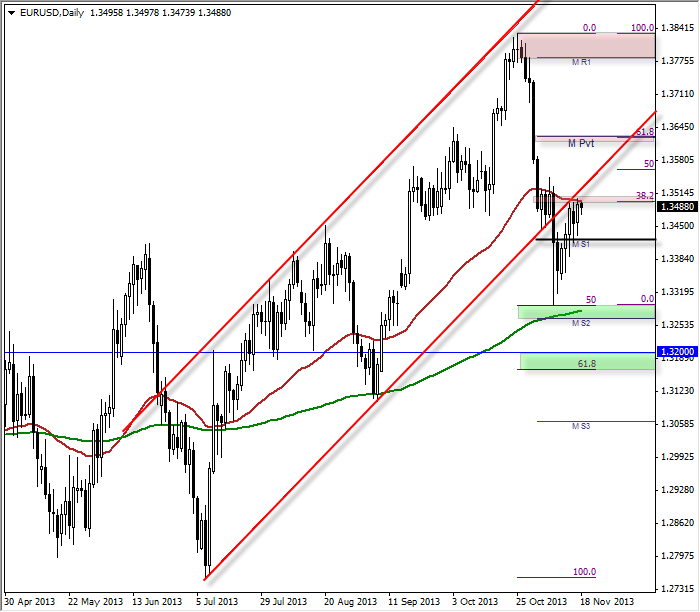

EURUSD DAILY:

The Euro has seen a modest recovery of +220 pips in comparison to the -538 pip sell-off seen prior to this. Also when you look at 'time and price' relationship between the two movements it does strongly suggest that gains seen last week are merely corrective, therefor we should be seeking selling opportunities and for price to make a new low beneath 1.3280.

At time of writing we are trading just beneath a good confluence of resistance which comprises of the 50eMA, the 38.2% retracement and a previous price cluster which formed around the end of September. These 'clusters' I refer to are where price trades sideways for period of time, and there is a lot of overlap amongst the candles. If these areas are revisited in future they tend to act as a temporary S/R zone - we are now trading within this prize zone so I will count this as another confluence of resistance.

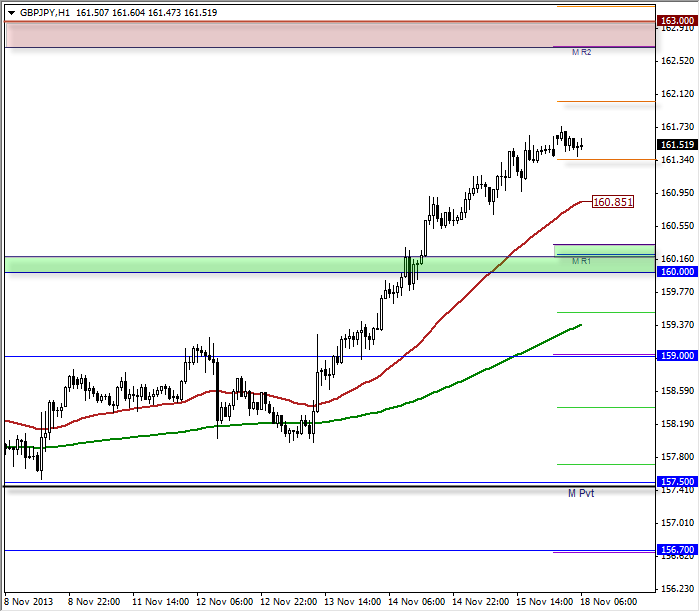

GBPJPY INTRADAY

View previous Analysis:

This pair was definitely one of the cleaner chart from last weak, as the breakout above the neckline to confirm the Inverted Head & Shoulders pattern has since provided ample of opportunities to get long on the intraday timeframes.

Whilst momentum is waning slightly and the pullbacks have been very shallow (borderline non-existent) even if we do get a pullback to a support level the bias will remain bullish as we have a target around 164.50.

159 and 160 have strong confluences of support so any pullbacks to these levels may provide excellent buying opportunities to trade back upto 164.50 on the H4 or D1 timeframes.

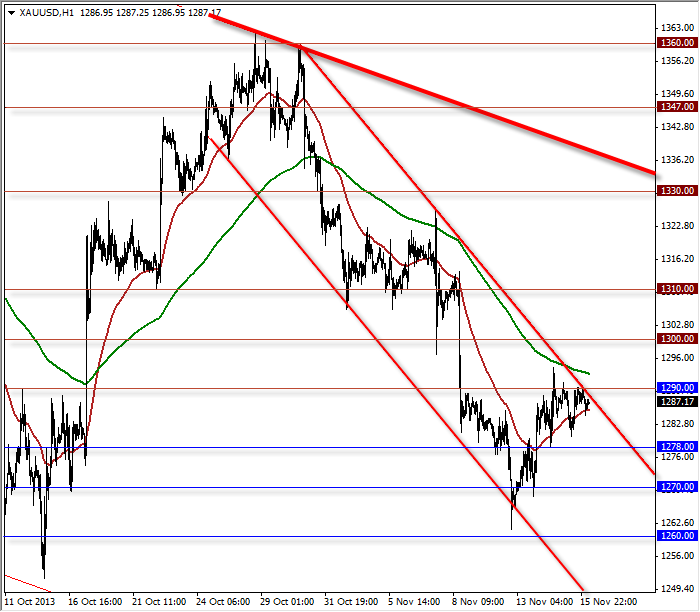

GOLD INTRADAY:

View today's post for the larger picture

We are just managing to trade beneath the 1290 resistance where we have met the pivotal S/R level and the upper channel of a declining channel. Should this level continue to hold then the preference is to keep to the short-side with any bearish setups around resistance areas.

A break above 1290 opens up 1300, 1310 and 1330 consecutively.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.