Technical Analysis

EUR/USD ends another session in limbo

“We believe the strong-dollar trend we’ve seen over the last couple of years has come to an end.”

- Pacific Investment Management Co. (based on Bloomberg)

-

Pair’s Outlook

Since last Friday neither bulls nor bears have managed to take market in hand. Yesterday was a turbulent day, as the spot ranged from 1.1340 to 1.1455. However, ultimately the pair has been barely down by 22 pips over the whole day. Fresh daily and weekly technical indicators estimate a bullish correction. We tend to maintain a positive outlook as well, because there are many obstacles to limit a slump of the Euro and the first one is the weekly PP at 1.1326. The primary resistance we are looking at is the October peak at 1.15, which is boosted by the Bollinger band and weekly R1.

-

Traders’ Sentiment

Only 39% of all SWFX positions are bullish in the morning on April 8, no change over the previous trading session. Meanwhile, bullish orders set in the range of 50 pips from the spot dropped from 59% to 41%.

GBP/USD takes another shot at rebounding

“We believe that this [the April pro-Sterling seasonal effect] will merely delay what we see as renewed pressure on the pound heading into the Referendum.”

- BAML (based on PoundSterlingLive)

-

Pair’s Outlook

The British Pound plunged against the US Dollar for the third consecutive day yesterday, amid concerns over ‘Brexit’ continuing to weigh on the Sterling. The bottom target is now the monthly S1 at 1.4005, which is also bolstered by the Bollinger band today. In case this area gives in, the second demand level at 1.3932, namely the weekly S2, is expected to keep the Pound from falling deeper. Although the bearish scenario is more likely, we should not rule out the possibility of the GBP/USD pair undergoing a bullish correction and, thus, climbing back over the 1.41 psychological level.

-

Traders’ Sentiment

Bullish traders’ sentiment returned to its Tuesday’s level of 69%, compared to 63% yesterday. At the same time, all pending orders are equally divided between the buy and the sell ones.

USD/JPY attempts to regain the bullish momentum

“What (investors) are seeing now is that (Japanese) policymakers aren't providing the support for dollar/yen that they would have expected. That's creating some degree of confusion, and of course, prudent risk management suggests one scales back on short positions.”

- Credit Suisse (based on Reuters)

-

Pair’s Outlook

As was anticipated, the USD/JPY currency pair slumped after BoJ Kuroda’s statement yesterday, with the exchange rate reaching a fresh 18-month low of 107.67. However, the Buck stabilised slightly higher at 108.17, after having plunged for five days in a row. The newly-formed 18-month low is expected to provide sufficient support to keep the Greenback from falling deeper. Technical studies remain retain mixed signals, suggesting that the US currency might rebound today, if demand at the new low provided sufficient impetus for the recovery. In this case, the nearest resistance will be the cluster around 108.75, represented by the weekly S3, the monthly S2 and the Bollinger band.

-

Traders’ Sentiment

Today 74% of all open positions are long (previously 73%). Meanwhile, the portion of orders to buy the US Dollar declined from 62 to 51%.

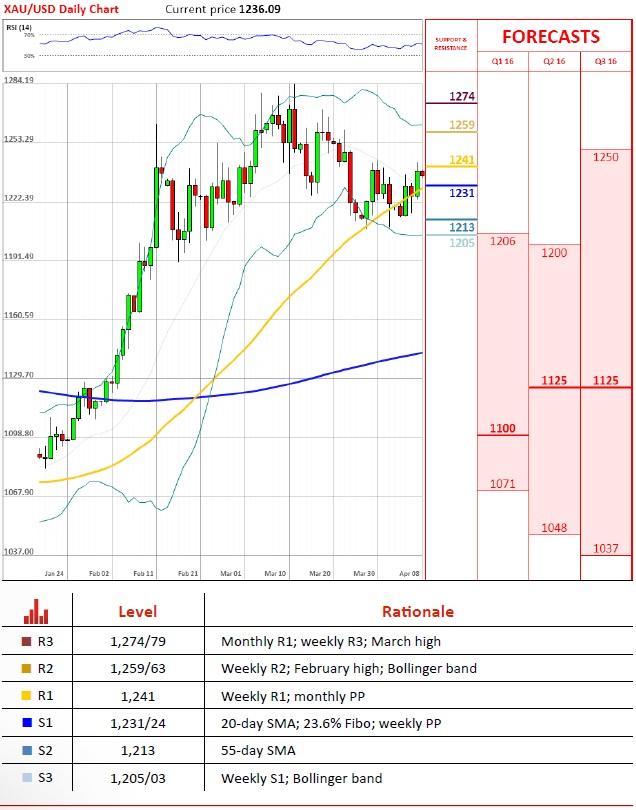

Gold awaits consolidation above 20-day SMA

“Risk appetite waned with renewed concern over the power of monetary policy. A weaker U.S. equity market lent support to global volatility and put gold again at centre stage for investors.”

- ANZ (based on CNBC)

-

Pair’s Outlook

Following Thursday's spike in gold prices, this precious metal is now finally awaiting a consolidation above a busy cluster of resistances placed between 1,224 and 1,231. The upper band of it is the 20-day SMA, and exactly a closure above this line would considerably improve the bullion's future forecast. To support this view, the new weekly technical indicators are strongly favouring a rally over the upcoming five-day period. At the same time, another failure of the bulls, if happens, is unlikely to become long lasting, as XAU/USD will then encounter a demand line in face of the 55-day SMA at 1,213.

-

Traders’ Sentiment

For the first time in precisely nine weeks the bullish SWFX market share soared above the 50% threshold. Now 51% of market participants believe the bullion is going to appreciate, up from only 48% yesterday.

Don't miss our new daily forecasts for EUR USD, GBP USD, USD CAD and USD JPY!

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.