Good morning from rainy Hamburg and welcome to our second-last Daily FX Report for this week. Israeli Prime Minster Benjamin Netanyahu said President Barack Obama yesterday that he must make sure that any final nuclear deal with Iran doesn’t leave it at the threshold of being able to develop nuclear weapons. Beyond that China Foreign Minister said that foreign countries should not meddle in China’s domestic affairs after US calls for Chinese authorities to show restraint towards the mass protests in Hong Kong.

However, we wish you a much luck in trading today!

Market Review – Fundamental Perspective

Yesterday the Dow Jones index of shares declined 1.4 percent and the Standard & Poor’s index fell 1.3 percent. U.S. Treasure yields rose to almost the highest versus the German counterparts since 1999 while the USD is close to its strongest level in two years versus the EUR. Germany sold 10-year bonds to yield less than 1 percent for the first time. The USD declined from a six-year high against the JPY amid bets it gained too much and too fast. The EUR/USD touched 1.2584 before trading at 1.2623. The USD/JPY tumbled 0.7 percent to 108.89 and the EUR depreciated 0.7 percent to 137.46 JPY. The EUR/GBP traded at 0.7795 after reports showed U.K. manufacturing grew at the slowest pace in 17 months. The GBP bought 1.6189 USD.

The European Central Bank is going to meet today and economists forecasted that interest rates will remain unchanged after unexpectedly dropping them to records on September 4. The ECB will present details on Thursday of a new asset-buying plan with which it hopes to revive the flagging euro zone economy and see off the specter of deflation. It plans to buy asset-backed securities with a view to support lending to the small- and mid-sized firms that form the backbone of the euro zone economy. Yesterday data showed that manufacturing in the euro zone slowed in the past month to the lowest since July and fell to 50.3 as new orders dropped for the fist time in over a a year. It is still above 50 which separates growth from contraction. In addition yesterday the Institute of Supply Management said that its index of national factory activity weakened to 56.6 in the past month, which is the lowest since June. The FED will start publishing a new monthly index of U.S. labor market conditions on Monday, October 6, that draws on a range of data to give a better sense of the economy’s health.

Daily Technical Analysis

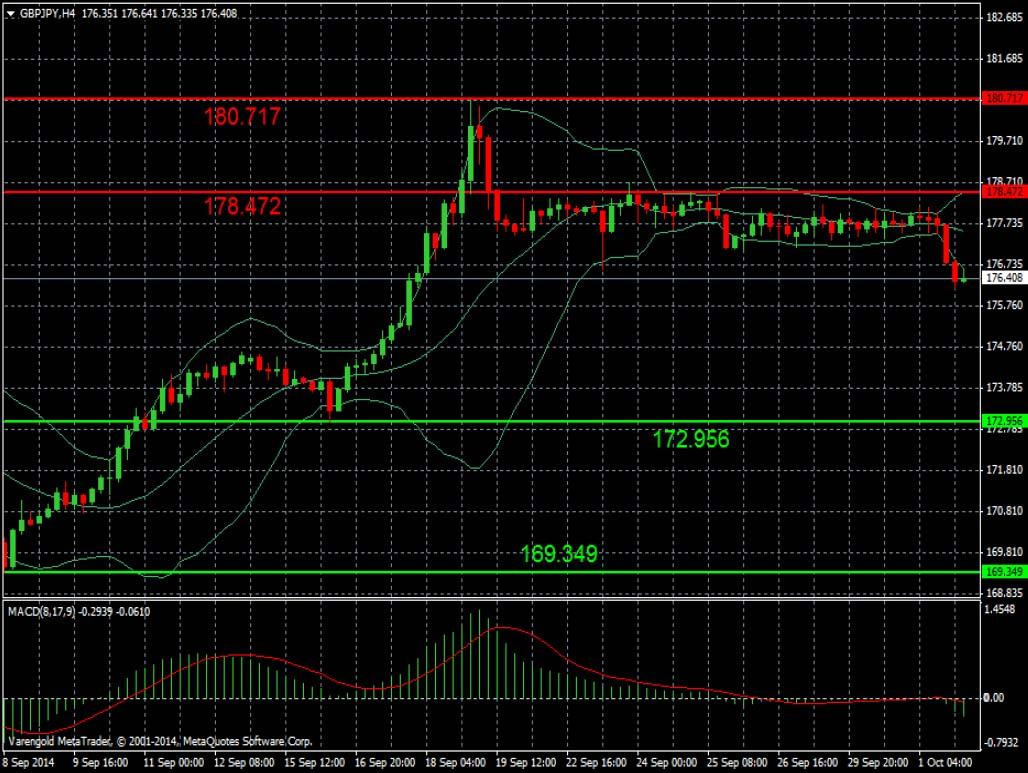

GBP/JPY (4 Hours)

After the pair had rose close to a six year high on September 19 around 180.71 it started a sideways trend. Currently it is trading even below the lowest Bollinger band which might be a signal for a comeback of the bears. The MACD is also assuming an upcoming decrease.

Support & Resistance (4 Hour)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum ETF issuers not giving up fight, expert says as Grayscale files S3 prospectus

Ethereum exchange-traded funds theme gained steam after the landmark approval of multiple BTC ETFs in January. However, the campaign for approval of this investment alternative continues, with evidence of ongoing back and forth between prospective issuers and the US SEC.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.