The U.S. dollar regained momentum moving higher against most of the major currencies. New home sales increased by the strongest amount in almost 30 years and this report validated the Federal Reserve's hawkish monetary policy stance. Yesterday's decline simply gave investors the opportunity to buy dollars at a lower level as the uniformity of comments from Fed Presidents shift market expectations. As more central bankers say that 2 or more hikes in 2016 is likely the more investors start to realize that they are underestimating the Fed's commitment to normalizing monetary policy. For the first time in 2 months, Fed fund futures are pricing a greater than 50% chance of a rate hike in July (it's actually closer to 55%). We believe that Dudley speaks for the leadership when he hinted at a summer hike and we doubt that Yellen will counter these views at her speech on Friday. So we expect the dollar to extend its gains and look for USD/JPY to head towards 112.

The rebound in the dollar drove euro to its lowest level in 2 months. The latest string of Eurozone economic reports were also mixed, adding pressure on the currency. According to the German ZEW survey, investors felt more comfortable with the current conditions in Germany's economy, but were concerned about the outlook. The expectations component of the report dropped to 6.4 from 11.2 with the same measure for the region slipping to 16.8 from 21.5. Growth in Germany was confirmed at 0.7% for the first quarter but investment was revised higher while private consumption and government spending were revised lower. EUR/USD has been slow to participate in the dollar rally and it was only a matter of time before the single currency also fell victim to the greenback's recovery. While the European Central Bank is not thinking about easing right now, they maintain a dovish bias and could certainly step up stimulus if Britain's decision to leave the European Union results in significant disruption to the financial markets.

Meanwhile Brexit headlines continue to move the British pound. Yesterday sterling traded sharply lower after the U.K. Treasury warned about the dire consequences of Britain's exit from the European Union. Today, the pound is up after Bank of England Governor Mark Carney said he doesn't share the Treasury's views on inflation and if the U.K. votes to remain in the EU, the next move for rates should be up. However the real takeaway is that U.K. policymakers including Carney believe that an exit would create significant uncertainty in the financial markets and the "BoE would take all necessary steps to ensure an orderly market." While Carney stopped short of using the word recession, his colleague Martin Weale admits that the risk of recession would increase with Brexit. He was also surprised that wage growth has not picked up in the past 18 months - this observation along with the continued warning of Brexit risks should limit the upside in GBP and continue the rollercoaster ride for the currency.

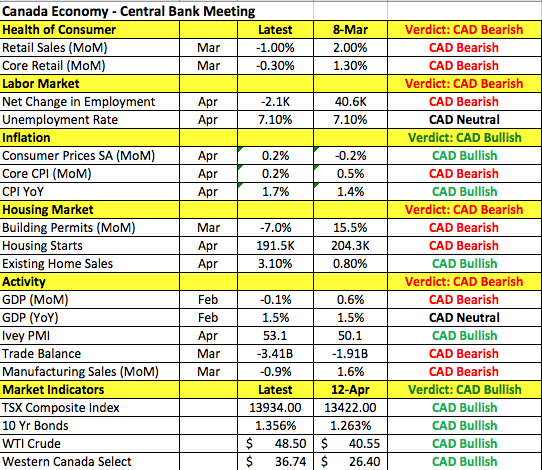

The Bank of Canada meets tomorrow and the Canadian dollar is trading higher ahead of the monetary policy announcement. No changes are expected but how USD/CAD trades in the days ahead could be largely determined by the central bank's tone. After a week of steady gains, USD/CAD is beginning to lose momentum and continued optimism by the BoC could erase more gains. The last time they met, the BoC left interest rates unchanged and upgraded their 2016 GDP forecasts. However it may be difficult to remain optimistic in the face of slowing consumer spending and after the wildfires in Alberta that could stall the recovery. The following table illustrates how Canada's economy changed since the April meeting. Aside from the weakness in spending, jobs were lost, building permits and housing starts declined, the trade deficit widened and overall growth slowed. Yet consumer prices increased significantly with year over year CPI growth hitting 1.7%, manufacturing activity accelerated and Western Canada Select oil prices are up 30% since the last meeting. So there are still reasons for the central bank to be optimistic and that's what makes predicting the BoC's bias so difficult.

Unlike the loonie, the Australian and New Zealand dollars experienced fresh losses against the greenback with AUD/USD falling to two month lows. The rise in oil prices failed to translate into gains for oil and copper. Comments from Reserve Bank of Australia Governor Stevens also added pressure to the currency. Stevens said AUD is doing what you would expect it to do (it is down 5 cents since the beginning of the month) and inflation is a bit too low which suggests that he remains open to the idea of additional easing. AUD ended the day off its lows but as long as the currency pair is below its 200-day SMA, the downtrend remains intact and a move to 71 cents is likely. New Zealand's trade balance is scheduled for release this evening and a much smaller surplus is expected. However with the manufacturing PMI index rising, the risk is to the upside for the report.

Past performance is not indicative of future results. Trading forex carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.