Technical Analysis

EUR/USD still capped by resistance at 1.2580

“The Fed is not likely to rush with raising rates until it begins seeing wage inflation pick up. To that end, they need more data to make a final decision.”

- Prudential Financial (based on MarketWatch)

Pair’s Outlook

Even though the shared currency managed to rise above the weekly resistance at 1.2580 on Wednesday, later the pair returned back to trade below this level. It looks like the next strong supply area around 1.2630 is putting additional pressure on pair’s bulls, as they struggle to push the pair higher. Technical indicators suggest the cross will start declining after it recovered some losses during last three weeks; however, a drop below 1.25 is unlikely this week.

Traders’ Sentiment

Market sentiment on EUR/USD became completely undecided on the SWFX market. At the moment 50% of all positions are held both by bulls and bears. Pending orders, in turn, entered the red zone, as now only 38% of them set to acquire the Euro in 100-pip range.

GBP/USD advanced above monthly S2

“It isn’t just the timing of liftoff the Fed cares about, but the whole path of federal funds rate. I think they do probably want to limit the extent of tightening that people expect, at least at the beginning.”

- Former New York Fed staff member (based on Bloomberg)

Pair’s Outlook

After six consecutive days of decline, the GBP/USD pair managed to gain value and erase some of losses that occurred during this and the previous week. The Cable rose above the monthly S2 at 1.5662 and closed at 1.5672 on Wednesday. However, the bearish sentiment continues to prevail on the market, meaning that the yesterday’s recovery could be only short-term. The pair is assumed to set a new 2014 low in the foreseeable future, as suggested by daily and weekly technical studies.

Traders’ Sentiment

At the moment 56% of traders still hold long positions on the Pound, the same as 24 hours ago. Pending orders, however, remain negative in relation to GBP/USD in both 50 and 100-pip ranges.

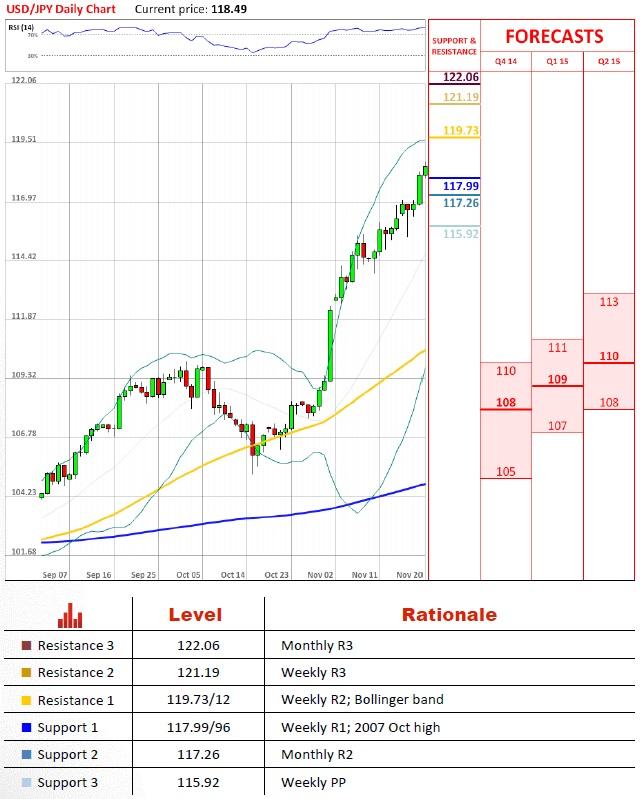

USD/JPY approaches weekly R2 around 119

“There is no backing away from our commitment to fiscal consolidation. We will keep our fiscal 2020 goal to achieve fiscal health. I am convinced that through that, there will be no loss of international trust.”

- Japan’s Prime Minister Shinzo Abe (based on Bloomberg)

Pair’s Outlook

USD/JPY pair continued with its long-term bullish trend and increased further during last 24 hours. The US dollar surpassed the 2007 Oct high and weekly R1 at 118 and jumped up to the next resistance line and the major level around 119. For the time being, this level manages to hold the pair from going higher. However, we are waiting for this line to be breached in the nearest future. After that, the pair may set the weekly R3 at 121.19 as a new target.

Traders’ Sentiment

Distribution between long and short positions improved slightly, but it still remains broadly neutral, as only 52% of all positions are bullish. Pending orders, in turn, surged with 66% and 69% of them set to buy the Greenback in 50 and 100-pip ranges, respectively.

USD/CHF failed in testing support at 0.9550

“We've had very good job creation this year. In fact, this year is on track to be the best job creation year since 1999 if the current pace keeps up for the rest of the year.”

- Federal Reserve Governor Jerome Powell (based on CNBC)

Pair’s Outlook

The bearish pressure continues to push the US dollar down versus the Swissie. On Wednesday, the pair even dropped below the dense demand area around 0.9550, but quickly returned back closer to the major level at 0.96. It seems that current strength of bears is not enough for the cross to decline considerably. Any significant downside movement can be expected only in the long-term. This idea is also suggested by monthly technical indicators, while daily and weekly ones are sending mixed signals.

Traders’ Sentiment

Attitude towards USD/CHF pair remains strongly bullish, as 63% of all positions are long. So do the pending orders, being that majority of them are set to acquire the Buck against the Swiss franc.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.