USDJPY – 2015 Market Moves

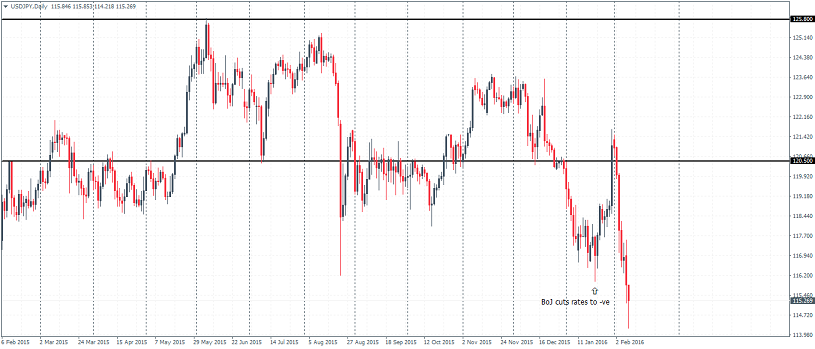

In early January, USDJPY fell to lows of 116.2 as the global economic conditions started to deteriorate further. Fuelled by low Oil prices which put pressure on inflation, slowing demand from China with weak manufacturing, the Yen evidently became a safe haven bet, which further rallied as the Fed's January meeting turned out to be more dovish than expected. However, the BoJ managed to form a floor by cutting interest rates to the negative in hopes to weaken the Yen. While the USDJPY did indeed manage to rally, 121 was the top that was formed with the currency pair falling sharply thereafter. What came later is now anybody’s guess. So what’s in store for the USDJPY over the next 10 months? We think that the Yen is likely to strengthen further but in the longer term horizon, the short term weakness is likely to be a mere blip than anything else.

USDJPY – Monthly Technical Chart

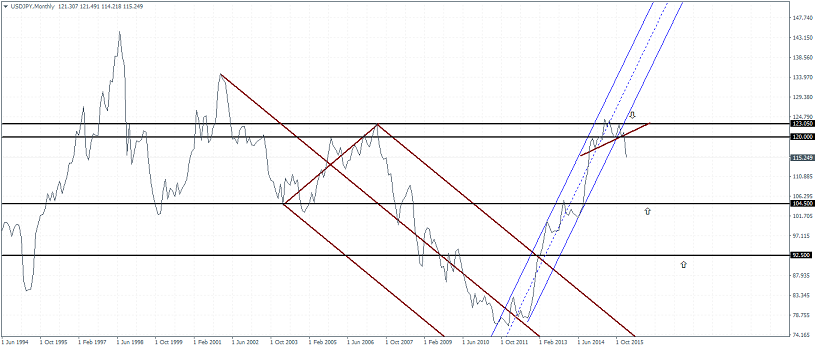

In order to get a better idea of the price action in USDJPY, we need take a step back and look into the longer term horizon. The first chart below shows the USDJPY monthly timeframe. We summarize the following points of observations.

USDJPY – Monthly Technical Overview

• The breakout from 92.5 in 2013 saw a strong marked move to the upside

• The price rally was capped near 125 – 120 region, followed by a minor head and shoulders pattern

• The breakdown of the neckline has taken the USDJPY to 115 region

• We expect to see a pullback to 120 over the next couple of weeks to establish resistance and pave way for a move to the downside

• If resistance at 120 is established, USDJPY could dip strongly down to 104.5 region where a support level is pending to be established

• If price fails to find support at 104.5, a steeper decline could see USDJPY test sub-100 levels to 92.5

USDJPY – What’s in store?

Looking at the same chart above, the levels of 104.5 and 92.5 interestingly mark the 61.8 and 38.2 Fib retracement levels of the rally from 75 – 125.

USDJPY – Potential levels to watch (Inverse head and shoulders)

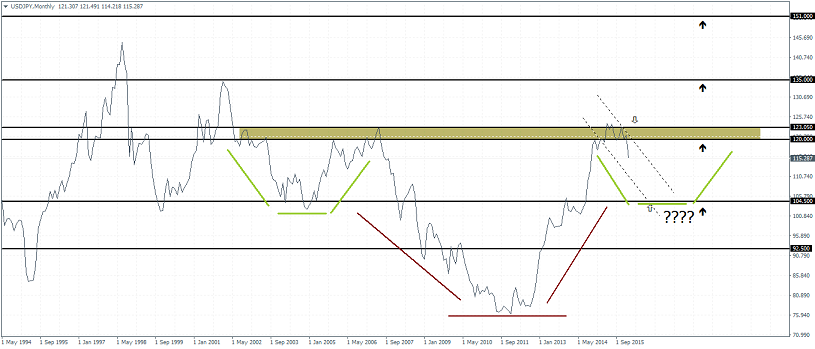

If prices indeed decline lower, the monthly chart for USDJPY marks a potential cup and handle/inverse head and shoulders pattern. Of course, for this to play out to a near text book pattern, we will need to see support coming in at 104.5 levels or at least expect prices to stay above the 100 psychological level.

The unfolding chart pattern projects a possible move to the upside on break of 125 resistance, with 135 marking the 127.2% Fib extension and 151 marking the 161.8% move higher.

While it is still early to tell, watch USDJPY as it gradually dips lower to 104.5 levels, which could mark a right shoulder as well as the handle.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

US economy grows at an annual rate of 1.6% in Q1 – LIVE

The US' real GDP expanded at an annual rate of 1.6% in the first quarter, the US Bureau of Economic Analysis' first estimate showed on Thursday. This reading came in worse than the market expectation for a growth of 2.5%.

EUR/USD retreats to 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated to the 1.0700 area. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 with first reaction to US data

GBP/USD declined below 1.2500 and erased a portion of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold falls below $2,330 as US yields push higher

Gold came under modest bearish pressure and declined below $2,330. The benchmark 10-year US Treasury bond yield is up more than 1% on the day after US GDP report, making it difficult for XAU/USD to extend its daily recovery.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.