We have a very busy economic calendar this week filled with market moving events that range from tier 1 economic reports, a central bank meeting to speeches by top policymakers. Today's price action is a taste of the potentially nerve wracking moves to come. This includes the sharp losses in AUD and NZD, the euro's struggle to clear 1.1400 and the drip lower in USD/JPY that has investors wondering if and when the Japanese government will check rates for intervention. So it is extremely important to weed through the noise and only hone in on the handful of event risks that could have a lasting impact on the currency.

For the U.S. dollar the most important events are in the second half of the week. There's no question that tomorrow's ISM non-manufacturing report will provide a jolt of volatility for the dollar but non-farm payrolls was released on Friday and the most interesting part of the service sector report is the guidance that it provides for NFPs. Between the relatively healthy labor data and the rise in manufacturing activity, we anticipate a dollar positive release. Yet the big question that investors hope to be answered this week how many U.S. policymakers share Janet Yellen's dovish view on interest rates and the economy. Nine Federal Reserve officials are poised to speak, 6 of whom are FOMC voters including Yellen. We heard from Rosengren today who is typically one of the more dovish voting members of the central bank and even he believes that the outlook is not as weak as market pricing suggests and the Fed may need more rate hikes than what is priced in. According to the Fed Fund futures, Yellen's views and the rise in the unemployment rate has caused investors to rule out a rate hike in 2016 - not only is this extremely pessimistic but also misaligned with the 2 rate hikes projected by the Fed's dot plot. If other policymakers share Rosengren's views, the dollar will recover but if Yellen remains steadfast and other Fed officials are wishy-washy, the greenback will fall to new lows.

USD/JPY is nearing intervention territory and with the high level of long yen short dollar positions, this is prime time for the Bank of Japan to intervene. However Japanese policymakers have not confirmed any intervention thus far even though USD/JPY experienced unusual spikes every time it dipped below 111 over the past 2 months. The Ministry of Finance, who makes the call on intervention could be waiting for fiscal stimulus from Prime Minister Abe. Last week he said a new economic stimulus package is being considered before the summer elections. There's no doubt that the economy desperately needs help and the waiting game can't last for very long. Nevertheless if USD/JPY drops below 111, even if the BoJ doesn't intervene, rate checking by the central bank could be enough for USD/JPY to hold its recent range.

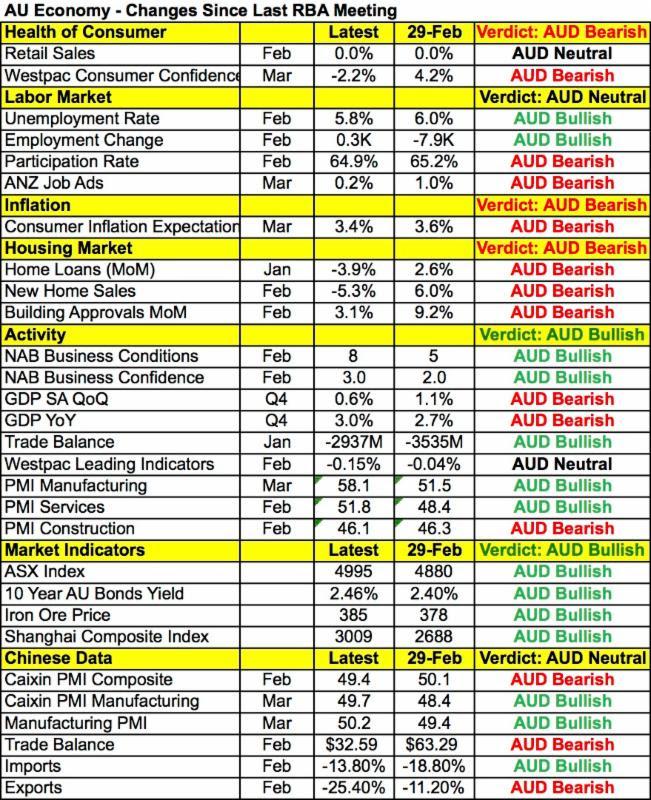

The main focus tonight will be on the Australian dollar, which experienced its largest decline in more than a week. Softer retail sales numbers are to blame even though they were offset by a rise in job ads and building approvals. Aside from the trade balance and PMI services report, the Reserve Bank delivers its latest monetary policy decision this evening. No one expects the RBA to cut interest rates but there's uncertainty around their comfort with recent moves in the currency. In the past, the RBA has said they prefer to see AUD/USD trading closer to 65 cents and has described it as overvalued near current levels but more recently we haven't heard any specific concerns. Based on the table below, there's been slightly more improvement than deterioration in Australian's economy since the last monetary policy meeting with notable upticks in Australian and Chinese manufacturing activity that signal limited damage from a strong AUD. If the RBA makes no specific mention of wanting to see the Australian dollar lower, AUD will most likely recover its losses but if they express renewed concern about currency fluctuations, it could mark a top for the high flying currency.

The New Zealand and Canadian dollars also traded lower versus the greenback. The 3% decline in oil prices supports the move in the Canadian dollar while NZD fell in sympathy with AUD. This is an important week for the Canadian dollar with the trade balance, IVEY PMI and employment numbers scheduled for release. Of these reports, the labor market numbers will be the most important but keep an eye on oil because if crude prices drop below $35 a barrel, we could see USD/CAD make its way to 1.3200. New Zealand has a dairy auction on Tuesday and while this is the most important event risk for kiwi this week, we expect the market's risk appetite and demand for AUD to have a stronger influence on the currency. China's PMI numbers should not be dismissed because strength in the service sector would validate the growing signs that the slowdown in China's economy is finally easing.

The euro ended the day unchanged while sterling moved slightly higher. Both currencies will be in play this week with UK PMI services scheduled for release tomorrow and Mario Draghi speaking on Thursday. Stronger than expected construction sector activity helped to boost sterling but we continue to believe that Brexit poses a major risk to the currency and that rallies should be sold. The performance of euro on the other hand hinges on the tone of the ECB minutes and the central bank President. A large part of the reason why EUR/USD shot higher is because the ECB signaled an end to rate cuts but renewed dovishness could trigger significant profit taking in the pair.

Past performance is not indicative of future results. Trading forex carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.