Good morning from beautiful Hamburg and welcome to our first Daily FX Report for this week. U.S.President Barack Obama accused North Korea to be responsible for the massive hacking of Sony Pictures which was classified as a cyber-vandalism. Obama and his advisers are weighing how to punish North Korea and he said that they will respond proportionately. One option might be to put North Korea again to the U.S. list of state sponsors of terrorism, from which North Korea was removed six years ago.

Anyway, we wish you a great start into a new trading week!

Market Review – Fundamental Perspective

Last Friday the Dow Jones index of shares climbed 0.1 percent and the Standard & Poor’s index even rose 0.5 percent. Yesterday Saudi Arabia said that it would not cut output to prop up oil markets even if non-OPEC nations did so. So the world’s top petroleum exporter plans to ride out the market’s biggest slump in year. U.S. crude future prices fell 14.2 percent over the past two weeks, last Friday they rose 5.1 percent to 57.13 USD per barrel.

Economists estimated that the Federal Reserve will increase interest rates as early as April as other major central banks continue monetary easing. Therefore the USD held gains from last week versus most major peers. It also advanced to match a two-year high against the EUR after European Central Bank Vice President Vitor Constancio told a German magazine that policy makers aren’t ruling out quantitative easing. In addition governing council member Luc Coene said in an interview on Saturday that the European Central Bank should start buying government bonds to tackle poor investor confidence and low inflation in the euro zone. According to the Belgian central bank chief Coene the ECB had already waited too long, and that this could be one tool to boost economic activity. The ECB Governing Council will hold its next policy meeting on January 22. The EUR/USD tumbled to 1.2224 and the USD/JPY was nearly unchaged at 119.55. The EUR bought 146.10 JPY. Last week the Bank of Japan maintained unprecedented stimulus as exports in Japan have shown signs of picking up. Australia’s currency strengthened 0.2 percent to 0.8146 USD, after decreasing 1.4 percent in its fifth straight weekly decline. New Zealand’s currency fell versus the USD to 0.7733 after a report showed a drop in consumer confidence.

Daily Technical Analysis

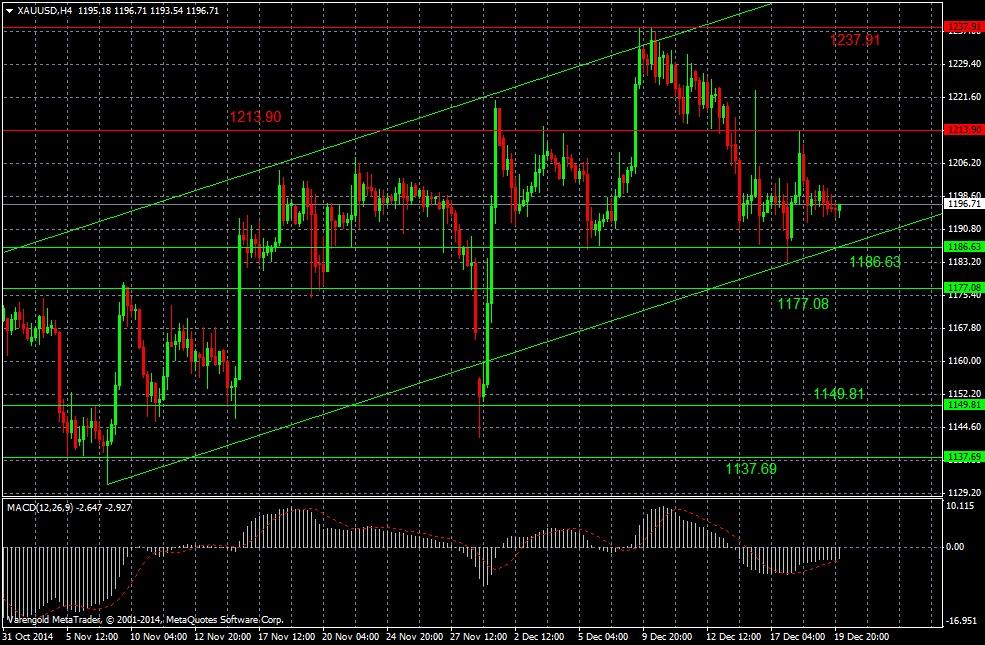

XAU/USD (4 Hours)

Six weeks ago the metal Gold recovered at the support line around 1137.6 and started an upward movement inside a bullish trend channel. It gradually rose towards an eight week high around 1237.9 but rebounded there. Last week it was in a sideways trend with signs of further decrease.

Support & Resistance (4 Hours)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.