Today's Highlights

China slowing again

Franch Stagnation a concern for europe

FX Market Overview

It would be easy to assume the only problem in the Eurozone is Greece but that couldn't be further from the truth. French private sector data is showing evidence of stagnation and that is largely in line with manufacturing and industrial output. As France is the 2nd largest economy in the Eurozone, that is very significant. It is also in stark contrast with the largest Euro-sharing economy, Germany. That is hampering the euro but more optimistic comments following the latest Greece v EU talks have brought a more optimistic tone to proceedings. Today's German business sentiment indices may add to that upbeat tone; the forecasts are good.

We heard from a Chinese official overnight that there were still downward pressures on the Chinese economy but that they are planning to provide assistance to start-ups. In other news, bad debt in China rose and Baoding Tianwei Group made history this week when it became the first company owned by the Chinese government to default on its debt. So the new business support may not be enough to allay fears of further slowdown in the region. Such a decline would weaken the Australasian Dollars and they weakened a tad overnight.

The only other news for today is the US durable goods orders which are forecast to have improved somewhat. If the forecasts are true, that will strengthen the US Dollar in later trade. So if you are a USD buyer, you may want to pre-empt that.

Currency - GBP/Australian Dollar

The upward trend in the Sterling – Australian Dollar exchange rate that started back in September 2014 is still intact. The Pound has ducked and dived a bit but whenever it has fallen back to the support line (in a fetching raspberry on this chart) it has found buyers and that has allowed it to rally again. The uptrend is also supported by fundamental data. The UK economy is strengthening whilst threats from a slowdown in China are weighing on the Aussie Dollar. Equally, UK interest rates are almost certainly ready for a rate hike sometime later this year or early next, whereas, there is still a distinct possibility of a rate cut in Australia. Were it not for the UK election, it is tempting to think the Pound would be stronger. A break of A$1.95 would allow for further rises but if we see A$1.92, the door is open for further falls in this pair.

Currency - GBP/Canadian Dollar

The Sterling - Canadian Dollar exchange is being ping-ponged around by the strength of the US Dollar, by the erratic behaviour of Canadian economic data and by the stuttering recovery in the British Pound. Since we saw the C$1.75 low we saw last November, we have seen a high of C$1.95 and we are now back down at C$1.83 or thereabouts. This level is pivotal though. A break below C$1.80 would see this pair back down at C$1.75 and a bounce through C$1.85 ought to see the Pound strengthen to C$1.95 again in the months ahead. If the UK election is holding the Pound back, and I suspect it is, then the upward move is the more likely one.

Currency - GBP/Euro

The upward trend in the Sterling – Euro exchange rate that started back in December is blatantly evident in the chart above. Similarly evident is the sideways pattern that has developed over the last 6 weeks. There is unmistakable Sterling buying interest around €1.35. That equates to roughly 74 pence per euro. There was a flurry of Euro buying activity when this pair peaked at €1.43 in March. So those battle lines are well and truly drawn and, having identified the outer reaches of the market range, traders have gone back to watching the UK elections on this side of the Channel and watching the developing Greece story on t'other. Sterling is undoubtedly being held back by the UK election fears and the euro is definitely in limbo pending a Greek resolution. So there would appear to be more scope for a GBPEUR rally than a collapse.

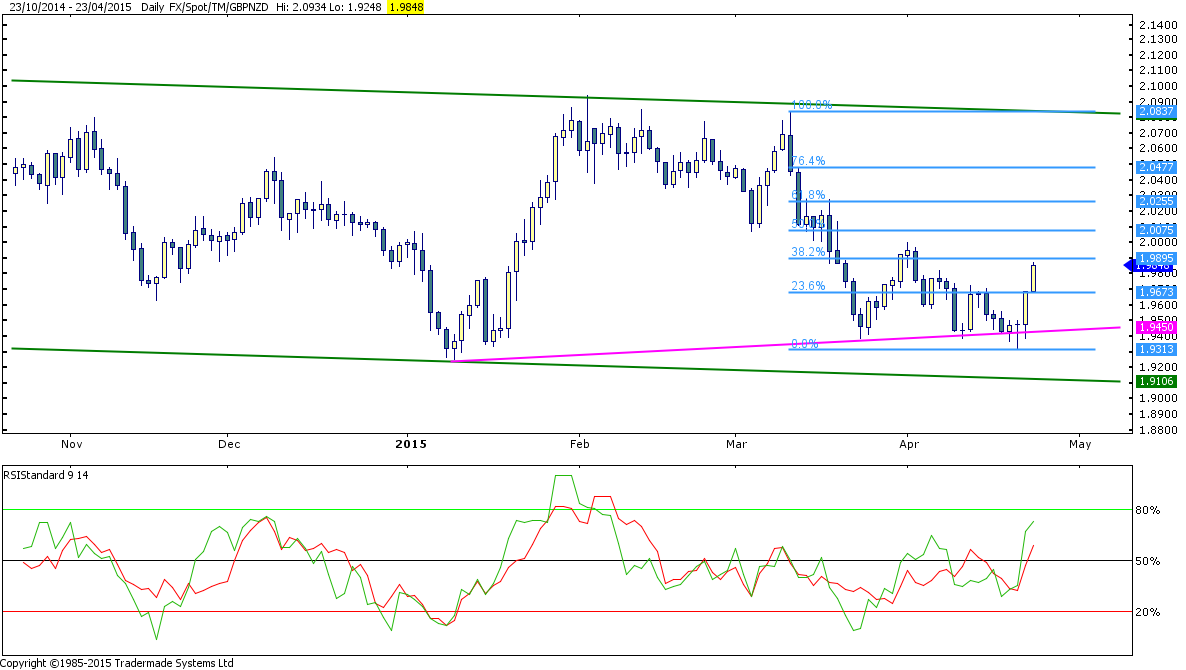

Currency - GBP/New Zealand Dollar

News that the Reserve Bank of New Zealand is open to the idea of further interest rate cuts came as a bit of a surprise. There had been more talk of monetary tightening in the past few weeks as the RBNZ sought to dampen the overheating housing market. So the idea of looser monetary policy was a surprise to NZD traders who immediately sold the NZD quite heavily. As a result, the GBPNZD exchange rate popped back up to the same levels we saw at the start of the month. With Sterling's nervousness ahead of the UK election, we may not see further gains for now but there is clearly some appetite to buy the Pound in the mid to low NZ$1.90 area. By the same token, traders are very happy to leap in and buy NZDs anywhere near to NZ$2.00, so it is struggling to reach the magic 2.0 number.

Currency - GBP/US Dollar

The Sterling – US Dollar exchange rate chart starting from July 2014 is like a ski slope. There are a few bumps and moguls on the way down but it is at least a red run. Tumbling energy prices, a slump in commodities, the recovery in the US economy and the expectation of higher US interest rates are all factors. The end of the Federal Reserve's QE program is also an influence. At the time of writing, the Pound has bounced a little but it hasn't broken out of the top of this downward channel in the whole of that 8 month period. The key levels are $1.45, the bottom of the last dive and $1.51, the channel top. Use these as your targets for automated orders but it is perhaps not wise to try to catch the market at these extremes because it turns around like a feather in a tumble drier.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.