Forex News and Events

RBA keeps all doors open (by Arnaud Masset)

Overnight, the Reserve Bank of Australia released its statement on monetary policy. Just like the BoE did, the RBA lowered its short-term inflation forecast. The bank stated that “wage growth has been broadly in line with expectations” and are not expected to accelerate over the next couple of years. Headline CPI is expected to reach 1.75% by year-end compared to a forecast of 2.5% in August. Likewise, the RBA’s inflation forecast for the year through June 2016 has been trimmed to between 1.5%-2.5% from between 2%-3% in the August statement.

Despite the fact that the RBA cut its growth forecast by a quarter point for 2015 to 2.25%, the bank remains upbeat about the outlook, and especially about the job market. All in all, the RBA seems to be pretty happy with the overall situation but is nevertheless still ready to take further measure to support the economy. Long story short, the Reserve Bank wants to keep all options open, just in case the Chinese situation deteriorates further. AUD/USD still sits on the 0.7139 key level (Fib. 50% on September-October rally).

All eyes on NFPs (by Peter Rosenstreich)

Recent Fed comments have made today’s payroll report the headline event once again. Fed Chair Janet Yellen in her testimony to House Financial Services Committee stated that December is a “live possibility” as long as the US economy remains firm. This suggests that, in Yellen’s view, today’s payroll number will provide critical details. The headline nonfarm payroll is expected to rebound to 185k from last month’s 142k. The unemployment rate is expected to fall 0.1% to 5.0%, while average hourly earnings should rise 0.2% according to consensus. In addition, the low print for the last two reads should see an upwards revision, considering the past trend of revisions. This week’s ADP payrolls printed at 182k indicating that NFP should come in around 185k. US jobless claims increase to 276k above 262k expectations in the week ending October 31 from 260k. This read indicates that the US is close to full employment, which could stimulate the Fed to hike. Further evidence of a strengthening labor market would cement a rate hike in December. From our vantage point any NFP read over 190k today will push the balance towards December. Given the demand for USD and sell-off in treasures we suspect that a disappointing read will trigger greater volatility then a strong read. Elsewhere, St. Louis Fed President Bullard and Governor Brainard will be speaking.

