Good morning from Hamburg and welcome to our latest Daily FX Report. FIFA ethics investigator Michael Garcia resigned on Wednesday in protest at the way his report into allegations of corruption in awarding the 2018 and 2022 World Cup tournaments to Russia and Qatar was handled by the soccer governing body's ethics judge. Former U.S. prosecutor Garcia said in a statement that he had lost confidence in the independence of the ethics committee's adjudicatory chamber after judge Hans-Joachim Eckert issued a 42-page statement in November based on the report.

Anyway, we wish you a successful trading day!

Market Review – Fundamental Perspective

The strongest dollar in more than five years is threatening to wreak havoc with the earnings of U.S. companies for a second straight quarter and into 2015. Just this week, Atlanta-based Coca Cola Co., said currency movements will cut its pre-tax profit by 5 to 6 percent next year. Pfizer Inc., the biggest U.S. drugmaker, has said it “expects significant negative sales and earnings impacts from foreign exchange” this quarter. While a rapidly rising dollar can be seen as a sign of confidence in the health of the U.S., it can also make the goods made by American companies less competitive and render hedges designed to protect against steep moves less effective. Traders have sought the dollar as a haven from global market turmoil, as well as prospects that the Federal Reserve is moving closer to raising interest rates after keeping its benchmark near zero since 2008. With the Fed dropping a pledge to keep rates low for a “considerable time” at its Dec. 16-17 policy meeting, traders are more confident than ever that U.S. borrowing costs will rise some time next year. The effects of Fed tightening on the U.S. currency are amplified by the divergence with the euro region and Japan, which are committed to further expanding the money supply. Strategists surveyed by Bloomberg see the dollar advancing against 12 of its 16 most-traded peers next year, including gains of more than 4 percent versus the euro and yen. In one day, the S&P 500 made up about 40 percent of the ground it lost in the seven days since touching a record 2,075.37 on Dec. 5. Yesterday´s gain – it closed at 2,012.89 – boosted the gauge´s 2014 return to 8.9 percent. The S&P 500 was down almost 5 percent in December as of Dec. 16. The Dow Jones Industrial Average increased 1.7 percent.

Daily Technical Analysis

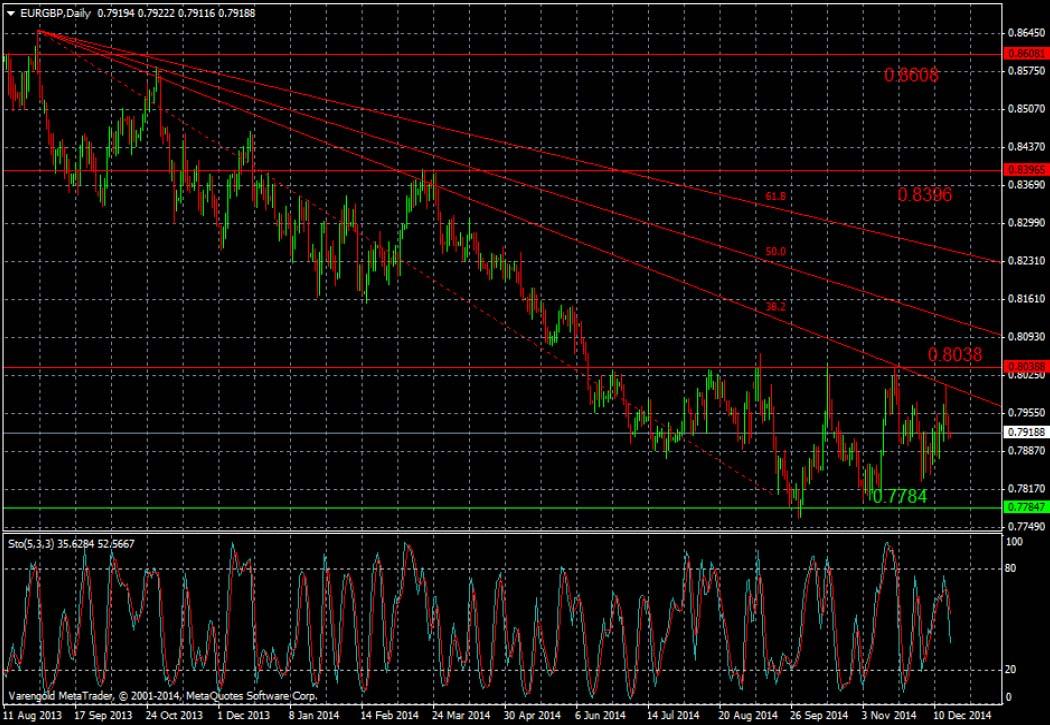

EUR/GBP (Daily)

Since the middle of August this currency pair is experiencing a storng control of the bears as it is falling below an downward Fibonacci fan. It could break through the first resistance line (38.2) twice but couldn’t strengthen its position and dropped back below it. Looking at the Stochastic one can see that it moves towards the 20-line toward the Center line, signaling that losses are possible.

Support & Resistance (Daily)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.