- RBA Preview: 3 Possible Scenarios and the AUD Impact

- USD/CAD Resumes Slide Ahead of Trade Data

- NZD: Global Dairy Trade Auction Next

- US Yields Continue to Rise but Dollar Does Not

- Euro Continues to Reject 100-day SMA

- Sterling Could Break 1.50

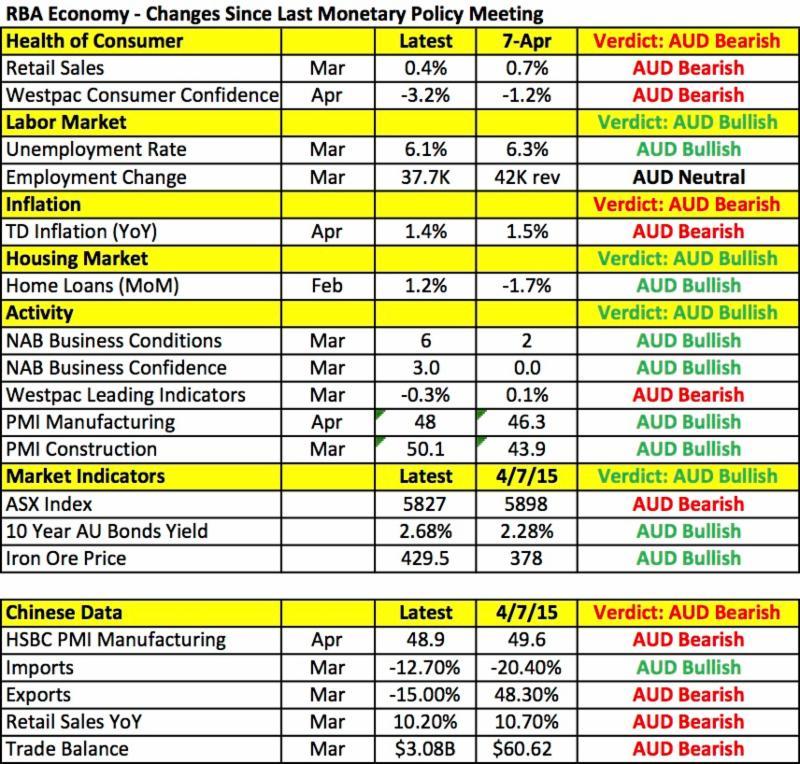

Between the U.K. general election, Chinese trade balance and labor market reports from the U.S., Canada, Australia and New Zealand this will be an extremely busy week for the forex market. The action starts tonight with the Reserve Bank of Australia's monetary policy announcement. Of the 29 economists surveyed by Bloomberg, all but 4 expect the central bank to lower interest rates for the second time this year by 25bp. The market is also pricing in an 80% chance of easing. However with the local economy improving since the last monetary policy meeting in April, the rate decision is a closer call than the projections suggest. According to the table below, the pickup in job growth, decline in the unemployment rate and steep recovery in iron ore prices clouds the case for easing. Business confidence has also improved and last night we learned that building permits rebounded 2.8%. When we last heard from Governor Glenn Stevens, he remained tight lipped about monetary policy, sparking speculation that the RBA could leave rates unchanged in May. Yet Chinese data has been very weak and the AUD/USD exchange rate is approximately 2 cents higher than where it was when the RBA met in April. We know that the central bank won't be happy with the appreciation of the currency but conditions were worse before the last minute and they decided to forgo a cut. At the time the central bank made it clear that they could still lower rates but the case could be made for waiting another month.

Here are the 3 possible scenarios for tonight's RBA rate decision and the potential impact on AUD/USD.

Scenario #1 - RBA keeps rates unchanged >> expect AUD/USD to squeeze to 80 cents

Scenario #2 - RBA cuts 25bp, moves to neutral bias >> expect AUD/USD to drop to 0.7750, stabilize then rebound

Scenario #3 - RBA cuts 25bp, maintains dovish bias >> expect AUD/USD to test and break 77 cents

Since there are similar probabilities for each one of these scenarios, tonight's rate decision will cause significant volatility in AUD/USD. We believe that the RBA will either leave rates unchanged or lower them and move to a neutral bias. In both cases, the negative impact on AUD/USD would be limited. Aside from the RBA rate decision, Australian PMI services and trade numbers are scheduled for release. Tomorrow, Canada will follow with its trade balance report.

