Good morning from Hamburg and welcome to our latest Daily FX Report. U.S. stocks rose on Monday on hopes that China will take further accommodative monetary policy action if needed, while merger deals kept traders focused even as volumes were below average.Energy shares weighed, with declines in Exxon and Chevron keeping the Dow industrials flat while the S&P 500 energy sector was down 1 percent. U.S. crude and Brent fell ahead of an OPEC meeting this week.

Anyway, we wish you a successful trading day!

Market Review – Fundamental Perspective

The yen dropped to almost a seven-year low versus the dollar as central banks worldwide add to monetary stimulus, damping demand for low-yielding haven assets such as Japan ́s. It leads losses versus the dollar this month, falling 5 percent, followed by South Korea ́s won, which is down 3.9 percent, according to data compiled by Bloomberg. It depreciated 0.4 percent against the dollar to 118.27 today, having touched 118.98 on November 20, the weakest level since August 2007. It dropped 0.8 percent to 147.15 yen per euro. The 18-nation euro rose against the U.S. currency after European Central Bank Governing Council member Jens Weidmann said expanding bond purchases to government debt would face “legal hurdles”. The euro rose for the first time in three days. It gained 0.4 percent to $1.2442, having dropped to $1.2358 on November 7, the lowest since August 2012. The German Ifo institute ́s business climate index, based on a survey of about 7000 executives, rose to 104.7 in November from 103.2 in October. Economists predicted a decline to 103, according to the median of estimates in a Bloomberg survey. The shared currency fell the most since the five days ending October 31 last week after ECB President Mario Draghi said policy makers “will do what we must” to boost consumer prices. The central bank won ́t make a hasty decision on further stimulus and will hinge any measures on incoming data, Executive Board memner Benoit Coeure said today. The ECB meets December 4 to discuss further measures to support the economy, after reducing rates to record lows and announcing a program to buy covered bonds and asser-backed securities. China joined Europe in easing its monetary policy last week, surprising markets with its first interest-rate cut since 2012. The Bank of Japan maintained its pace of monetary base expansion.

Daily Technical Analysis

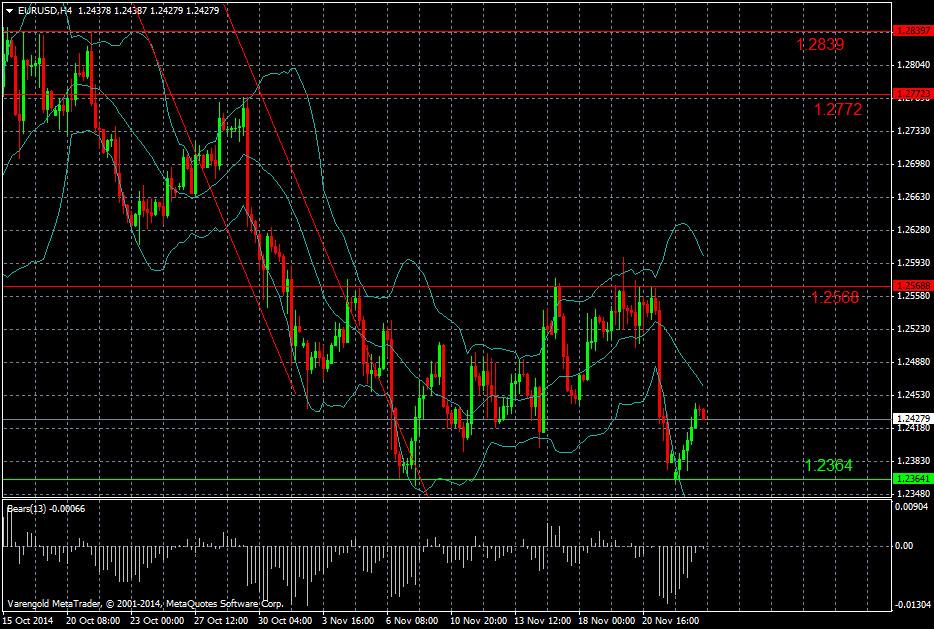

EUR/USD (4 Hours)

One of the most important currency pairs worldwide is held under control by the bears. It doesn’t seem to be a stable support line, as this pair is highly influenced by economic world data. The euro has already touched a two-year low. It stopped the recent fall at 1.2364 and is moving between this level and the resistance at 1.2568. The ECB meeting on Dec. 4 may determine the future direction of this pair at least in the short run.

Support & Resistance (4 Hours)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

AUD/USD holds hot Australian CPI-led gains above 0.6500

AUD/USD consolidates hot Australian CPI data-led strong gains above 0.6500 in early Europe on Wednesday. The Australian CPI rose 1% in QoQ in Q1 against the 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY sticks to 34-year high near 154.90 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price struggles to lure buyers amid positive risk tone, reduced Fed rate cut bets

Gold price lacks follow-through buying and is influenced by a combination of diverging forces. Easing geopolitical tensions continue to undermine demand for the safe-haven precious metal. Tuesday’s dismal US PMIs weigh on the USD and lend support ahead of the key US macro data.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.