Good morning from Hamburg and welcome to our latest Daily FX Report. U.S. stocks rose on Monday on hopes that China will take further accommodative monetary policy action if needed, while merger deals kept traders focused even as volumes were below average.Energy shares weighed, with declines in Exxon and Chevron keeping the Dow industrials flat while the S&P 500 energy sector was down 1 percent. U.S. crude and Brent fell ahead of an OPEC meeting this week.

Anyway, we wish you a successful trading day!

Market Review – Fundamental Perspective

The yen dropped to almost a seven-year low versus the dollar as central banks worldwide add to monetary stimulus, damping demand for low-yielding haven assets such as Japan ́s. It leads losses versus the dollar this month, falling 5 percent, followed by South Korea ́s won, which is down 3.9 percent, according to data compiled by Bloomberg. It depreciated 0.4 percent against the dollar to 118.27 today, having touched 118.98 on November 20, the weakest level since August 2007. It dropped 0.8 percent to 147.15 yen per euro. The 18-nation euro rose against the U.S. currency after European Central Bank Governing Council member Jens Weidmann said expanding bond purchases to government debt would face “legal hurdles”. The euro rose for the first time in three days. It gained 0.4 percent to $1.2442, having dropped to $1.2358 on November 7, the lowest since August 2012. The German Ifo institute ́s business climate index, based on a survey of about 7000 executives, rose to 104.7 in November from 103.2 in October. Economists predicted a decline to 103, according to the median of estimates in a Bloomberg survey. The shared currency fell the most since the five days ending October 31 last week after ECB President Mario Draghi said policy makers “will do what we must” to boost consumer prices. The central bank won ́t make a hasty decision on further stimulus and will hinge any measures on incoming data, Executive Board memner Benoit Coeure said today. The ECB meets December 4 to discuss further measures to support the economy, after reducing rates to record lows and announcing a program to buy covered bonds and asser-backed securities. China joined Europe in easing its monetary policy last week, surprising markets with its first interest-rate cut since 2012. The Bank of Japan maintained its pace of monetary base expansion.

Daily Technical Analysis

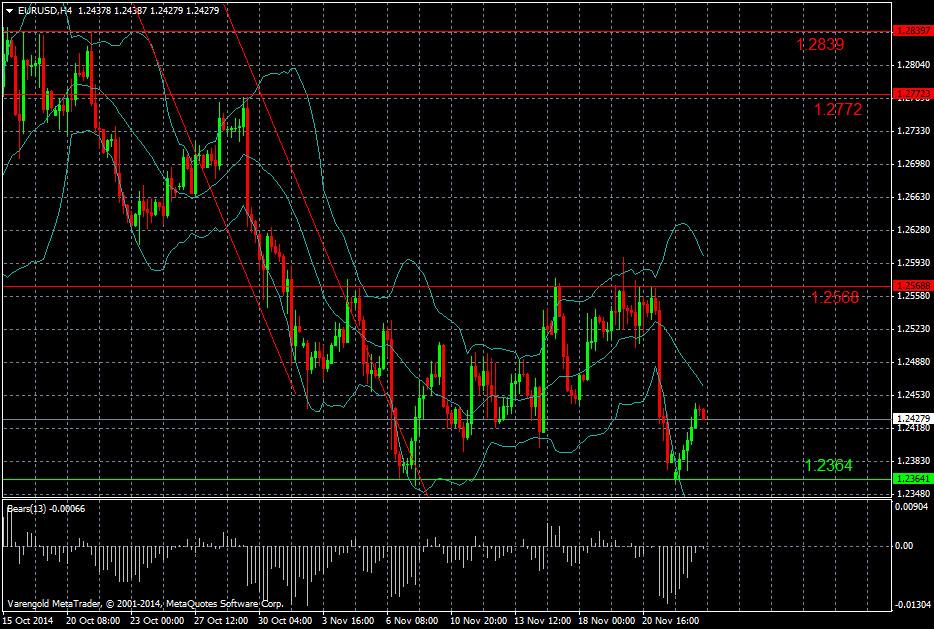

EUR/USD (4 Hours)

One of the most important currency pairs worldwide is held under control by the bears. It doesn’t seem to be a stable support line, as this pair is highly influenced by economic world data. The euro has already touched a two-year low. It stopped the recent fall at 1.2364 and is moving between this level and the resistance at 1.2568. The ECB meeting on Dec. 4 may determine the future direction of this pair at least in the short run.

Support & Resistance (4 Hours)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

AUD/USD favours extra retracements in the short term

AUD/USD kept the negative stance well in place and briefly broke below the key 0.6400 support to clinch a new low for the year on the back of the strong dollar and mixed results from the Chinese docket.

EUR/USD now shifts its attention to 1.0500

The ongoing upward momentum of the Greenback prompted EUR/USD to lose more ground, hitting new lows for 2024 around 1.0600, driven by the significant divergence in monetary policy between the Fed and the ECB.

Gold aiming to re-conquer the $2,400 level

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

Bitcoin price defends $60K as whales hold onto their BTC despite market dip

Bitcoin (BTC) price still has traders and investors at the edge of their seats as it slides further away from its all-time high (ATH) of $73,777. Some call it a shakeout meant to dispel the weak hands, while others see it as a buying opportunity.

Friday's Silver selloff may have actually been great news for silver bulls!

Silver endured a significant selloff last Friday. Was this another step forward in the bull market? This may seem counterintuitive, but GoldMoney founder James Turk thinks it was a positive sign for silver bulls.