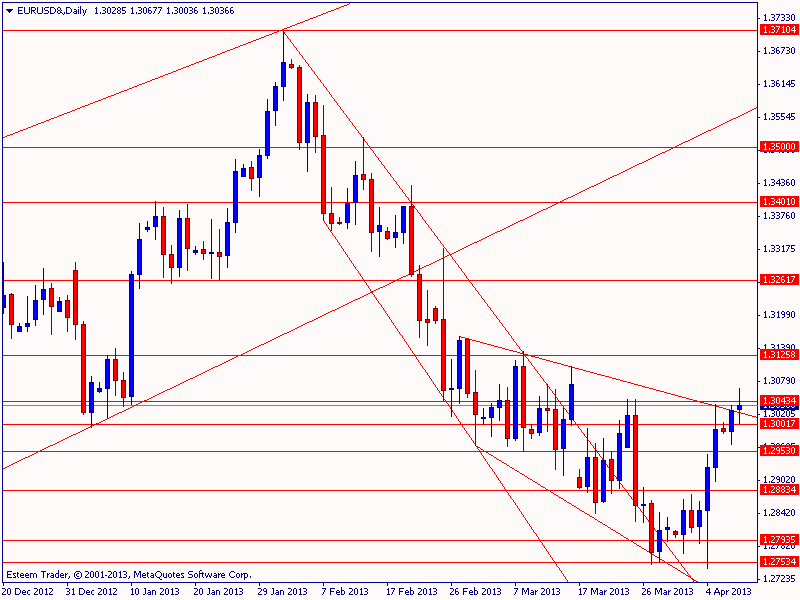

Just noticing a developing situation on the EUR/USD daily chart that merits bringing to everyone’s attention. Right now price is trading above even the new channel that we’ve been watching develop over the last month. Of course, I would like to see a daily close above this channel before I get too excited but take a look at today’s candle so far, in the chart at the bottom.

Of course, we have FOMC Meeting Minutes from the March 19-20 meeting coming out on Wednesday. This will give us some potentially market moving information about what the FED folks were thinking a few weeks back. They did not have the terrible employment data from last week in their hands at that point so it’s just another somewhat stale peek but as far as technical situations go, a break above this channel could signal a willingness to move higher from here. Stay tuned and let’s see what happens. If I plan any trades I’ll update things here.

As always, please remember, this is NOT a trade call, just an opinion I’m sharing as things develop in real time. Please plan your own trading accordingly and take responsibility for whatever you do with your own account.

1) Grentone Inc (a trading name of Grentone Capital Management (NZ Ltd) is not a broker-dealer. Grentone Inc is in the business of traders education and training. Grentone Inc's products and services are delivered through the internet and in person. For the purpose of education, Grentone Inc offers a virtual trading environment, where a community through which are independent traders (subscribers), as well as OkaFX (a trading name of Esteem Financials (AUS) Pty Ltd), observes the virtual trading environment 2) OkaFX (a trading name of Esteem Financials Pty Ltd) is a Registered ASIC Broker-Dealer and licensed under the Australian Financial Services Licence No. 400364. All trading and assessments conducted by Grentone Inc and Grentone Capital Management (NZ) Ltd are done through OkaFX. 3) All illustrations and presentations made to you by Grentone Inc are for the purpose of education only. All information present must never be, nor should be construed, as an offer, or a solicitation of an offer, to buy or sell any investment products. You shall be fully responsible for any investment decision you make, and such decisions will be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance, and liquidity needs.

Recommended Content

Editors’ Picks

EUR/USD fluctuates in daily range above 1.0600

EUR/USD struggles to gather directional momentum and continues to fluctuate above 1.0600 on Tuesday. The modest improvement seen in risk mood limits the US Dollar's gains as investors await Fed Chairman Jerome Powell's speech.

GBP/USD stabilizes near 1.2450 ahead of Powell speech

GBP/USD holds steady at around 1.2450 after recovering from the multi-month low it touched near 1.2400 in the European morning. The USD struggles to gather strength after disappointing housing data. Market focus shifts to Fed Chairman Powell's appearance.

Gold retreats to $2,370 as US yields push higher

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world.