Following the ECB's meeting yesterday the euro gave back its initial gains, while precious metals pulled back strongly from their intraday rally. However, price action across the board still looks a bit volatile, but there is a possibility that the US dollar could see some upside in the near term.

EURUSD Daily Analysis

EURUSD (1.12): EURUSD formed an outside bar doji following the bearish close the previous day. Prices remain close to the 1.130 handle so the bias remains flat as prices could still attempt to break higher. The 4-hour chart shows prices trading within a consolidating triangle which could eventually open up a strong momentum led abreakout. $1.140 is the resistance to watch on the upside while $1.120 will be the support to watch to the downside. Plotting the median line, we expect to see the downside momentum prevail but only on a close below the lows at 1.123 - 1.125.

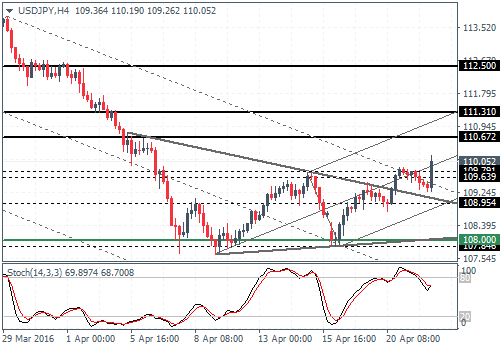

USDJPY Daily Analysis

USDJPY (109.9): USDJPY closed bearish yesterday and formed an inside bar following three days of gains and could potentially spell a pullback in the near term unless prices close strongly higher today. The breakout from the minor median line and with prices trading outside the median line indicates further upside to prevail towards 110.14 - 110.67. For further gains, USDJPY needs to close above the current support/resistance region near 109.8 - 109.64. For the moment, the 4-hour chart shows a bullish breakout from the consolidating triangle, but resistance is seen near 110.220 – 110 which could push prices lower in the near term.

GBPUSD Daily Analysis

GBPUSD (1.43): GBPUSD price action was similar to that of the EURUSD with price action forming an outside bar doji, just below the 1.4425 resistance. Price action could remain ranging unless the resistance level is broken. On the 4-hour chart, GBPUSD posted a strong decline after a test to 1.443 - 1.4425 resistance but is currently trading near the lower median line. Unless prices move higher and break above 1.4425, GBPUSD could fall back and test the support at 1.4263 - 1.4247.

Gold Daily Analysis

XAUUSD (1248): Gold prices were volatile yesterday, but prices managed to pull back towards the end of the day. Failure to close above the most recent doji high at 1262.68 indicates a move lower. 1231.5 support will be key to watch initially; a break below could see a move to 1200. On the 4-hour chart, gold is seen trading in the 1250 - 1243 support level below which comes the previously tested support at 1230 - 1225 as gold trades within a broadening wedge pattern.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.