Technical Analysis

EUR/USD is inclined to rally

“They [the ECB] are clearly concerned about inflation being too low. The downward revision should make them more concerned and it should make them more sensitive to euro strength.”

- TD Securities (based on MarketWatch)

Pair’s Outlook

Although it took EUR/USD a considerable amount of time and effort, the currency pair has finally risen above the monthly R1 level. Accordingly, the next target for the Euro is likely to be the monthly R2 at 1.4047. In the longer-term perspective the exchange rate even retains the potential to approach the 2010 highs at 1.43, the current location of the major up-trend resistance and the monthly R3.

Traders’ Sentiment

A considerable majority of traders stay pessimistic with respect to the single European currency. Right now as many as 69% of them expect it to lose value against the U.S. Dollar. The distribution between the buy and sell orders is also quite stable—44% and 56% respectively.

GBP/USD remains directionless

“They are going to move away from thresholds on specific economic indicators and take a more holistic approach that depends on subjective evaluation of a broad array of economic indicators. They are trying to move back to a more normal approach to policy.”

- Jefferies (based on Reuters)

Pair’s Outlook

Even though GBP/USD seems to be well-supported, having a long-term up-trend, monthly pivot point and 55-day SMA as guarantors of bullish outlook, it does not appear to be willing to advance north. The weekly and monthly technical indicators are also implying a positive bias, but the currency pair stays beneath the resistance at 1.6672/50, thereby calling into question ability of the support at 1.6604/1.6559 to initiate a recovery.

Traders’ Sentiment

The bearish towards the Great Britain Pound sentiment in the market continues to strengthen. The share of short positions added another percentage point and now amounts to 59% (54% five days ago).

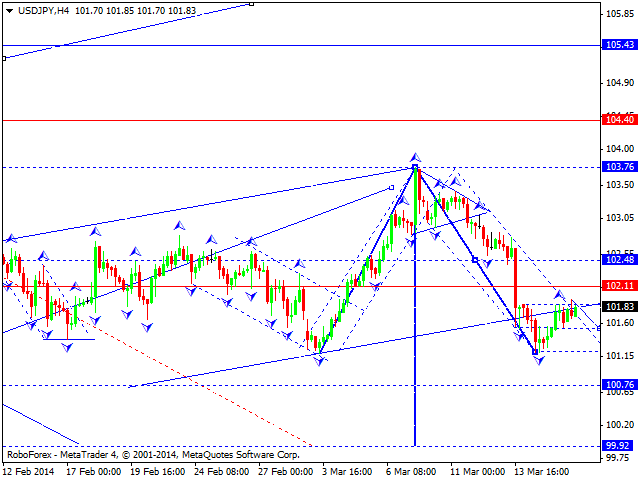

USD/JPY halted at 102

“The FOMC meeting this week could be a catalyst for USD gains. We think removal of guidance related to the 6.5 percent unemployment threshold will weaken the Fed’s forward guidance on the margin, which could see some increase in US rates and USD support.”

- Nomura (based on Bloomberg)

Pair’s Outlook

The bullish impetus USD/JPY received a day earlier proved to be insufficient to result in a breach the monthly PP and the 38.2% Fibo. Now, if the pair does not stop sliding near 101.77, it may return back to 101, the level which is unlikely to let the price to extend the decline. Even if the Dollar dives beneath this support, the 200-day SMA, coupled with the monthly S1, will be expected to help the currency to quickly regain the lost ground.

Traders’ Sentiment

The gap between the long (71%) and short (29%) positions remains perfectly unchanged compared to yesterday’s reading, as an overwhelming majority of SWFX market participants are betting on the U.S. Dollar.

USD/CHF hesitates to move up

“In immediate focus is Russian president Putin's speech later today. If he plays down an immediate annexation of Crimea by Russia, the dollar could gain further ground on unwinding of risk aversion.”

- Praevidentia Strategy (based on CNBC)

Pair’s Outlook

For the time being the support at 0.87, consisting of the major down-trend and the monthly S1, fails to cause the intended effect, namely rapid appreciation of the U.S. Dollar. Instead the technical indicators are largely giving ‘sell’ signals and the weekly PP turned out to be enough to prevent USD/CHF from surging. Still, eventually the rate should overcome weakness and start a strong recovery.

Traders’ Sentiment

The bulls have even further increased their dominance over the bears, being that now the former take up as much as 75% of the market (74% yesterday). Similarly, there is a notable advantage of buy orders (75%) over the sell ones (25%), meaning the demand for the greenback may increase.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.