EUR/USD Current Price: 1.1263

View Live Chart for the EUR/USD

The dollar maintained its positive tone against its European rivals during the first half of the day, resulting in the EUR/USD plummeting to a fresh 2-week low of 1.1233. The release of the EU final March CPI figures was slightly encouraging, as compared to a year before, it came in flat, against a previous 0.1% decline. Monthly basis, it rose by 1.2% as expected, whilst the core year-on-year reading came in at 1.5%. In the US, weekly unemployment claims decreased to 253K in the week ending April 8th, better-than-expected, while inflation, in March, grew less than expected, up 0.1% from the previous month. The year-on-year reading also resulted below expected, printing 0.9%, with US data once again halting dollar's rally.

The EUR/USD pair has posted quite a shallow bounce, and continues trading near its daily low, with the 1 hour chart showing that the price is incapable to advance beyond its 20 SMA, whilst the technical indicators hold directionless within negative territory. In the 4 hours chart, the technical indicators have lost their bearish strength near oversold readings, while the 20 SMA accelerated its decline above the current level, and stands now around 1.1350. At this point, only a clear recovery above 1.1330, the base of the range that contained price for almost two weeks, is the level to beat to confirm a stronger bullish potential, yet as long as the price remains below it, the risk is towards the downside.

Support levels: 1.1235 1.1200 1.1160

Resistance levels: 1.1280 1.1330 1.1380

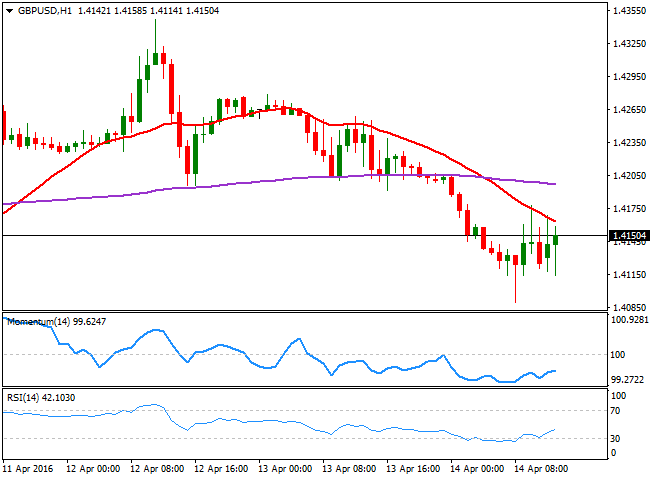

GBP/USD Current price: 1.4149

View Live Chart for the GBP/USD

The Sterling remained muted after the BOE announced its lately economic policy decision, in line with market's expectations of an on-hold stance. All of the 9 MPC members voted to maintain rates, and the only note of color was a comment regarding the risks involving a Brexit. But the Super-Thursday ended up being a non-event, as the pair barely moved 20 pips afterwards. Trading below the 1.4200 level, the technical picture favors additional declines for today, as in the 1 hour chart, the price develops below a bearish 20 SMA, steadily attracting selling interest ever since the European session started, while the technical indicators bounced from oversold territory before losing upward strength and turned flat. In the 4 hours chart, the price is well below its moving averages, whilst the technical indicators have lost bearish momentum within negative territory, but are far from suggesting an upward corrective move.

Support levels: 1.4110 1.4050 1.4000

Resistance levels: 1..4185 1.4240 1.4285

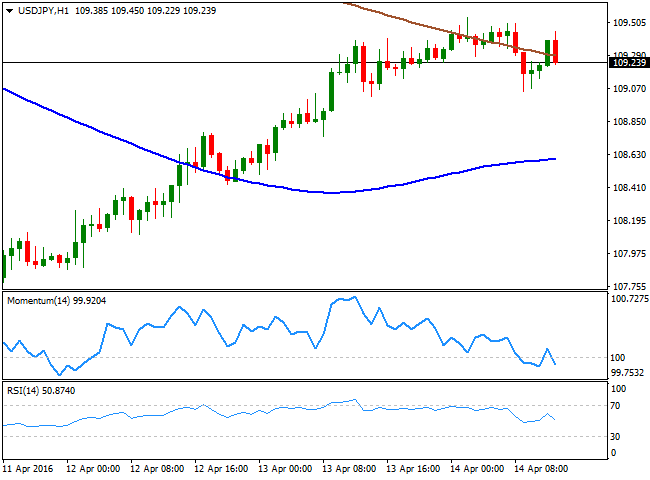

USD/JPY Current price: 109.22

View Live Chart for the USD/JPY

Bears still lead. The USD/JPY pair is showing little signs of life this Thursday, still trading within a limited range above the 109.00 level. Poor US inflation figures, however, are pushing the pair slightly lower, but with no much conviction. Technically, the 1 hour chart shows that the price has been struggling around a bearish 200 SMA ever since the day started, unable to advance beyond it. In the same chart, the technical indicators have turned south around their mid-lines, but lack enough strength to confirm a downward continuation. In the 4 hours chart, the technical indicators have retreated from overbought levels, but remain well above their mid-lines, losing their downward strength. Overall, the pair remains bearish, and will probably extend its decline on a break below 108.90, the immediate support, but needs a good trigger to do it, and seems it won't get it today.

Support levels: 108.90 108.40 107.95

Resistance levels: 109.50 110.00 110.45

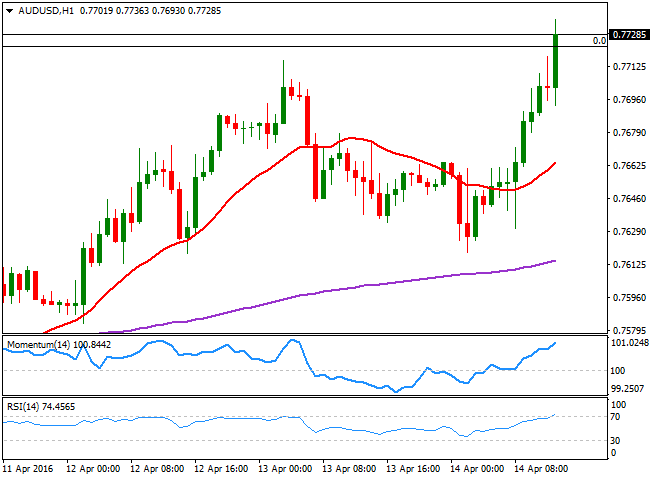

AUD/USD Current price: 0.7729

View Live Chart for the AUD/USD

The Aussie trades at fresh year highs against its American rival, boosted at the beginning of the day by pretty encouraging Australian employment data, showing that the unemployment rate fell to 5.7% in March, while the economy added 26,100 new jobs. Stocks got a boost from US tepid inflation readings, as they signal that rates will remain lower for longer, sending the AUD/USD up to 0.7736 ahead of the US opening. Technically, the 1 hour chart shows that the technical indicators maintain a strong upward momentum, despite being in overbought territory, while in the 4 hours chart, the technical picture also favors the upside, despite indicators lack upward momentum.

Support levels: 0.7720 0.7670 0.7625

Resistance levels: 0.7760 0.7800 0.7840

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'