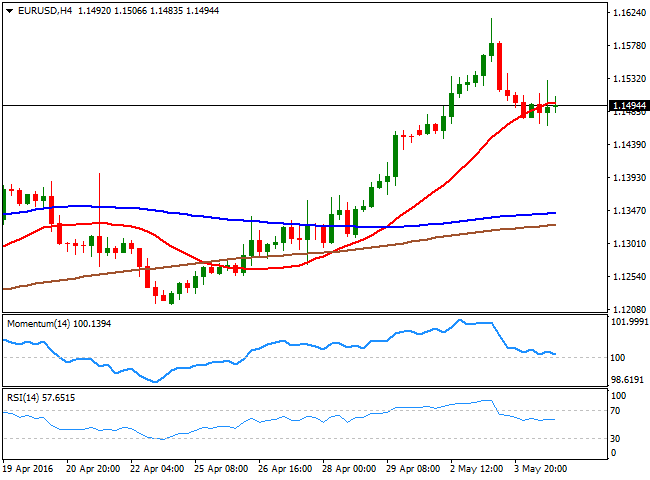

EUR/USD Current Price: 1.1493

View Live Chart for the EUR/USD

The American dollar edged marginally higher against most of its major rivals, although commodity-related currencies under-performed, weighed by falling oil and gold prices, and poor local data. The EUR/USD pair aimed to recover above the 1.1500 figure, but failed to do so, and ended the day a handful of pips below the level. The release of the final Services and Composite readings for the month of April in the EU, showed that activity grew at a slower pace than initially estimated, indicating a tepid start of the second quarter. Retail Sales in the EU, declined by 0.5% in March compared to the previous month, up by 2.1% compared to a year before, against expectations of a 2.5% advance. In the US, data came in mixed, with the ADP employment survey disappointing, as it showed that the private sector added 156,000 new jobs in March, although the Services sector grew by more than expected whilst new orders for U.S. factory goods also rose more than expected up by 1.1% after February's downwardly revised 1.9% decline.

The 4 hours chart for the EUR/USD pair shows that the technical indicators have erased all of their extreme readings and stabilized above their mid-lines, with the Momentum indicator heading lower right above its100 level and the RSI flat around 57, whilst the price is unable to establish itself above a still bullish 20 SMA. The daily low was of 1.1469, showing that buying interest is aligned around the major support, yet at this point, the pair needs to advance firmly above the 1.1530 level to regain its previous positive tone and be able to retest the high at 1.1615. Below the mentioned support on the other hand, the price can decline down to 1.1380, and it will take a break below this last to deny the recently born bullish trend.

Support levels: 1.1500 1.1460 1.1420

Resistance levels: 1.1530 1.1565 1.1615

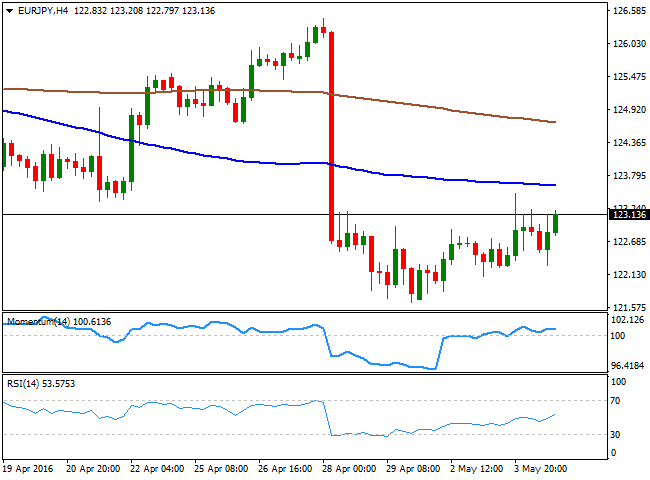

EUR/JPY Current price: 123.13

View Live Chart for the EUR/JPY

The EUR/JPY pair advanced for a third consecutive day, posting a daily high of 123.49 before ending the day just above the 123.00 figure. Demand for the Japanese yen continues to be nonexistent in spite of a risk-averse environment, as speculators remain side-lined on fears the BOJ may intervene the market. The short term picture for the pair is neutral-to-bullish, as in the 1 hour chart, the price has managed to extend above a horizontal 100 SMA, currently around 122.40, while the 200 SMA stands at 123.90, providing a strong resistance in the case of further advances. In this time frame, the technical indicators lack directional strength, with the RSI indicator turning slightly lower around 58 and the Momentum stuck around its mid-line. In the 4 hours chart, the technical indicators hold within positive territory, but also lacking directional strength, whilst the price is well below its moving averages, indicating there's still a long way to go before talking about a steeper recovery.

