Technical Analysis

EUR/USD faces strong demand at 1.35

“The euro has been in a range with $1.35 as a bottom. The euro will probably trend lower now.”

- TD Securities (based on CNBC)

Pair’s Outlook

Last week, despite the pair breaching a long-term down-trend, the bulls successfully defended the key level at 1.35, thus prodding EUR/USD to return to the monthly S1. However, given the number and density of the supply lying overhead, there is little chance the Euro will be able to sustain its current recovery. The price is likely to turn around either at 1.3563/53 or 1.3630/1.3598 and then pierce through 1.35, thereby confirming its bearish intentions.

Traders’ Sentiment

There are still no significant changes observed in the sentiment of the market towards EUR/USD—54% of traders are long and 46% are short. On the other hand, there has been a major increase in the sell orders near the spot—from 35% to 65% (50 pips around it).

GBP/USD grinds lower

“Largely the market has been very long sterling and perhaps with some of the events that have happened over the past 24 hours, traders have taken some profits on those positions and have scaled back on some of the risk.”

- JPMorgan (based on Reuters)

Pair’s Outlook

There are less and less arguments in favour of a rally. First, the currency pair has been failing to make any meaningful progress for the last three weeks. Second, there is a decreasing number of technical indicators supporting appreciation of the Sterling. Nevertheless, there still are a lot of supports capable of preventing development of the current dip. The closest one is formed by the 2009 high at 1.7042, followed by the monthly PP and 55-day SMA.

Traders’ Sentiment

The SWFX traders remain strongly convinced that the Great Britain Pound is overvalued relative to the U.S. Dollar, as evidenced by a large share of short positions opened in the market—72% of the total amount.

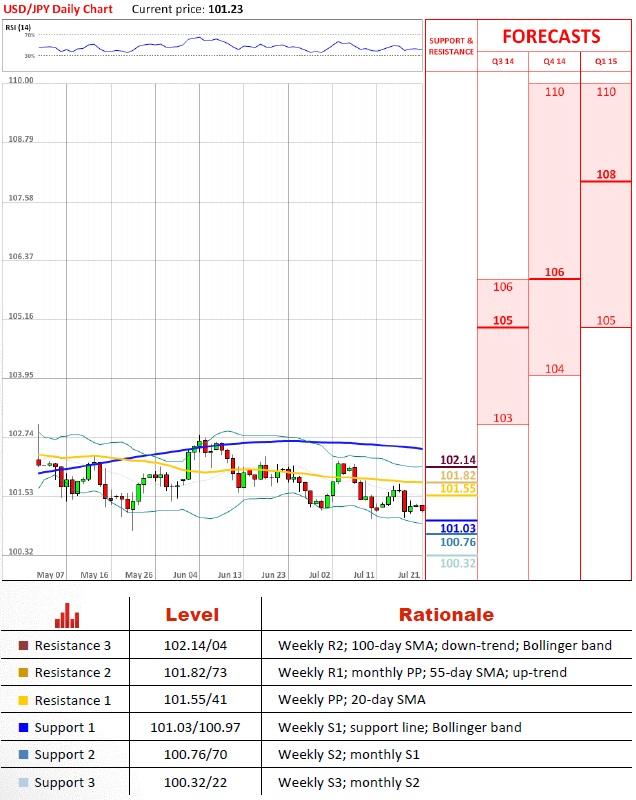

USD/JPY’s bullish outlook relies on 101

“A stronger CPI number would boost the U.S. dollar and we’re seeing that data begin to edge up. That’s the biggest risk for the start of the week.”

- ASB Bank (based on Bloomberg)

Pair’s Outlook

Abundance of various resistances between 101.50 and 102.50 is not letting USD/JPY to regain its bullish momentum. For now the support at 101 copes with the downward pressure, but a breach of this level could potentially entail a strong sell-off, since there is low concentration of demand beneath. Nonetheless, the monthly technical indicators seem to be mostly optimistic—four out of eight are presently giving ‘buy’ signals.

Traders’ Sentiment

In most pairs the Greenback is considered to be undervalued, and USD/JPY is not an exception—74% of traders are currently holding long positions. As for the orders, a majority of them are to purchase the Buck against the Yen.

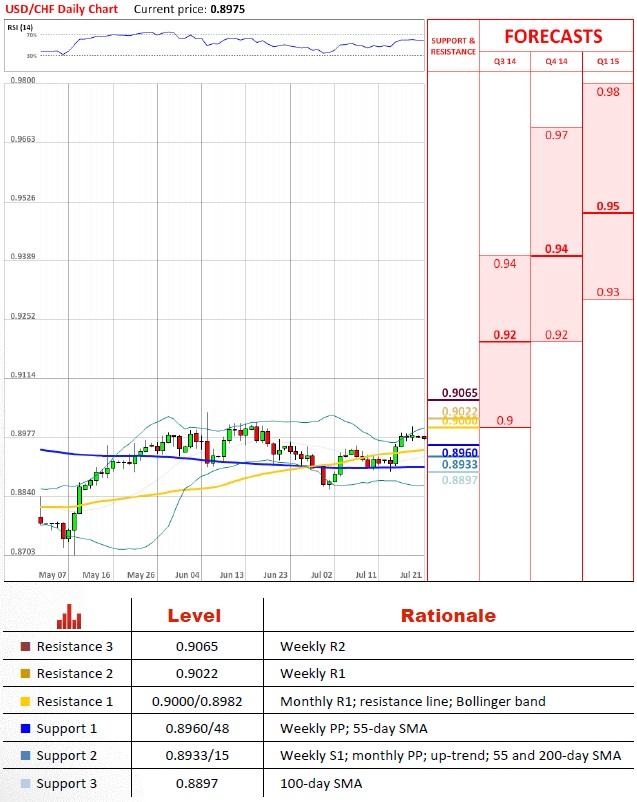

USD/CHF capped by 0.90

“The dollar is still the safe-haven currency.”

- IronFX (based on MarketWatch)

Pair’s Outlook

USD/CHF made a good attempt to break the resistance at 0.90 on Friday, but in the end it was unable to advance further. As a result, the downside risks substantially increased. The rate is now expected to retreat to a cluster at 0.8933/15, where the monthly pivot point merges with the 200-day SMA and a three-month up-trend. Below, there is the 100-day SMA that could help the pair restore the bullish momentum and launch yet another attack on 0.90.

Traders’ Sentiment

The sentiment stays distinctly bullish with respect to USD/CHF, being that 74% of positions are presently long (71% last week). Concerning the pending orders placed 100 pips from the spot, there is completely no difference between the buy and sell ones.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.