Good morning from Hamburg and welcome to our latest Daily FX Report. General Motors Co said Tuesday it is recalling 473,000 pickups and SUVs in North America because brake pedals could fail due to a faulty nut. The Detroit automaker is calling back 426,573 2015-16 Chevrolet Silverado HD, GMC Sierra HD, and Chevrolet Tahoe police vehicles in the United States and 46,837 in Canada. GM says the brake pedal pivot nut may become loose, causing the brake pedal to be loose or inoperative. There are no reports of injuries or crashes. Dealers will inspect the bolt to determine if the vehicle has already received a fix added during production. If not, dealers will add adhesive to the nut and reinstall the nut.

Anyway, we wish you a successful trading day!

Market Review – Fundamental Perspective

Oil prices slid for a fourth straight session on Tuesday and teetered close to 12-1/2-year lows hit last month, after weak demand forecasts from the U.S. government and the western world's energy watchdog, while weak equities also pressured prices. U.S. crude lost $1.75, or 5.9 percent, to finish at $27.94. It fell to $26.19 last week, its lowest since May 2003. Prices were under pressure throughout the session, but hit intraday lows after the U.S. Energy Information Administration (EIA) lowered its oil demand growth forecast for the next two years. Investors do not normally watch the quarterly report so intensely, but the fact that it triggered fresh selling reflected deepening nerves across the crude market. It came just hours after Paris-based International Energy Agency (IEA) warned the world would remain awash with unwanted oil for most of 2016 as declines in U.S. output take time and OPEC is unlikely to cut a deal with other producers to reduce ballooning output. Yellen is expected to defend the U.S. central bank's first rate hike in a decade and likely insist that further rises this year remain on track, albeit at a slower pace, when she addresses Congress on Wednesday. The Dow Jones industrial average closed down 12.67 points, or 0.08 percent, to 16,014.38, the S&P 500 lost 1.23 points, or 0.07 percent, to 1,852.21 and the Nasdaq Composite dropped 14.99 points, or 0.35 percent, to 4,268.76. The S&P 500 bounced 33 points from its session low to its high. Global uncertainty and worries about weak spending on information technology have forced investors in cloud computing stocks and related enterprise companies to take a reality check.

Daily Technical Analysis

XAU/USD (Weekly)

Looking long-term, Gold has experienced a high volatility and the price moved to a low at around $1139. Since August 2014 it was moving in a range between $1303 and $1158. Recently the price sharply rose till the short term resistance around 1190. The CCI is showing a possible turn down.

Support & Resistance (Weekly)

| Support Levels around | Resistance Levels around |

| N/A | 1303.11 |

| N/A | 1346.40 |

| N/A | 1784.53 |

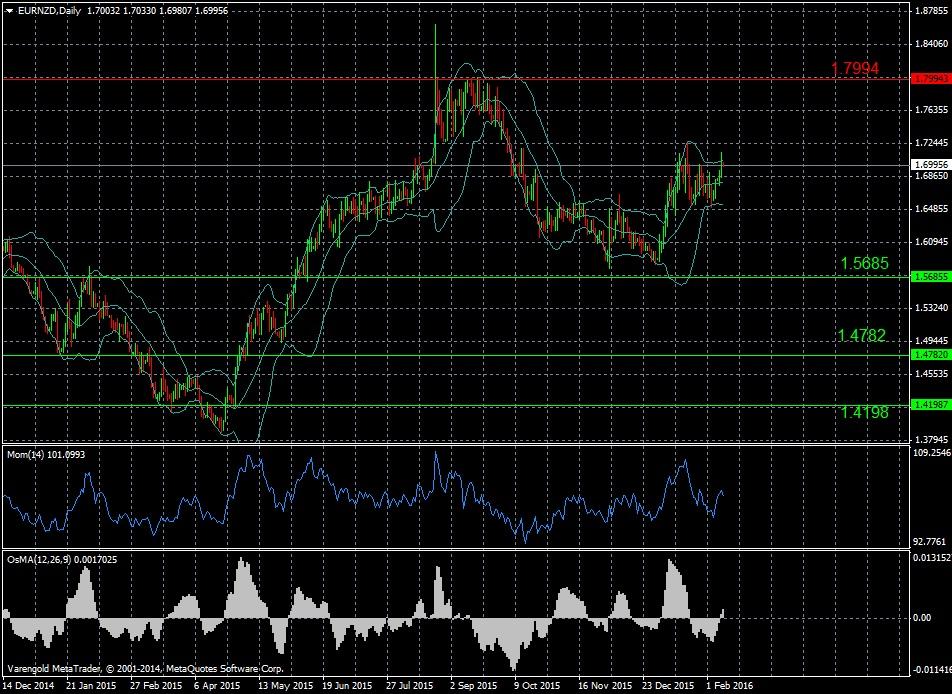

EUR/NZD (Daily)

Since December 2013 one can see the downward trend. In the mid of December 2014 there was a fall of about 800 pips to the level about 1.5056. Since December there was a strong upward trend with a sideward movement. The Momentum is moving above the center line pointing out for a possible upward trend.

Support & Resistance (Daily)

| Support Levels around | Resistance Levels around |

| 1.5685 | 1.7994 |

| 1.4782 | N/A |

| 1.4198 | N/A |

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.