Support levels: 122.55 122.10 121.65

Resistance levels: 123.90 124.40 124.80

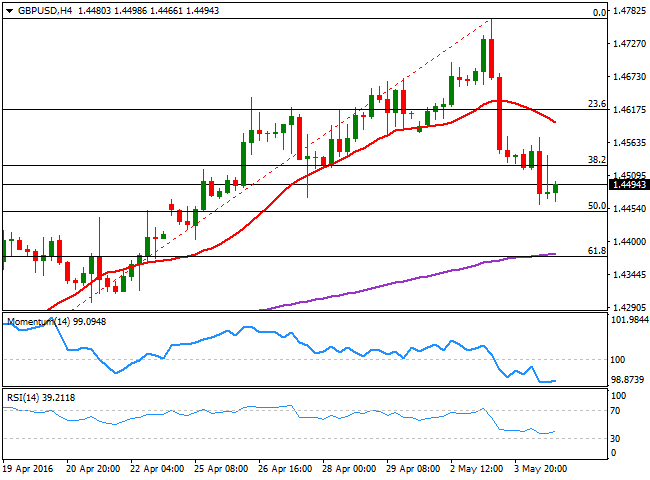

GBP/USD Current price: 1.4494

View Live Chart for the GBP/USD

The Sterling fell against the greenback to its lowest in seven days, after the release of the UK Construction PMI, which showed that output growth eased to the weakest for almost three years, finally resulting at 52.0, amid stalling new business volumes in April, according to the Markit report. The GBP/USD pair fell down to 1.4460, bouncing from this last up to 1.4571 before losing momentum and closing the day below the 1.4500 mark. The daily chart shows that after over two weeks of advances, the pair retreated almost 50% in just two days, confirming that buying interest somehow faded. For the upcoming sessions, the risk is towards the downside, as in the 4 hours chart, the 20 SMA continues grinding lower well above the current level, whilst the technical indicators have lost their downward strength near overbought levels, but are far from indicating an upward move. Further slides below 1.4475 should see the decline extending down to 1.4450, the 61.8% retracement of the latest bullish run and the 200 EMA.

Support levels: 1.4450 1.4410 1.4375

Resistance levels: 1.4530 1.4580 1.4620

USD/JPY Current price: 107.08

View Live Chart for the USD/JPY

The USD/JPY pair trades around the 107.00 level as the US session ends, modestly higher daily basis, but maintaining the overall bearish tone seen on previous updates. With a long holiday going on in Japan, market players remain away from JPY crosses due to the lack of local clues, whilst a still weak greenback limits chances of a strong advance. The pair remained below Tuesday's high of 107.43, and the 1 hour chart shows that the price is a few pips above a bearish 100 SMA, still unable to clearly advance beyond it, whilst the technical indicators have re-entered negative territory and present bearish slopes, keeping the risk towards the downside. In the 4 hours chart, this latest consolidation has helped indicators to correct extreme oversold readings, but are currently flat around their mid-lines, whilst the price is far below its 100 and 200 SMAs, all of which supports additional slides towards the 105.00 region, particularly if the ongoing negative mood prevails.

Support levels: 106.60 106.20 105.70

Resistance levels: 107.45 107.90 108.30

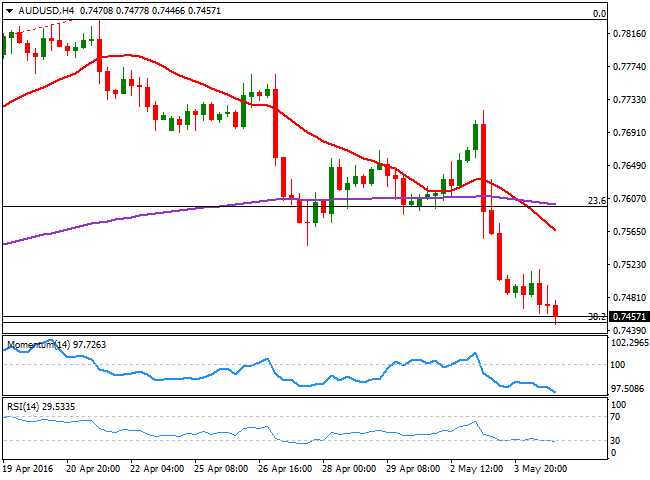

AUD/USD Current price: 0.7457

View Live Chart for the AUD/USD

The Australian dollar kept falling this Wednesday on the back of the RBA surprise rate cut earlier this week, plummeting against the greenback to 0.7446, its lowest in two months. During the upcoming Asian session, Australia will release its Retail Sales and Trade Balance figures for March, both expected to have improved compared to February. If that's not the case, the pair could extend its decline down to the 0.7330 region, the 50% retracement of this year's run. Technically, the price is currently hovering around the 38.2% retracement of the same rally, whist in the 4 hours chart, the Momentum indicator heads strongly lower within oversold territory, and the RSI also heads south around 29, all of which suggests that renewed selling pressure below 0.7450, should confirm a bearish continuation. A recovery from the current price zone, on the other hand, needs to extend at least above the 0.7510 level, to see the bearish pressure easing and the recovery extending towards the 0.7600 price zone.

Support levels: 0.7450 0.7415 0.7370

Resistance levels: 0.7510 0.7560 0.7600

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

GBP/USD steadies near 1.2450, awaits mid-tier US data

GBP/USD is keeping its range at around 1.2450 in European trading on Wednesday. A broadly muted US Dollar combined with a risk-on market mood lend support to the pair, as traders await the mid-tier US Durable Goods data for further trading directives.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.