Technical Analysis

EUR/USD rebounds from 12-year lows

“If the euro rises further, I think there will be lots of people who will look for opportunities to sell into the rally.”

- Brown Brothers Harriman (based on Reuters)

Pair’s Outlook

EUR/USD rebounded during trading on Monday of this week, while the pair returned back above 1.12 level. All in all, daily gains reached as many as 100 pips, with no resistance levels crossed in course of this move. The closest supply zone is located at 1.1332 and is represented by the weekly pivot point, which may even stop bulls by acting alone. Therefore, short-term gains up to 1.1350 are possible, but the medium-term outlook remains negative for the Euro.

Traders’ Sentiment

Distribution between long and short opened positions on EUR/USD pair decreased slightly from yesterday to 49% and 51%, respectively. At the same time, commands to acquire the Euro lost one more percentage point during last 24 hours to stay at just 31%.

GBP/USD jumps above weekly PP

“We should see some stabilization and perhaps some scope for sterling to move higher in the near term.”

- Bank of America Merrill Lynch (based on Bloomberg)

Pair’s Outlook

Though we expected more weakness for the Sterling, the currency rebounded from 1.50 because of the new speculations regarding the rate hike in the UK. There is a good chance the currency has not yet fully realised its near-term bullish potential, and GBP/USD may reach the monthly S3 at 1.5150 in the coming days. The key resistance is at 1.53, where the multi-month down-trend joins forces with the monthly S2 level.

Traders’ Sentiment

The bulls remain in a majority, and the current percentage of long positions is at its 10-day average, namely at 57%. At the same time, there are less and less people willing to sell the Pound, the share of orders to sell the currency declined from 74 to 66%.

USD/JPY challenges 55-day SMA

“The U.S. dollar remains supported, and that will continue for the foreseeable future. That’s being driven by other central banks needing to be much more aggressive.”

- Westpac Banking Corp. (based on Bloomberg)

Pair’s Outlook

USD/JPY managed to offset all the Friday’s losses and gained a foothold above 118 once again. However, the resistance at 119 remains intact, and the currency pair must break it to confirm bullish intentions. The first target will then be the late December highs at 121, followed by the 2014 maximum just below 122. In the meantime, the support at 118 seems no longer reliable, the demand at 116 is a better candidate to be the medium-term line in the sand.

Traders’ Sentiment

There are even more people confident in appreciation of the US Dollar relative to the Yen than yesterday, as 65% of open positions are now long. The share of buy orders increased by a considerably wider margin, from 57 to 70%.

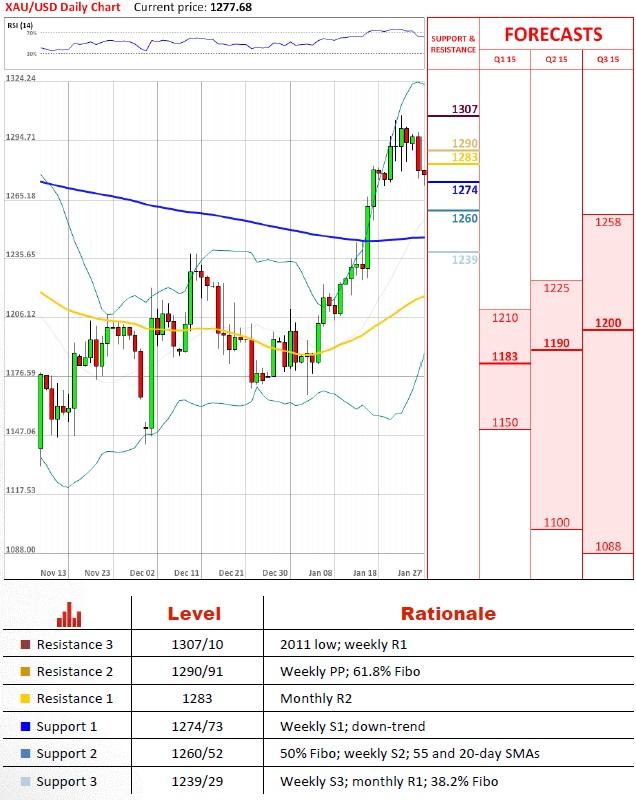

XAU/USD pierces through monthly R2

“The bullion market's focus may shift to the upcoming FOMC two-day meeting on 27-28 January.”

- HSBC (based on CNBC)

Pair’s Outlook

On the first day of this week the precious metal lost around $15 per ounce and crossed a number of major demand areas during trading. At first, a support in face of weekly PP and 61.8% Fibonacci retracement was eliminated. The same happened with the monthly R2 at $1,283; therefore, gold managed to close at $1,281 in the night between Monday and Tuesday. If the bearish pressure persists in the near term, a violation of weekly S1/down-trend around $1,273 seems more than possible. In case of success, a decline may even extend down to 38.2% retracement.

Traders’ Sentiment

Advantage of bulls over bears to buy the precious metal continues to stay close to 70% after a short-term fall in the beginning of the previous week, as the share of long positions among SWFX traders rose three percentage points from Monday to hit the 69% mark on Tuesday's morning.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter gross domestic product (GDP) data on Thursday.