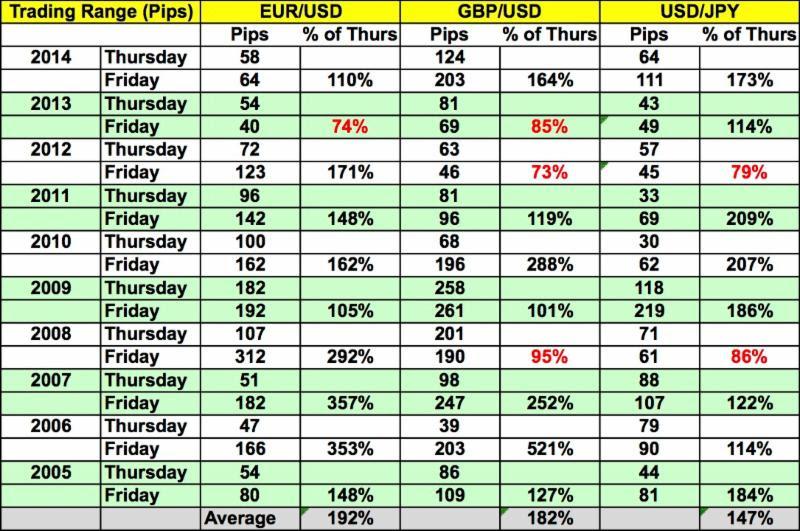

The following table shows has the 3 major currency pairs (EUR/USD, GBP/USD and USD/JPY) performed on Thanksgiving Thursday and on the Friday after. Even though European markets are open, Thursday is traditionally a quiet day marked by tight trading ranges. However in 2007, 2008, 2010 and 2011 the range for EUR/USD and USD/JPY expanded significantly. In other years it was another quiet day. With only revisions to Q3 U.K. GDP and Eurozone confidence numbers on the calendar, we are not looking for any big moves.

The Wednesday before Thanksgiving generally tends to be interesting. Today for example, EUR/USD dropped below 1.06 to trade at a fresh 7 month low while USD/CHF climbed to its strongest level in 5 years. The decline in the euro was driven by reports that the European Central Bank could resort to unconventional monetary policy that would involve introducing a two tiered deposit rate. According to the report, large depositors would be charged more than small depositors. This plan isn't likely to receive much support from Germany and France whose banks widely use the ECB's facility. However it is clear from today's price action that while investors have considered more ECB stimulus, they have not considered how aggressive or creative they will be. As such, we are still looking for EUR/USD to test 1.0520 either before or on the back of next week's ECB meeting.

Despite mostly better U.S. data, there wasn't much consistency in the performance of the dollar. The greenback traded higher versus the euro, Yen and Swiss Franc but lost value versus the British pound and New Zealand dollars. Personal incomes grew 0.4% in October but personal spending growth held steady at 0.1%, which was less than economists anticipated. While this is healthy consumer behavior reflective of better saving habits, the Fed may not welcome it because stronger spending is needed to fuel growth. The PCE deflator, an inflation measure also grew at a slower pace. Durable goods rebounded, jobless claims fell to a 1 month low, service sector activity accelerated and new home sales rebounded sharply. Overall these reports taken together won't change the Fed's plans for monetary policy. No additional U.S. economic reports are scheduled for release this week.

Sterling rebounded against the U.S. dollar on the back of higher home loans. Although U.K. GDP numbers are scheduled for release on Friday, the Brits tend to do a good job of forecasting growth and revisions are unusual. Since the beginning of the year, sterling appreciated between 8 to 10% versus the euro, Australian, Canadian and New Zealand dollars. Not only has the strong currency been putting downward pressure on prices in a low inflation environment but it also hurt exports. The U.K. conducts the majority of its trade activity with the European Union and the recent slide in EUR/GBP means trouble for the economy. Recent developments have been negative for the pound and at this stage the 1.50 level in GBP/USD is looking dangerously vulnerable.

The Canadian dollar held steady versus the greenback despite mixed inventory data. While inventories were less than anticipated, gasoline and distillate inventories increased. Many economists have been watching the 2 year U.S. - Canadian yield spread which is rapidly closing in on new highs. However a strong move to the upside for the spread and a slide in oil prices would be needed to drive USD/CAD to a fresh 11 year high above 1.3457.

The New Zealand dollar traded higher versus the greenback today ahead of this afternoon's trade balance report. With dairy prices rising in October, economists are looking for an improvement in exports that should help to reduce the trade deficit. However any positive impact on NZD should be short lived because prices fell in November and manufacturing activity weakened according to the latest business PMI index. The outlook for New Zealand's economy remains grim and for this reason we expect the currency's rally to be limited. Meanwhile the Australian dollar traded slightly lower versus the greenback. The recent strength of A$ has been driven entirely by central bank speak as data including last nights skilled vacancies and construction work report show slowing activity.

Past performance is not indicative of future results. Trading forex carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD tumbles toward 0.6350 as Middle East war fears mount

AUD/USD has come under intense selling pressure and slides toward 0.6350, as risk-aversion intensifies following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY breaches 154.00 as sell-off intensifies on Israel-Iran escalation

USD/JPY is trading below 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price jumps above $2,400 as MidEast escalation sparks flight to safety

Gold price has caught a fresh bid wave, jumping beyond $2,400 after Israel's retaliatory strikes on Iran sparked a global flight to safety mode and rushed flows into the ultimate safe-haven Gold. Risk assets are taking a big hit, as risk-aversion creeps into Asian trading on Friday.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.