Technical Analysis

EUR/USD stands still at 1.31

“There are a many reasons to continue selling the euro.”

- Commerzbank (based on Reuters)

Pair’s Outlook

Although EUR/USD has finally reached a major support, the bulls largely remain inactive. As a result, the pair is trading flat. And even if we do see an upward correction, the bias will still be to the downside. The Euro has broken out of the rising wedge pattern this quarter, meaning the sell-off may push the price through the 2013 low at 1.2750 down to the 2012 low at 1.2050. However, the monthly technical indicators are persistently bullish.

Traders’ Sentiment

Despite poor performance of the Euro, there are still more bullish traders in the SWFX market—they take up 62% of it. As for the orders, most (70%) of them are to sell the single currency, but their share is currently decreasing (from 81% yesterday).

GBP/USD returns to May low

“The dollar's gains are driven by actual flows, such as options-related buying. The market is also keeping an eye on the rise in equities.”

- Barclays Bank (based on CNBC)

Pair’s Outlook

For now the Cable stays on a bullish path and may gain another 70-80 pips before turning around. Despite the long-term technical indicators mostly giving ‘buy’ signals, the current upward momentum is likely to be insufficient to break a high concentration of resistances around 1.67. GBP/USD has a better chance of falling back to this year’s low at 1.6250. From there the pair may start a decline towards the 2013 low at 1.48.

Traders’ Sentiment

The sentiment towards GBP/USD remains bullish, but is notably weaker than yesterday, as the percentage of longs fell from 65% down to 56%. Concerning the orders, there is no difference between the amounts of buy (53%) and sell (47%) ones.

USD/JPY aims for 2014 high

“The risks favor additional dollar appreciation.”

- Citigroup (based on Bloomberg)

Pair’s Outlook

Despite a high risk of a pull-back to the July high at 103, USD/JPY preserved a strong bullish momentum. However, the currency pair is getting close to a significant supply area above the level of 105, which is represented by the monthly R1 and this year’s high. Accordingly, a dip down to 104 in the coming weeks should not be a surprise, and it will not invalidate the positive outlook. Meanwhile, the daily and monthly studies point North.

Traders’ Sentiment

There has been a significant change in the distribution between the bulls and bears, as the share of the former has gone from 53 to 39% during the last 24 hours. At the same time, the share of buy orders has plummeted from 56 to 32%.

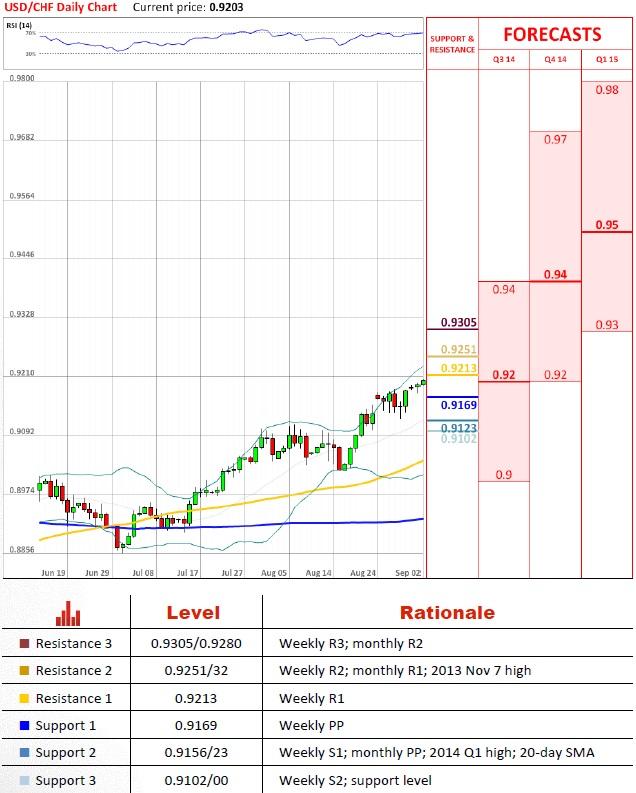

USD/CHF charges at 0.9250

“The franc remains highly valued against the euro.”

- Thomas Jordan, SNB President (based on Bloomberg)

Pair’s Outlook

USD/CHF keeps on grinding higher, being that there are no tough resistances nearby. The bullish tendency is expected to persist until the rate touches the 2013 Nov 7 high at 0.9250. However, there the U.S. Dollar will be prone to a sell-off, which should stop to develop around 0.9150—the 2014 Q1 high. But even a deeper bearish correction, as long as it is halted above the key up-trend at 0.90, will not change the outlook.

Traders’ Sentiment

The attitude of the SWFX market worsened with respect to USD/CHF—there is no more gap between the bullish and bearish participants. But 50 pips from spot there are a lot more commands to sell (70%) than to buy (30%).

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.