Forex News and Events

The RBNZ kept its official cash rate unchanged at 3.50% as expected, while delivering more-dovish-than-expected accompanying statement. Policymakers signaled that RBNZ rates will remain on hold longer “in the current circumstances”. Major explanatory factors in RBNZ’s dovish shift are the lower oil and commodity prices and the cool-off in inflationary pressures as elsewhere in the world. The New Zealand’s CPI decelerated by 0.2% in Q4, pulling the year-on-year inflation down from 1.0% to 0.8%. In the current circumstances indeed, there was little enthusiasm to maintain the hawkish tone. Despite the recent sell-off, the NZD is still considered unjustifiably high. There is no need to revive carry inflows to push the kiwi higher verse its negative-rate peers (EUR, CHF). Moreover, the weak dairy auctions, subdued volumes and expensive Kiwi all together brought the 12-month trade deficit to NZD -1.150 million, higher deficit in more than a year. The Kiwi needs to depreciate further to improve its trade terms and to boost growth. As a result, the RBNZ decision to pause its tightening cycle is easily welcomed. The stagnation is unlikely to resume until at least December 2015. On a final note, Wheeler said “future interest-rate adjustments, either up or down, will depend on the emerging flow of economic data” signaling that a rate cut remains a remote possibility. However, we believe it should only be used if the TWI NZD rises to unbearable levels.

We expect the extension of the period of NZD underperformance verse USD and GBP, while the sentiment verse EUR, CAD remains balanced. NZD/CAD hits 200-dma (0.9128) for the first time since August. A break below the 200-dma should open way toward 0.8950/0.9000 (end-December / January support). Yet the persistent slide in oil prices keep the CAD-bulls equally skeptical on the other leg.

USD/CAD clears resistance at 1.2500 psychological level as the WTI crude tests $44 as the front-end of the futures curve shifts lower and steepens from a week ago. As the bullish trend gains momentum, we see reinforced support at 1.2205 (Fibonacci 76.4% level on 2009-2011 sell-off). The key mid-run technical resistance stands at 1.2734 (2005 high), then 1.3065 (2009 high). Canada releases November GDP data on Friday. If the soft expectations are met, USD/CAD should push it higher despite overbought conditions (RSI at 80% & 30-day upper Bollinger Band at 1.2560).

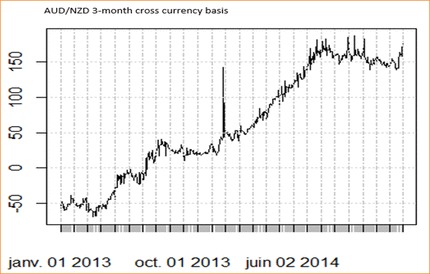

AUD/NZD is expected to face decent offers at 1.0884/85 (Fibonacci 38.2% on July-November 2014 hike / 200-dma) as soaring speculations on a potential RBA cut keep the AUD-bulls aside before the weekly closing bell. The 3-month cross currency basis displays stagnation in AUD preference verse NZD over the past quarter. The focus is fully on the RBA’s “prudent course is likely to be a period of stability in interest rates” rhetoric. Any modification / drop on the key phrase will confirm shift from neutral to dovish RBA statement and increase speculations of a rate cut as soon as next month (if no concrete action is taken next week). AUD/USD trades at 0.7800/0.7907 range. Solid offers trail below 80 cents.

AUD preference stagnates verse NZD

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD holds above 1.0700 on weaker US Dollar, upbeat Eurozone PMI

EUR/USD holds above the 1.0700 psychological barrier during the early Asian session on Wednesday. The weaker-than-expected US PMI data for April drags the Greenback lower and creates a tailwind for the pair.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum ETF issuers not giving up fight, expert says as Grayscale files S3 prospectus

Ethereum exchange-traded funds theme gained steam after the landmark approval of multiple BTC ETFs in January. However, the campaign for approval of this investment alternative continues, with evidence of ongoing back and forth between prospective issuers and the US SEC.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.