Good morning from Hamburg and welcome to our latest Daily FX Report. Amazon.com Inc.reported profit for the fourth quarter that topped analysts’ estimates, shrugging off the effects of heavy spending on fast delivery and original video programming to attract customers. The online retailer posted a final profit of $214 million, or 45 cents a share. The average of analysts had projected a profit of 18 cents a share. Revenue was $29.3 billion, slightly below the average analysts’ estimate of $29.7 billion. The results boosted amazon following two consecutive periods of losses but they have not been good enough to avoid end 2014 with the first annual loo in at least 12 years. After the results, shares surged as much as 9% in the extending trading after early closing at $311.78.

However, we wish you a successful trading day!

Market Review – Fundamental Perspective

The dollar Closed at the highest level against its peers in more than a decade after the government report showed an improvement of labor market. This strong figures reinforces the views that the Federal Reserve is on track to raise interest rates this year, likely in October’s meeting. This prospect for higher rates in the U.S contracts with the new stimulus measures being enacted by central banks, like EBC last week, among others across the globe. With all this easing, the U.S Federal Reserve is the only central bank that is talking about normalizing their interest rates policy, and this is reflected in the strength of the currency. The only central bank that, at the moment, could follow the steps of the Fed is the Bank of England, but lately Mark carney and his colleagues have become more prudent about the possibility of an interest rate hike in 2015. The U.S. dollar gained 0.6% to 118.29 yen. Against the euro, it fell 0.3% to $1.1320. The Krone remained close to the euro after Denmark’s Central Bank unexpectedly cut its benchmark rate to a record minus 0.5% in order to protect the peg. On the other hand, Turkey’s lira fell to a record versus the dollar, the Aussie reached lowest since July 2009 and the New Zealand’s dollar slid to the least in almost four years. While those central banks lean dovish, the U.S. Fed is headed in the opposite direction, helped by good jobless claims figures to the lowest level since April 2000. According to this wide view, we just can expect the appreciation of the U.S. dollar continues during 2015 and 2016 against most peers, euro of course included, not being difficult to reach the parity in that period.

Daily Technical Analysis

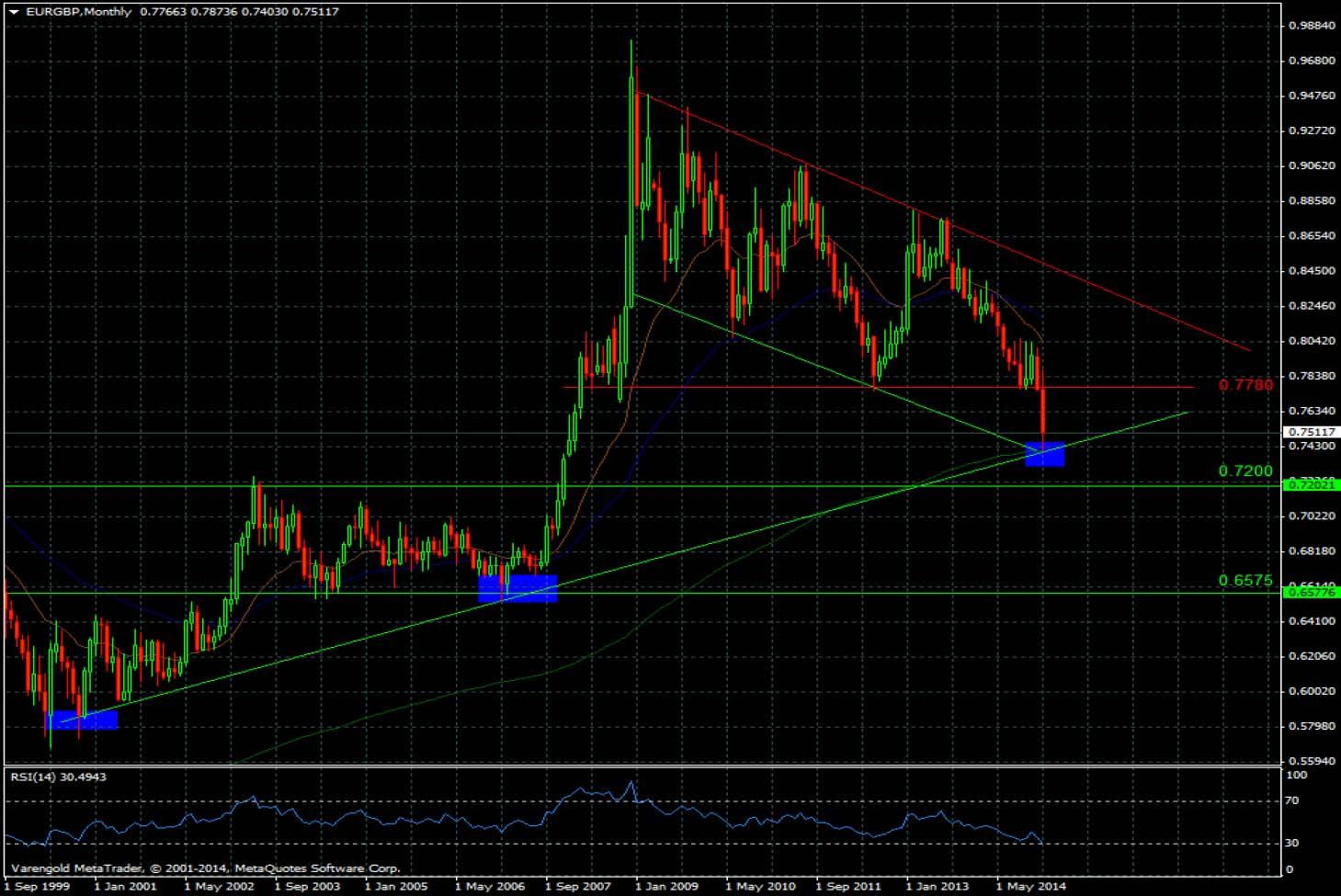

EURGBP (Monthly)

At the moment, the EURGBP is technically in a crucial point because the peer is touching the downside of a down term channel and, at the same time it is standing on the long term uptrend. Even though the momentum is clearly bearish, we believe it is not going to be easy for the peer to cross the mentioned line at first, being probably to expect a bounce to the closest resistance at 0.7780 or even higher. Below the current price, we identify two significant supports at 0.7200 and 0.6575, being the second one stronger.

Support & Resistance (Monthly)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'