USDJPY could be a cheap buy-on-dips before the end of quarter.

MACD convergence to signal a bullish reversal.

In Japan, the industry production may have slumped at a faster-than-expected speed in February (-6.2% m/m) according to the preliminary figure. The Nikkei and the Topix sold-off in Tokyo, the USDJPY eased to 112.25.

As we are approaching the month/quarter end, the USDJPY could be an interesting buy in dips into the 110.60 (March low) starting from April due to a relocation of the yen repatriated for the end of the quarter and also on the anticipation of a looser fiscal policy from Abe's government.

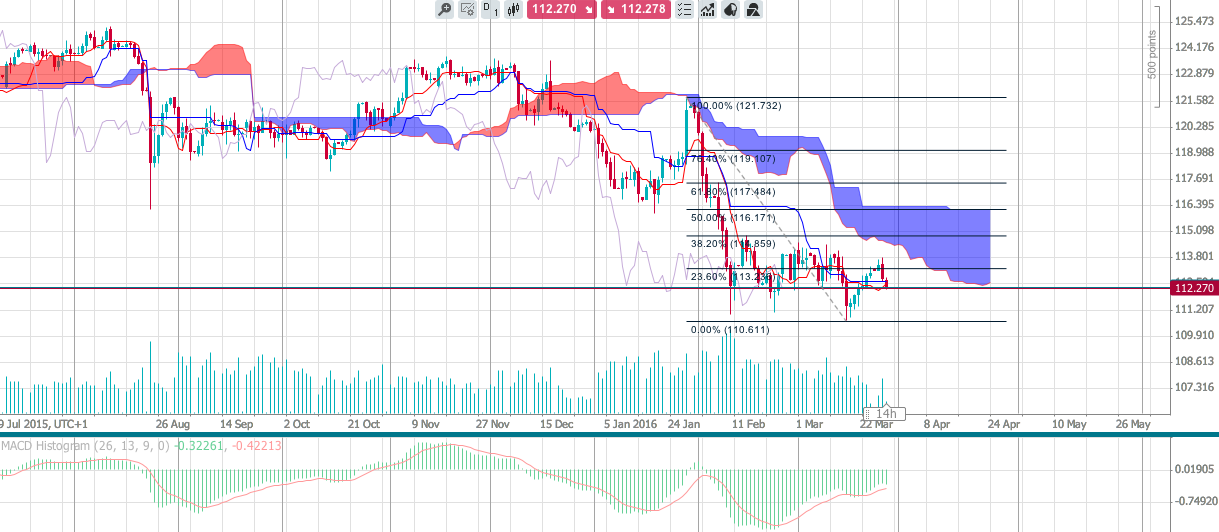

The MACD on a daily chart remains negative, yet the convergence signals that the downside momentum in the USDJPY has eased and renewed downside attempts could find a base before the 110.60/110.00 for a recovery to 113.25 (minor 23.6% retrace on Jan-Mar decline) before breaking into the daily Ichimoku cloud cover, 114.55 and testing the critical short-term resistance of 114.86 (major 38.2%). Only clearing the 114.85/115.00 resistance could signal a mid-term bullish reversal.

On an hourly chart, the intermediate supports are eyed at 111.87 (61.8% retrace on March 17 – 29 recovery), 111.40 (minor 76.4%) before the 110.60 dip.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.