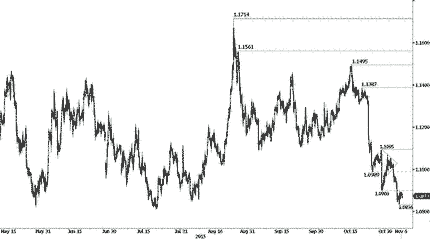

EURUSD - Weak bounce

| Today's Key Issues | Country/GMT |

| Oct Foreign Currency Reserves, last 541.5b, rev 541.4b | CHF/08:00 |

| Sep Industrial Production MoM, last 2,70%, rev 4,50% | DKK/08:00 |

| Sep Industrial Output NSA YoY, last 5,00% | EUR/08:00 |

| Sep Industrial Output SA YoY, exp 2,80%, last 2,70%, rev 2,80% | EUR/08:00 |

| Sep House transactions YoY, last 24,20% | EUR/08:00 |

| Sep Industrial Production MoM, exp 0,40%, last -1,40% | EUR/08:00 |

| Oct Budget Balance, last 4.8b | SEK/08:30 |

| Oct Average House Prices, last 2.456m | SEK/08:30 |

| ECB's Praet Speaks in Frankfurt | EUR/08:45 |

| Sep Industrial Production MoM, last 1,70% | NOK/09:00 |

| Sep Industrial Production WDA YoY, last 3,10% | NOK/09:00 |

| Sep Ind Prod Manufacturing MoM, exp 0,00%, last -0,40% | NOK/09:00 |

| Sep Ind Prod Manufacturing WDA YoY, last -7,40% | NOK/09:00 |

| ECB's Knot Speaks at Dutch Economist Day | EUR/09:00 |

| Sep Industrial Production MoM, exp -0,10%, last 1,00% | GBP/09:30 |

| Sep Industrial Production YoY, exp 1,30%, last 1,90% | GBP/09:30 |

| Sep Manufacturing Production MoM, exp 0,60%, last 0,50% | GBP/09:30 |

| Sep Manufacturing Production YoY, exp -0,70%, last -0,80% | GBP/09:30 |

| Sep Visible Trade Balance GBP/Mn, exp -£10600, last -£11149 | GBP/09:30 |

| Sep Trade Balance Non EU GBP/Mn, exp -£3100, last -£3765 | GBP/09:30 |

| Sep Trade Balance, exp -£3000, last -£3268 | GBP/09:30 |

| Oct FGV Inflation IGP-DI MoM, exp 1,62%, last 1,42% | BRL/10:00 |

| Oct FGV Inflation IGP-DI YoY, exp 10,40%, last 9,31% | BRL/10:00 |

| Bank of Italy Report on Balance-Sheet Aggregates | EUR/10:00 |

| ECB's Mersch Speaks in Ljubljana | EUR/10:00 |

| Oct IBGE Inflation IPCA MoM, exp 0,80%, last 0,54% | BRL/11:00 |

| Oct IBGE Inflation IPCA YoY, exp 9,91%, last 9,49% | BRL/11:00 |

| Oct Vehicle Production Anfavea, last 174240 | BRL/13:20 |

| Oct Vehicle Sales Anfavea, last 200077 | BRL/13:20 |

| Oct Vehicle Exports Anfavea, last 33502 | BRL/13:20 |

| Oct Change in Nonfarm Payrolls, exp 185k, last 142k | USD/13:30 |

| Sep Building Permits MoM, exp 1,50%, last -3,70% | CAD/13:30 |

| Oct Unemployment Rate, exp 7,10%, last 7,10% | CAD/13:30 |

| Oct Net Change in Employment, exp 10.0k, last 12.1k | CAD/13:30 |

| Oct Two-Month Payroll Net Revision | USD/13:30 |

| Oct Change in Private Payrolls, exp 169k, last 118k | USD/13:30 |

| Oct Full Time Employment Change, last -61,9 | CAD/13:30 |

| Oct Change in Manufact. Payrolls, exp -5k, last -9k | USD/13:30 |

| Oct Part Time Employment Change, last 74 | CAD/13:30 |

| Oct Unemployment Rate, exp 5,00%, last 5,10% | USD/13:30 |

| Oct Participation Rate, exp 65,8, last 65,9 | CAD/13:30 |

| Oct Average Hourly Earnings MoM, exp 0,20%, last 0,00% | USD/13:30 |

| Oct Average Hourly Earnings YoY, exp 2,30%, last 2,20% | USD/13:30 |

| Oct Average Weekly Hours All Employees, exp 34,5, last 34,5 | USD/13:30 |

| Oct Underemployment Rate, exp 9,90%, last 10,00% | USD/13:30 |

| Oct Change in Household Employment, exp 187,5, last -236, rev -236 | USD/13:30 |

| Oct Labor Force Participation Rate, exp 62,40%, last 62,40% | USD/13:30 |

| Fed's Bullard Speaks on Economy and Policy in St. Louis | USD/14:15 |

| Oct NIESR GDP Estimate, last 0,50% | GBP/15:00 |

| Sep Consumer Credit, exp $18.000b, last $16.018b | USD/20:00 |

| Fed's Brainard Takes Part in IMF Panel on Monetary Policy | USD/21:15 |

| Fed's Tarullo Addresses International Banking Conference | USD/23:00 |

The Risk Today

Peter Rosenstreich

EUR/USD has bounced close to the support implied by the recent low (around 1.0836).

Hourly supports can now be found at 1.0836 then 1.0812 (21/07/2015). Hourly resistances stand at 1.0888 (intraday high) and 1.0968 (04/11/2015). In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD has broken the support at 1.5364 invalidating the recent short-term uptrend and suggesting a deeper corrective phase. Next supports can now be found at 1.5140 (06/10/2015 low) and 1.5110 (30/09/2015 low). Hourly resistances stand at 1.5219 (intraday high). The long-term technical pattern is negative and favours a further decline towards the key support at 1.5089 , as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY continues to improve. Hourly resistances now stand at 121.98 (intraday high) The short-term technical structure favours a further rise as long as the hourly support at 121.65/70 region holds. Another support lies at 121.40 (05/11/2015low). A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF has broken the resistance at 0.9957 (28/10/2015 range high and long term decliing trendline), confirming an increasing buying interest. As long as the support at 0.9808 (27/10/2015 low) holds, the technical structure looks to further bullish momentum. Additional hourly support is given at 0.9476 (15/10/2015 low). Resistance is located at 1.000 key psychological level. In the long-term, the pair has broken resistance at 0.9448 and key resistance at 0.9957 suggesting further uptrend. Key support can be found 0.8986 (30/01/2015 low). As long as these levels hold, a long term bullish bias is favoured.

Resistance and Support:

| EURUSD | GBPUSD | USDCHF | USDJPY |

| 1.1561 | 1.5819 | 1.0676 | 147.66 |

| 1.1387 | 1.5659 | 1.024 | 135.15 |

| 1.1079 | 1.5508 | 1.0129 | 125.86 |

| 1.087 | 1.5181 | 0.9965 | 121.92 |

| 1.0809 | 1.5143 | 0.9739 | 120.07 |

| 1.0521 | 1.5089 | 0.9476 | 118.07 |

| 1.0458 | 1.496 | 0.9384 | 116.18 |

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.