Technical Analysis

EUR/USD forces its way through 1.3823/15

“With the increased market expectations for QE providing support to European asset markets and peripheral markets outperforming as a result of renewed foreign investor appetite, we would anticipate EUR remaining supported, at least until the ECB decides to take action.”

- Morgan Stanley (based on MarketWatch)

Pair’s Outlook

EUR/USD is still struggling to decouple from the monthly pivot point, as it is apparently facing tough resistance. However, if 1.3823/15 is broken, there will be no significant levels until 1.39, which is supposed to be a ceiling for the currency pair, even though both the short and long-term technical indicators are pointing upwards. After the test of the down-trend, the Euro is expected to come under strong selling pressure, which could then alleviate near 1.37.

Traders’ Sentiment

SWFX market participants largely stick to the view that the common currency is going to depreciate—65% of open positions are short. At the same time, the share of sell orders is on the rise—it increased from 60% up to 64%.

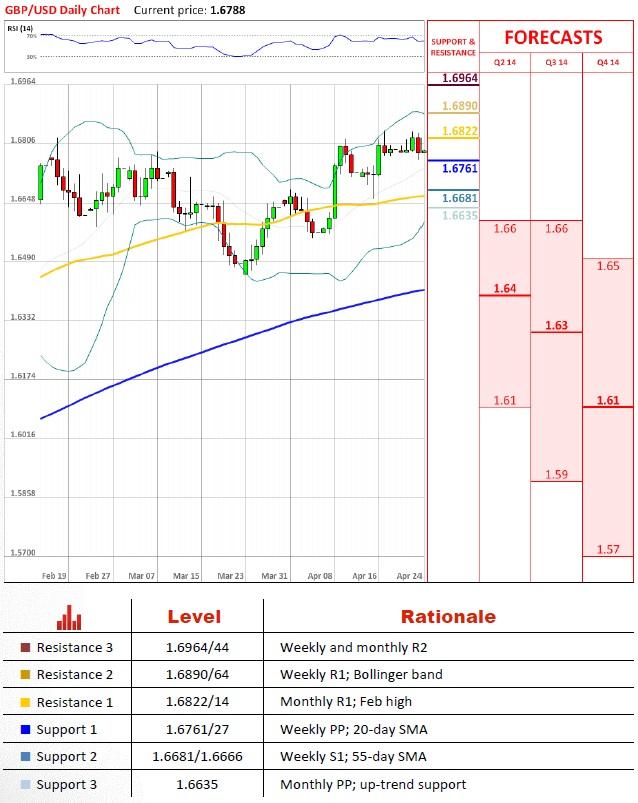

GBP/USD confirms resistance at 1.6822/14

“The [BOE] minutes are highlighting a rise in wages and a more durable recovery and is also quiet about sterling strength. So we could see sterling recover.”

- Western Union (based on Reuters)

Pair’s Outlook

Although at first it seemed as if the resistance at 1.6822/14 is about to be breached, later in the day the bears moved GBP/USD away from the Feb high. But, unless the price falls beneath the nearest supports, such as the weekly PP and 20-day SMA, which would be a bearish sign, the technical studies assure us that the Pound retains a bullish potential and it is able to reach 1.70, if the monthly R1 and Feb high finally give in to the buying pressure.

Traders’ Sentiment

The distribution between the bulls and bears is perfectly unchanged compared to the previous repost, as 26% of the positions are long and 74% are short. Meanwhile, the gap between the buy (39%) and sell (61%) orders 50 pips from the spot price went up.

USD/JPY approaches 102.20

“The CPI data could be a trigger for yen strength.”

- Nomura (based on Bloomberg)

Pair’s Outlook

While the 20 and 55-day SMAs failed to underpin USD/JPY, the support at 102.20 successfully repelled the attack. Accordingly, the current bearish correction is likely to end near the weekly PP and 38.2%, thus giving way for the latest rally to resume. If this demand turns out to be insufficient to turn the pair around, the support at 101.77/69 (monthly S1 and long-term up-trend) has an even greater chance of restoring the bullish outlook.

Traders’ Sentiment

The difference between the longs and shorts widened even more. Now 73% of traders wait for the U.S. Dollar to rise in value (71% yesterday). The change in the share of buy orders was much more substantial—from 55% to 67%.

USD/CHF to cede ground

“As (U.S.) equities underperform, this leads to buying of Treasuries and yields fall. The dollar is softer as a result because it is reflecting other markets rather than internal components.”

- Societe Generale (based on CNBC)

Pair’s Outlook

As the resistance at 0.8857 proved to be impenetrable, the bias towards USD/CHF is fairly negative. The currency pair could ultimately give up more than two figures to arrive at 0.86 (2011 lows) before regaining the upward momentum. Still, there is a number of formidable supports that may prevent a precipitous decline. The nearest is a combination of the 20 and 55-day SMAs, followed by the weekly and monthly pivot points.

Traders’ Sentiment

The portion of longs fell three percentage points, but the sentiment towards USD/CHF stays explicitly bullish, as 70% of traders expect the greenback to appreciate. The number of commands to buy the buck, in the meantime, plunged from 65% to 47%.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

AUD/USD tumbles toward 0.6350 as Middle East war fears mount

AUD/USD has come under intense selling pressure and slides toward 0.6350, as risk-aversion intensifies following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY breaches 154.00 as sell-off intensifies on Israel-Iran escalation

USD/JPY is trading below 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price jumps above $2,400 as MidEast escalation sparks flight to safety

Gold price has caught a fresh bid wave, jumping beyond $2,400 after Israel's retaliatory strikes on Iran sparked a global flight to safety mode and rushed flows into the ultimate safe-haven Gold. Risk assets are taking a big hit, as risk-aversion creeps into Asian trading on Friday.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.