Technical Analysis

EUR/USD on a highway to 1.35

“There’s wasn’t much new from the ECB, but it confirmed the easing bias in Europe. It confirmed the contrast in the direction of U.S. and euro-area monetary policy, and the outlooks for the dollar and the euro.”

- Sumitomo Mitsui Trust Bank (based on Bloomberg)

Pair’s Outlook

The U.S. Dollar continues to strengthen, and this tendency is unlikely to be stopped by any of the nearby supports—the weekly pivot point has already been broken. The demand at 1.35 and below, on the other hand, has a higher chance of succeeding, also considering the bullishness of the monthly indicators. Nevertheless, the long-term outlook is still deemed to be bearish, since the key resistances remain intact and it is not expected to be changed any time soon.

Traders’ Sentiment

As the Euro gets cheaper, there are less and less incentives for the traders to hold onto it. As a result, the share of the short positions has declined from 56% down to 52%. Meanwhile, the percentage of buy orders surged from 40% to 59%.

GBP/USD looks towards 1.74

“The data supports expectations for the Fed to begin coaxing the Fed funds rate higher by the middle of next year.”

- BNP Paribas (based on Reuters)

Pair’s Outlook

Taking into account the technical studies, the weekly R3 should not prevent further appreciation of the Sterling. Conversely, the currency is reckoned to have the potential to test the resistance at 1.74 this quarter, consisting of the monthly R2 and 16-month up-trend resistance (upper boundary of the bullish channel). But if the upward momentum does not prove to be strong, there are strong supports near 1.70 and 1.68.

Traders’ Sentiment

Despite the fluctuations in the price, the sentiment with respect to the Pound remains distinctly bearish—as many as 75% of the traders are currently holding short positions. As for the orders, 43% are to buy and 57% are to sell the currency against the buck.

USD/JPY fights 100-day SMA and up-trend

“The payrolls report confirmed that from a macroeconomic perspective the U.S. economy is growing. Based on fundamentals, recent dollar buying should continue.”

- Sumitomo Mitsui Trust Bank (based on Bloomberg)

Pair’s Outlook

USD/JPY has just encountered the 100-day SMA and up-trend resistance line at 102.13. If this resistance withstands the buying pressure, it will most likely bring the bad news for the support at 101.20, which then will be expected to be breached. But if the momentum is preserved and the 200-day SMA is also removed from the way, the rally could extend up to this year’s high at 104, a scenario suggested by the monthly indicators.

Traders’ Sentiment

The bullish sentiment towards USD/JPY strengthened, being that now 75% of the SWFX market participants believe the U.S. Dollar is going to appreciate relative to the Japanese Yen instead of 71% observed yesterday.

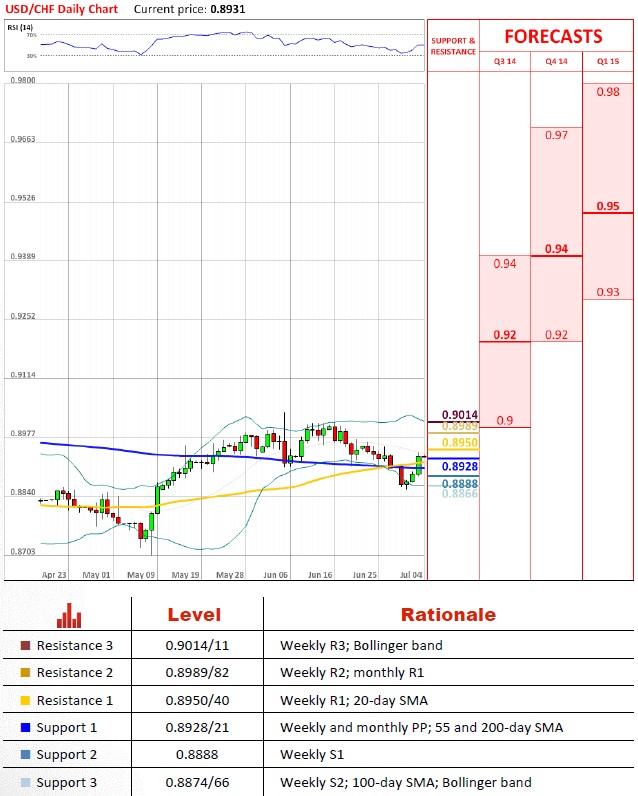

USD/CHF closes north from 200-day SMA

“The dollar's gains look limited considering how strong the jobs data was, as participants are still unsure how U.S. inflation pans out.”

- IG Securities (based on CNBC)

Pair’s Outlook

The yesterday’s events have greatly influenced the balance of powers in USD/CHF. Instead of respecting 0.8928/21 and resuming the decline, the currency pair soared only to take a break already above the monthly PP and 200-day SMA. If the price manages to stay at current levels or even advance further during the next few days, it could mean a re-test of 0.90, a resistance level that halted the May rally and triggered heavy selling.

Traders’ Sentiment

While there were no apparent changes in the distribution between the longs and shorts because of the recent spike in the rate, the portion of the buy orders 50 pips from the spot jumped from 55% up to 77%.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.