US Yields Continue to Rise but Dollar Does Not

In the past 2 weeks we have seen a steady and consistent move higher in Treasury yields but the impact on the dollar has been limited. Part of the reason is because investors adjusted their expectations for Fed tightening after disappointing economic data in the month of April. However U.S. policymakers believe that the setback last month will be temporary and judging from the first set of May data, the U.S. economy could be turning around. Factory orders rebounded by 2.1% in the month of March after falling -0.1% in February. NY manufacturing activity also accelerated significantly in April. We expect Friday's non-farm payrolls to show significant improvement in job growth that will reinforce the rise the yields. However the dollar is having a difficult time following yields higher because investors are still divided on when the Fed will raise rates. According to Fed President Williams, "we have seen amazing progress" and there's "reason to be optimistic about the U.S." His view that the jobless rate will fall below 5% this year signals that he will support liftoff in 2015. Fed President Evan on the other hand thinks the central bank should delay raising rates until early 2016. He seems no reason for a rush because low inflation is a sign that Fed policy is not too easy and he wants to see more evidence of wage growth. Nonetheless he also believes that Q1 weakness is partly transitory. Both of these gentlemen are voting members of the FOMC. We are going to hear from a lot of U.S. policymakers this week and for the most part we expect their comments to support the dollar rally. U.S. trade and ISM service sector reports are scheduled for release on Tuesday. Non-manufacturing ISM is an important leading indicator for non-farm payrolls, so we'll be watching the number closely.

Euro Continues to Reject 100-day SMA

The euro continued to reject the 100-day SMA today, trading lower against the U.S. dollar despite an upward revision to recent data. While it will be an eventful week in the forex market, we have very little market moving Eurozone data. This means that the performance of EUR/USD will be driven by U.S. data and risk appetite. According to Markit Economics, manufacturing activity in the Eurozone was slightly firmer than initially reported in the month of April. The PMI index was revised higher to 52 from 51.9. According to our colleague Boris Schlossberg, "the individual reports showed a lot of variance. In Germany and Italy the final readings were better than expected with Italian PMIs rising to their highest levels in more than a year, but in France and Spain the data lagged with French manufacturing still stuck in contractionary territory at 48 versus 48.4 projected. The latest manufacturing results show that EZ continues to benefit from the lower exchange rate but the gains are uneven and there is little upside momentum in the data. Over the past several weeks the euro staged a massive short covering rally fueled primarily by the disappointing misses in US economic results that have shifted investors expectations of a Fed rate hike to September and perhaps even later than that. However having now risen nearly 800 points of the yearly lows the euro is likely to pause at these levels as the lackluster growth in the region could weigh on the pair as investor focus returns to fundamentals once again" Support in EUR/USD is at 1.10 with the 100-day SMA capping gains near 1.13.

Sterling Could Break 1.50

There is no doubt that this is a big week for the British pound. Twenty-four hours before the U.K. General Election on May 7th, the service sector and composite PMI indices will be released. Having trading as high as 1.5499 last week, sterling has taken a sharp turn and is now aiming for a move to 1.50. The 2015 U.K. Election is expected to be one of the most unpredictable ever with the two main parties running neck to neck. Chances are we'll have a hung Parliament that won't bode well for the currency. In week before the 2010 the election, GBP/USD dropped 300 pips and on Election Day it fell 400 pips followed by another 500 pip slide in the 2 weeks that followed. So chances are the currency pair will not only test 1.50 but break it swiftly in the coming days.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

GBP/USD steadies near 1.2450, awaits mid-tier US data

GBP/USD is keeping its range at around 1.2450 in European trading on Wednesday. A broadly muted US Dollar combined with a risk-on market mood lend support to the pair, as traders await the mid-tier US Durable Goods data for further trading directives.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.