Our focus is on AUD, CAD and GBP. The USD started the new trading week firm but there's not enough on the calendar to take USD/JPY out of its 118.25-121.75 trading range and EUR/USD out of its 1.10-1.14 range. An October rate hike from the Federal Reserve is off the table and the most important piece of U.S. data this week - the non-manufacturing ISM report failed to incite big moves in the greenback. According to ISM, U.S. service sector activity grew at its slowest pace in 3 months. However this report isn't necessarily a reflection of weakness in the U.S. economy because the slowdown came after very strong growth in July. The service sector expanded at its fastest pace in nearly 10 years this summer. The rally in the dollar along with the rise in stocks and Treasury yields today tells us that investors are hopeful that the U.S. economy is still on track and the Fed will raise interest rates before the end of the year. The minutes from the September Fed meeting are scheduled for release on Thursday but since the meeting was held before the latest NFP report, which caught many policymakers by surprise, the impact on the dollar should be limited.

Fed speak will be the central focus for U.S. dollar traders but only 3 of the 6 policymakers scheduled to speak this week are voting members of the FOMC and all are doves. Therefore the chance of USD/JPY extending today's gains to break out of the triangle pattern remains slim. We heard from Rosengren (nonvoter) in the early hours and he felt that the weak jobs report showed that the Fed was right to delay its hike in September and 2% growth is needed for rate liftoff this year. December is a close call and even if some policymakers believe it is still possible, none of them will vote to raise interest rates until there is a significant improvement in labor data.

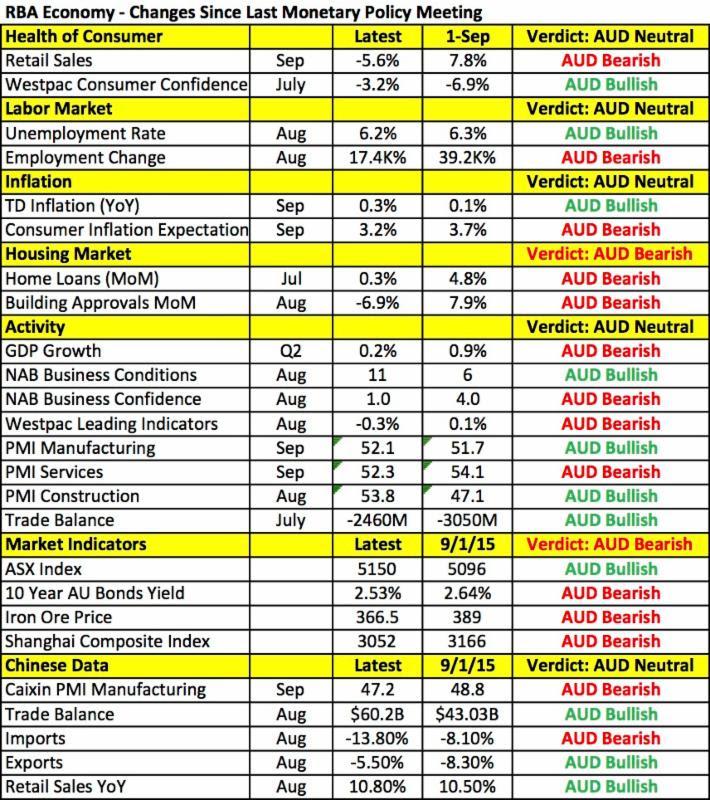

So that leaves our focus on the 3 central bank rate decisions and Canadian manufacturing and employment numbers. Tonight, the Reserve Bank of Australia is widely expected to leave interest rates unchanged at 2%. The last time the RBA cut interest rates was in May and while the Chinese economy and their stock market struggled since then, Australia's central bank did not feel enough concern to lower rates. They maintained a dovish bias that is not likely to have changed significantly this month because according to the table below, there have been just as much improvement as deterioration in Australia and China's economies since the September meeting. On balance, we believe the RBA should be a bit more concerned about their economic outlook and if the RBA lets out a tinge of pessimism, AUD/USD could erase today's gains.

The Bank of England also has more to be worried about. The latest PMI reports show weaker manufacturing and service sector activity. Sterling sold off in response to the latest reports and while we are still looking for a reversal in GBP/USD, on a technical basis, sterling looks poised to test 1.51. Whether this level holds will hinge upon the minutes from the Bank of England's monetary policy decision. If the central bank is still concerned about wages, which increased further since the last meeting it could ignite a stronger recovery in sterling.

After rising strongly in the last 2 weeks of September, USD/CAD reversed fast and hard last week. The sell-off in the currency gained traction today and if this week's Canadian economic reports are weak, we could see USD/CAD test 1.30. The change in trend was driven by a combination of weaker U.S. data and a rebound in oil prices. Canada's trade balance and IVEY PMI numbers are scheduled for release tomorrow followed by the employment report on Friday. With economists looking for a larger trade deficit and weaker manufacturing activity, USD/CAD could settle above 1.30.

The Japanese Yen traded lower against all of the major currencies today. While part of the move was driven by the improvement in risk appetite, demand for the Yen was also hit by weaker data. Service sector activity slowed and labor cash earnings grew at a weaker pace. The Bank of Japan meets this week and with data taking a turn for the worse, the central bank could grow more dovish and warn that further easing in Q4 is possible.

The euro also lost ground versus the greenback following softer data. Service sector activity in the month of September was revised down with Germany experiencing slower growth. We are beginning to see a major disconnect between the Eurozone's 2 largest economies. France is starting to recover at a faster pace while Germany is beginning to slow. If the weakness deepens, the Bundesbank could pressure the ECB to increase stimulus (though the chances now are still very low).

Finally NZD/USD rose nearly 1% to its strongest level in more than a month, making the New Zealand dollar, the day's best performer. No economic reports were released from New Zealand but there are high hopes for tomorrow's Global Dairy Trade Auction. Dairy prices rose sharply at the last 3 auctions and if this momentum is sustained, investors will look at 62 cents as the bottom in NZD/USD.

Past performance is not indicative of future results. Trading forex carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.