Good morning from beautiful Hamburg and welcome to our second-last Daily FX Report for this week. The chief executive of Brazil's biggest independent investment bank and the leading senator in the governing coalition were arrested on Wednesday on suspicion of obstructing the country's most sweeping corruption investigation ever. The detention of such prominent power brokers on orders from the Supreme Court raised the stakes dramatically in a bribery scandal that started with state-run oil company Petrobras and now threatens the heights of Brazilian banking and politics. The arrest of André Esteves, the billionaire CEO and controlling shareholder of BTG Pactual SA and Brazil's most influential dealmaker, sent the bank's listed shares into a dive that wiped out a fifth of its market value and raised red flags at the central bank.

Anyway, we wish you a successful trading day!

Market Review – Fundamental Perspective

The major U.S. indexes were virtually unchanged at the close of a quiet trading day on Wednesday with gains in healthcare and consumer stocks after data showed U.S. modest economic growth. Trading volume was low as many market participants were away in the last session before the U.S. Thanksgiving holiday. Markets will be closed Thursday and most of Friday afternoon. Data showed claims for jobless benefits fell more than expected to 260,000 last week, while durable goods orders for October, excluding aircraft, increased 1.3 percent, far more than the 0.4 percent expected. However, other reports suggested consumers were not in a spending mood, with consumer spending increasing just 0.1 percent in October compared with the 0.3 percent expected. The University of Michigan's final index of consumer sentiment for November also fell short of estimates. While investors cited good conditions for consumers, they were cautious about global security issues and the impact from the first U.S. interest rate hike since 2006, which is widely expected to happen in December. The Dow Jones industrial average rose 1.2 points, or 0.01 percent, to 17,813.39, the S&P 500 lost 0.27 points, or 0.01 percent, to 2,088.87 and the Nasdaq Composite added 13.34 points, or 0.26 percent, to 5,116.14. The U.S. dollar gained and the euro briefly hit a seven-month low on Wednesday in a volatile session on views the European Central Bank will ease monetary policy further, including buying more debt and charging banks for hoarding cash.

Daily Technical Analysis

EUR/CAD (Daily)

The European currency was strong over 2 years but at the level around 1.550 the bears took the control. As against the most important currencies the euro began its decrease and almost the whole 2014 it depreciated against the CAD. Not even the support level at 1.3369 could stop the fall, but the level around 1.3064. The Momentum is pointing out for a possible downward movement.

Support & Resistance (Daily)

| Support Levels around | Resistance Levels around |

| 1.4017 | 1.5291 |

| 1.3369 | N/A |

| 1.3064 | N/A |

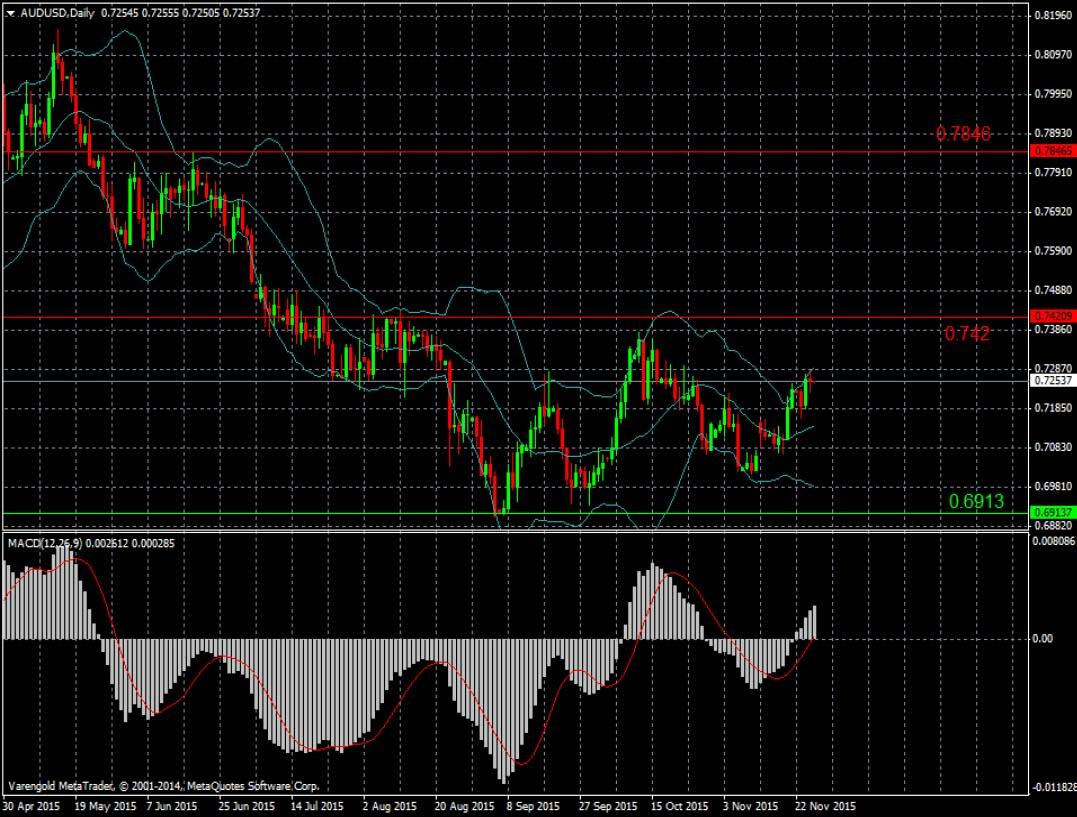

AUD/USD (Daily)

This currency pair was moving in an downward trend channel since the beginning of August. Not at least a strong U.S. data helped the bears to take control. The support line at 0.6913 has stopped the depreciation of the Australian dollar, and it seems to be a reliable support level. The MACD is moving above the Center line, which might be a possible signal for buyers.

Support & Resistance (Daily)

| Support Levels around | Resistance Levels around |

| 0.6913 | 0.7420 |

| N/A | 0.7846 |

| N/A | N/A |

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.