- FX: When Selling in May and Going Away is a GOOD Idea

- Dollar Bid Ahead of Next Week's Global Uncertainty and Payrolls Report

- AUD Extends Losses Ahead of Busy Data Week

- USD/CAD Supported by Decline in Oil

- NZD Hit by USD Strength

- Sterling Tanks on Weaker PMI

FX: When Selling in May and Going Away is a GOOD Idea

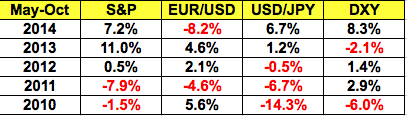

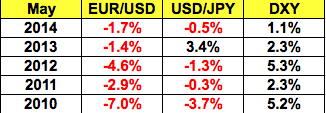

Every May, market junkies like to revisit the idea of "Selling in May and Going Away." This is an old saying in the stock market that comes from data gathered by the Stock Trader's Almanac since 1950. According to their reports, stocks tend to perform better between November and April than May and October. However in the last 5 years, there was very little consistency in the performance of equities and in fact, stocks traded higher in each of the last 3 years. Taking a look at the table below, both the EUR/USD and the Dollar Index rose more years between May and October than it declined. So in a nutshell, in recent years, there has been no real support for the mantra of selling in May and going away.

Yet selling in May and going away IS a GOOD idea if you are only looking to bail out of long EUR/USD and USD/JPY for the next month. Better yet, one idea to consider is shorting EUR/USD and/or buying the Dollar Index in May. While USD/JPY also fell this month in 4 out of the last 5 years, the decline in most cases was small. From a technical perspective, the move in the EUR/USD is becoming overstretched with the pair nearing its 100-day SMA resistance. The Dollar Index is also hovering near support at 94. Fundamentally, the prospect of Fed tightening, the crisis in Greece, upcoming election in the U.K. and credit problems in China make the dollar an attractive investment. Also, Japan's Global Pension Investment Fund, who widened their investment mandate will lend support to the dollar as they expand their purchases of foreign assets.

Dollar Bid Ahead of Next Week's Global Uncertainty and Payrolls Report

It is always interesting when the dollar rallies on weak data and declines on positive reports. On Friday the greenback traded higher against most of the major currencies despite an unexpected decline in construction spending, softer than anticipated manufacturing ISM and University of Michigan consumer sentiment reports. On Thursday, the dollar received very little support from jobless claims, which dropped to its lowest level in 15 years. The fact that many markets in continental Europe were closed contributed to the unusual reaction and the general volatility in the forex market. With that in mind, next week will be an important one for not only dollar but all major currencies. We will be focused on non-dollar drivers in the front of the week with the RBA rate decision, U.K. election, New Zealand and Australian employment reports scheduled for release. The uncertainty and risk posed by these reports could make the U.S. dollar more attractive. Towards the end of the week, the focus will turn to non-farm payrolls. Given last month's surprisingly anemic job growth and the big improvement in jobless claims, everyone expects a significant rebound in payroll growth. The unemployment rate is also expected to drop to 5.4%, which would represent a big improvement that should breathe new life into the U.S. dollar.

AUD Extends Losses Ahead of Busy Data Week

All three of the commodity currencies traded lower against the greenback today as stronger producer price growth in Australia, steady manufacturing activity in China and an uptick in Canadian manufacturing activity failed to lend support to AUD and CAD. Instead, these currencies were driven lower by a decline in commodity prices and rebound in the U.S. dollar. Next week will be a busy one for all three currencies, particularly the Australian dollar. Earlier this week, RBA Governor Glenn Stevens' refusal to talk about monetary policy was interpreted as a less dovish move that could mean either a shift to a neutral monetary policy stance after a rate cut or no rate cut at all. However later in the week, a report by a local newspaper suggested that the central bank could still lower rates, forcing AUD to give up its gains. What the central bank decides to say and do on May 5th could determine how AUD trades for the next few weeks. IVEY PMI, trade and employment reports will influence trade in the Canadian dollar while New Zealand looks forward to its first quarter labor market report. On top of all this, China will release its April trade balance - a number that will not only impact the commodity currencies but risk appetite in general.

Sterling Tanks on Weaker PMI

The British pound traded sharply lower versus the euro and British pound today, with EUR/GBP rising to its strongest level in 2 months. In the past two trading days, we have seen the currency pair lose more than 2% of its value versus the euro and a further decline is possible if the outcome of next week's general election is undesirable. U.K. manufacturing PMI numbers were released and unfortunately activity slowed with the index falling to 51.9 in April from 54. Mortgage approvals also dropped to 61.3k from 61.5. Economists had been looking for an improvement in both reports. According to Rob Dobson of Markit, "Growth remains largely consumer-led, with the strong performance of the consumer goods sector in stark contrast with other sectors. Companies that supply manufactured inputs to other firms reported a return to contraction, suggesting other firms are planning to cut production". Our colleague Boris Schlossberg says, "That is not good news for cable bulls as UK economic data continues to show signs of a slowdown. Next week's UK PMI Services report will now become pivotal to the market and if it misses badly sterling could quickly return to the 1.5000 figure."

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.