Technical Analysis

EUR/USD

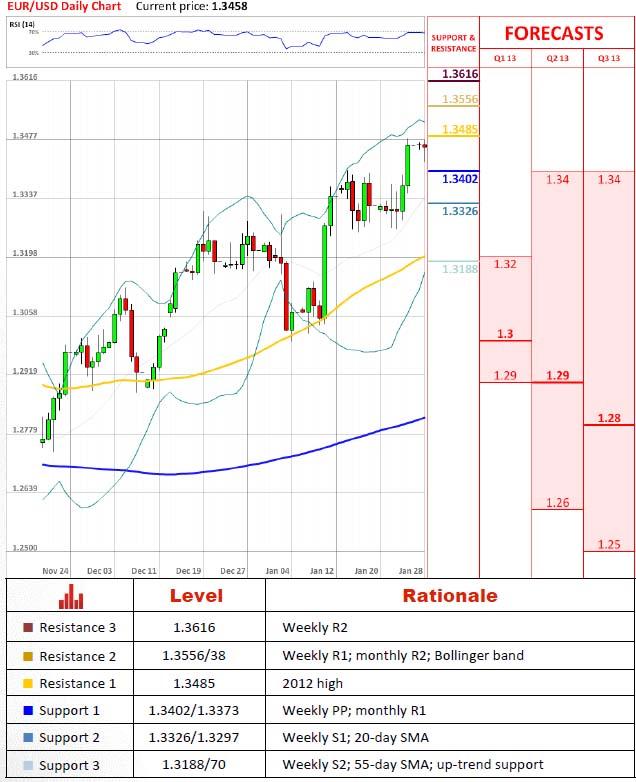

EUR/USD gradually slips from a 2012’s high

“There is still some room for euro to go higher, but the road upwards will be characterized by bumps, pauses and even by corrections.”

- Commerzbank (based on Reuters

Pair’s Outlook

The major currency pair gradually depreciates from a 2012’s high, but bearish sentiments still are very weak and don’t demonstrate any correction momentum. The pair perfectly moves in the upper part of the Bollinger bands. In case of a down-side scenario, the price has to overcome a 1.3402/1.3373 level, where the weekly PP and monthly R1 are located, and after that 1.3327, where the 20-day SMA merges with the weekly S1. In an up-side scenario, the pair will face difficulties at 1.3556, where the monthly R2 intersects the weekly R1 and the Bollinger band.

Traders’ Sentiment

SWFX market traders have bearish sentiments, since 34% of positions are long and 66% are short. Pending orders market is rather neutral, as both sides have equal shares.

GBP/USD

GBP/USD reaches a long-term support line

“The prospect of more activist monetary policy is not an encouraging one for GBP, certainly not as it comes on top of a host of other negative developments - an economy that is triple-dipping, a government that is struggling to cut its deficit.”

- JPMorgan (based on Reuters)

Pair’s Outlook

The Cable exhibits significant bearish sentiments, as the price depreciates without any corrections. Yesterday, the pair has reached a 11-month support line at 1.5707, which might be strong enough support to halt the recent price depreciation. Also, an oversold situation is very possible, as the RSI indicator implies increased risk. The index has a value of 24 in a daily graph and 39 in a weekly graph.

Traders’ Sentiment

Sharp depreciation of the Sterling attracts a lot of traders, as the buy side has 71% of all opened positions and bearish side has only 29% of positions. Pending orders market is gently bullish, as 52% of orders are long and 48% are short.

USD/JPY

USD/JPY little changed

“I still think dollar/yen will head higher. In the near term, I think the dollar will trade between 90 yen to 92 yen. Everyone is only thinking about where to buy (the dollar) on dips.”

- Trader for a European bank in Tokyo (based on Reuters)

Pair’s Outlook

USD/JPY pair has made a bearish correction yesterday, as the price has reached the 423% Fibonacci level at 90.92 and the Bollinger line. The currency pair is still in a very strong bullish trend, despite the fact that the RSI indicator has significant values in various timeframes, especially 82 points in a weekly graph. Therefore, any short position would mean unrewarded elevated risk.

Traders’ Sentiment

SWFX market traders are slightly bearish on USD/JPY pair, as 43% of positions are long and 57% of positions are short. Pending orders segment is bullish, as 78% of waiting orders are for a long position and only 22% are for a short position.

USD/CHF

USD/CHF breaches the 20-day SMA

“We’re going to get a pretty clear reiteration from the Fed that quantitative easing will continue for quite some time. The strong dollar story is a tough case to make right now.“

- Westpac Banking Corp. (based on Bloomberg)

Pair’s Outlook

USD/CHF pair experiences bearish sentiments during the last few weeks and has already reached the 20-day SMA. Settlement beneath it would open a free area till a 0.9236 level, where the 55-day SMA is located. Since the pair is mostly depreciating, but it still remaining above the 20-day and 55-day SMAs, being a bullish signal, the current situation is rather vague and position opening would be associated with heightened uncertainty.

Traders’ Sentiment

The majority of USD/CHF pair traders are bulls, since 86% of opened position are long and only 14% are short. Waiting orders market situation is bullish, as 59% of orders are for a long position and 41% for a short position.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.