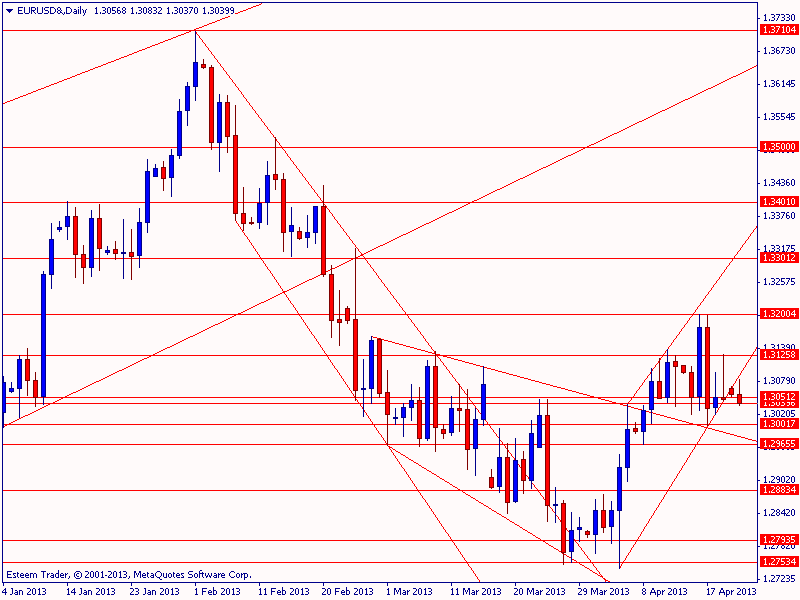

Resistance Levels:

1.3400

1.3300

1.3200

1.3125

Support Levels:

1.3000

1.2965

1.2883

Price action summary for last week:

The pair traded last week in a 200 pip range, opening the week at 1.3095, trading as high as 1.3200, as low as 1.3000 and closing the week at 1.3056. On the week, the pair closed 39 pips below it’s open. The close was outside an upward sloping channel that has been forming on the last few weeks. It is still above the larger channel that I spoke about on April 9th. As you can see, the close about the top of that channel did lead to a bullish market for the last two weeks, most of which was reversed in one bad day, including a test of that top of the channel trendline, right at 1.3000 on April 17th. On the downside from here, I would expect some support to come from another touch of the top of that downward sloping trendline. That support will likely come between 1.3000 down to 1.2950.

Fundamental news that came out last week was largely inline with expectations.

The major misses were the TIC Flows which came in at $17.8B versus an expectation of $41.3B. The German ZEW Economic Sentiment data also missed to the downside, coming in at 36.3 versus 42.0 expected as well as the German ZEW Current Situation data missing with 9.2 versus 12 expected. Although the pair attempted to rally later in the week it closed down for the week, a potentially bearish sign.

This week so far has seen the pair trading a bit lower as well. As long as we’re above the channel top, I’m not comfortable going either way on this pair although it does look more bearish than bullish in it’s current chart condition. I’m waiting for the test of the top of the previous channel and then will switch to shorter term charts to see what they look like for a day trade or swing trade setup.

Fundamentals to watch this week:

This is a very light week for for high impact fundamentals affecting this pair. The biggest USD news of the week will be the GDP number on Friday.

If anything out of expectations develops I will post new updates.

IMPORTANT COMPLIANCE NOTES: Everything contained in this post is my own personal opinion. Nothing here constitutes any kind of advice to anyone on how to trade their own account. I am not giving any type of advice here, I am merely giving you insight into how I prepare my analysis for trading my own accounts and how I arrive at the personal opinions I have to trade my own personal accounts. If somehow you have been led to believe that I am offering trading advice, please let me be abundantly clear: THERE IS NO TRADING ADVICE ANYWHERE IN THIS COLUMN, IT’S JUST MY OPINIONS. If you do not have a system of your own and are not able to do your own analysis, it is highly unlikely that you will ever trade an account profitably. If you follow my opinions here without a complete understanding of my methods, you will likely fail, If you fail, you will have to own that for yourself. I make no claims about past or future success using any methods that may be apparent here and am unable to disclose my own past results due to strict regulations about discussing past, hypothetical or future results in a column of this sort. Please abide by this warning and do not trade any account using any of my opinions or methods contained in this post unless you have done your own analysis and are willing to take complete responsibility for putting your own capital at risk. I cannot take any liability for any losses you may incur in your trading account, that is all up to you.

1) Grentone Inc (a trading name of Grentone Capital Management (NZ Ltd) is not a broker-dealer. Grentone Inc is in the business of traders education and training. Grentone Inc's products and services are delivered through the internet and in person. For the purpose of education, Grentone Inc offers a virtual trading environment, where a community through which are independent traders (subscribers), as well as OkaFX (a trading name of Esteem Financials (AUS) Pty Ltd), observes the virtual trading environment 2) OkaFX (a trading name of Esteem Financials Pty Ltd) is a Registered ASIC Broker-Dealer and licensed under the Australian Financial Services Licence No. 400364. All trading and assessments conducted by Grentone Inc and Grentone Capital Management (NZ) Ltd are done through OkaFX. 3) All illustrations and presentations made to you by Grentone Inc are for the purpose of education only. All information present must never be, nor should be construed, as an offer, or a solicitation of an offer, to buy or sell any investment products. You shall be fully responsible for any investment decision you make, and such decisions will be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance, and liquidity needs.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.