Technical Analysis

EUR/USD attacks 200-day SMA

“It should only be a matter of time before the dollar finally begins to gain some traction.”

- Commerzbank (based on Reuters)

Pair’s Outlook

The currency pair has finally touched upon one of the main resistances, which in turn is expected to prove propensity of the Euro to decline over the long term. But if the 200-day SMA at 1.37 fails to negate the current bullish momentum, there is the 100-day SMA with monthly R1 at 1.3758/40 and also a major down-trend resistance line at 1.3870 that are likely to turn the upward tendency of the price around should it persist.

Traders’ Sentiment

The sentiment towards the Euro continues to deteriorate—the share of short positions increased from 59% to 64%. In the meantime, there is no difference between the amounts of buy and sell orders—50% and 50% respectively.

GBP/USD rises above 2009 high

“The market appears to be torn between the surprisingly weak U.S. economic data in Q1 of this year and the seemingly stronger evidence of growth in the most recent economic reports.”

- BK Asset Management (based on MarketWatch)

Pair’s Outlook

Although the Cable has been hesitating to extend the rally the past two weeks, in the end the exchange rate managed to overcome the 2009 high at 1.7044. Accordingly, instead of forming a rising wedge by falling to 1.68, the Sterling should now move further north. The medium-term target is considered to be 1.74. There the monthly R2 level merges with the upper rising trend-line of the bullish channel and is therefore capable of initiating a downward correction.

Traders’ Sentiment

While the percentage of the bearish market participants is more or less the same as yesterday—70%, the portion of the sell orders plunged compared to the previous report, specifically from 63% to 54%.

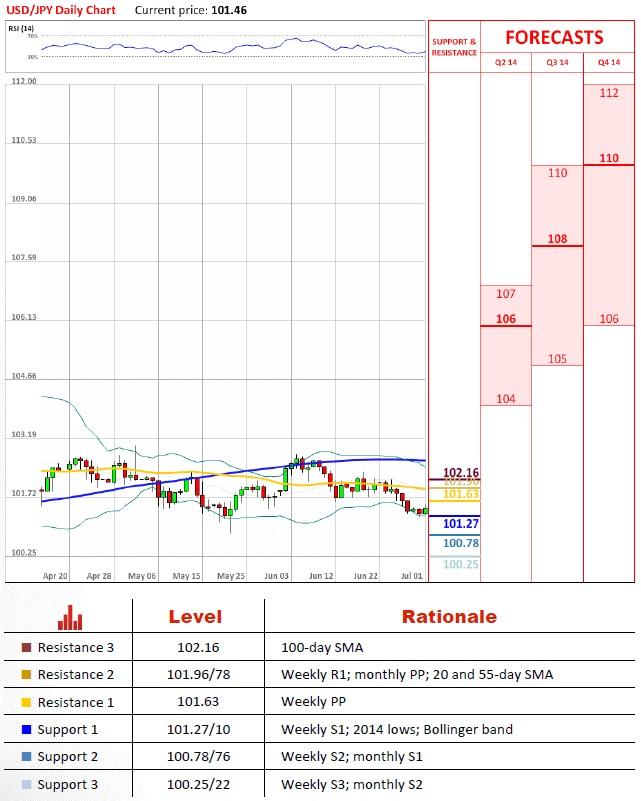

USD/JPY supported by 2014 lows

“The risk-off sentiment that was gaining traction in the market is now easing back. The yen is weakening as stocks rise.”

- Money Square Japan (based on Bloomberg)

Pair’s Outlook

For now the support at 101.20 stands its ground, meaning there is still a chance, even though slim, the U.S. Dollar is going to recover from here. But the pair will have to breach a slew of tough resistance levels between 102 and 102.50 in order to confirm its bullish intentions. There are the long-term moving averages (100 and 200 days) and some of the major trend-lines. Once all of them are out of the way, the 2014 high could become a potential target.

Traders’ Sentiment

A majority (70%) of the SWFX market participants believe the greenback is going to outperform the Japanese Yen. At the same time, the buying pressure is unlikely to subside, being that most (60%) of the orders are placed to purchase the buck against the Yen.

USD/CHF reaches 100-day SMA

“People are more nervous about the data this week so the dollar is on the defensive.”

- BNP Paribas (based on CNBC)

Pair’s Outlook

The pair continues its journey south, as none of the nearby supports were able to stop the bears. At the moment USD/CHF is testing the 100-day SMA and, according to the monthly technical indicators, is likely to break it. If this is the case, the dip could extend down to 0.88—the monthly S1 level. On the other hand, it the bulls regain their strength, they will have to push the price above the 55 and 200-day SMAs to put this year’s high back on the map.

Traders’ Sentiment

Nearly three out of four (73%) traders are planning to profit from U.S. Dollar’s appreciation against the Franc. Moreover, a large portion (69%) of the orders set 100 pips from the spot are to acquire the buck, thus supporting the bullish outlook.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.