Technical Analysis

EUR/USD heads towards 1.31

“This relatively marginal hawkish shift [in Fed minutes] has reinvigorated the rally in the greenback, taking the EURUSD down to test key Fibonacci support in the 1.3250 area, while USDJPY bulls look to target previous resistance in the 104.00 zone.”

- Forex.com (based on MarketWatch)

Pair’s Outlook

Despite toughness of the demand area around 1.33 and ‘buy’ signals on the monthly chart, the bears continued to push the price lower. The currency pair has already closed beneath the 2013 Q4 low and monthly S1, meaning the downward momentum is likely to persist in the coming weeks. The next significant support level is represented by the monthly S2 at 1.3450, followed by the 2013 September low at 1.31.Traders’ Sentiment

The share of bullish market participants continues to grow while the Euro is becoming cheaper. Right now 58% of open positions are long. Concerning the pending orders, there is currently no difference between the amounts of buy and sell ones.

GBP/USD extends losses

“On balance the minutes should ease recent sterling weakness somewhat, but we prefer to keep longer positions through euro/sterling shorts.”

- Citi (based on Reuters)

Pair’s Outlook

An attempt of the bulls to negate the selling pressure at 1.66 turned out to be fruitless, as all of the intraday gains were eventually negated and the bears remained in control of the market. And even though the monthly studies suggest the down-trend is about to come to an end, the Sterling has a low chance of starting a robust recovery before falling down to this year’s low at 1.6250. There is also an important level at 1.6450—monthly S3.

Traders’ Sentiment

Just as in EUR/USD, here the part of long positions is also increasing. The bulls now constitute 65% of the market (61% five days ago). However, the gap between the buy and sell orders is closing—it has fallen from 18 to 4 percentage points during the last 24 hours.

USD/JPY approaches 2014 Q2 high

“The momentum is there. The market is experiencing a bit of an euphoria, putting logic aside and now aiming for 104 yen. I hesitate to use the term but it's 'risk-on'.”

- Masashi Murata, Brown Brothers Harriman (based on CNBC)

Pair’s Outlook

Since the July peak is now out of the way, just as the monthly R1, there is only the 2014 Q2 high at 104.12 seen capable of preventing a re-test of 105.44—this year’s highest point. At the same time the monthly technical studies confirm that the upward momentum is here to stay—four our of eight imply appreciation of the Dollar. In the meantime, the recently breached resistance at 103 should now act as a floor for the near-term dips.

Traders’ Sentiment

There has been a major drop in the percentage of long positions held on USD/JPY since yesterday’s update—it has plunged from 75 down to 59%. But at the same time there are less sell orders—their portion declined from 63 to 58%.

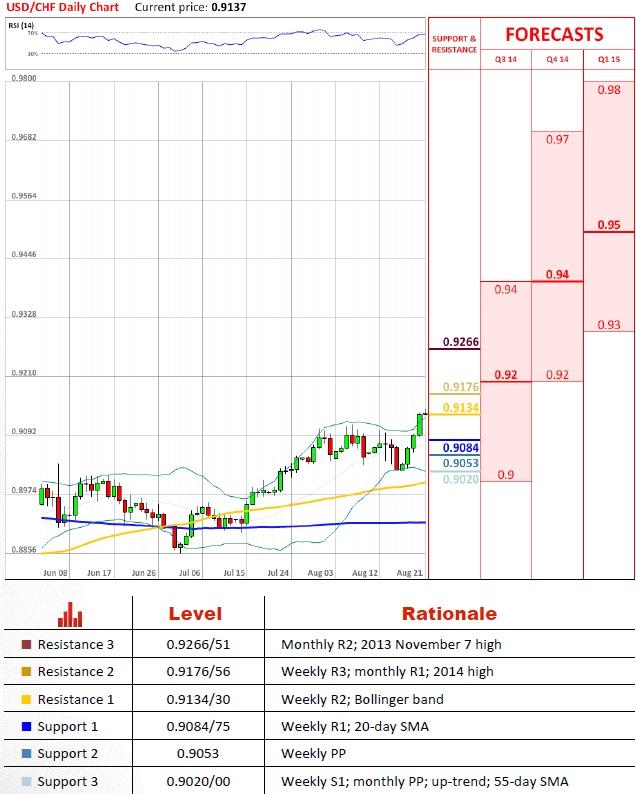

USD/CHF to challenge 2014 high

“Dollar crosses are weakening, led by the euro, as the Fed minutes were more hawkish than people had been expecting.”

- FX Prime (based on Bloomberg)

Pair’s Outlook

The resistance at 0.91 had been finally broken, meaning there are now no obstacles for USD/CHF to touch 0.9156. This supply zone may also prove to be difficult to cross, considering that it is reinforced by the monthly R1 level and the technical indicators are not in favour of a rally. Should the bulls show weakness in the face of 2014 high, the support at 0.90 will be there to keep the rate away from the 100 and 200-day SMAs.

Traders’ Sentiment

According to the SWFX market, USD/CHF has already reached its fair value, being that the sentiment has changed from strongly bullish (74%) to neutral (54%). The share of buy orders also fell, but less noticeably, from 75 to 67%.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price flat lines above $2,300 mark, looks to US macro data for fresh impetus

Gold price (XAU/USD) struggles to capitalize on the previous day's bounce from over a two-week low – levels just below the $2,300 mark – and oscillates in a narrow range heading into the European session on Wednesday.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.