EUR/USD Current Price: 1.1385

View Live Chart for the EUR/USD

The EUR/USD pair trades uneventfully around 1.1370/80, having seen little activity so far this Monday. So far, data coming from the EU has been pretty discouraging, given that the Sentix Investor confidence index for April, showed a tepid growth, up to 5.7 from previous 5.5, below market's expectations of 6.4. The Producer Price index for the region plummeted further into the red on February, down by 0.7% monthly basis, and leaving the annual reading at -4.2%. Nevertheless, the dollar remains under pressure across the board, as local share markets recovered some of the ground lost last Friday. Technically, the 1 hour chart shows that the price is advancing towards its 20 SMA, while the technical indicators head higher towards their mid-lines, still unable to confirm an upward continuation. In the 4 hours chart, the price is holding above its 20 SMA, whilst the technical indicators lack directional strength within bullish territory, suggesting some additional gains beyond 1.1410 are required before confirming an upward continuation.

Support levels: 1.1360 1.1320 1.1280

Resistance levels: 1.1410 1.1460 1.1500

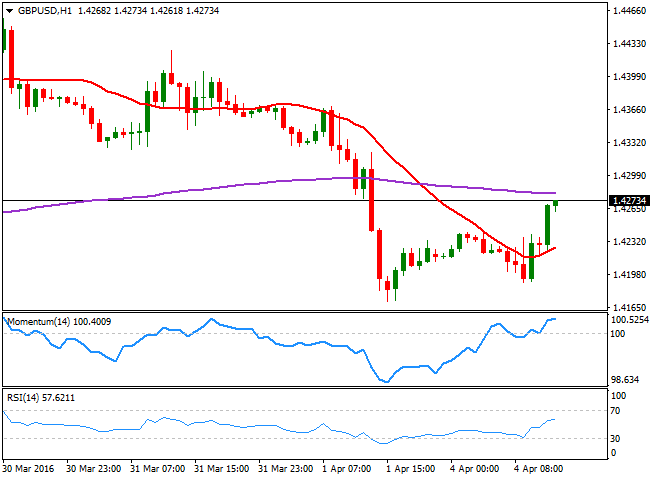

GBP/USD Current price: 1.4273

View Live Chart for the GBP/USD

The GBP/USD pair accelerates north ahead of the US opening, approaching the 1.4300 level, and shrugging off recent weakness, in spite of a weaker-than-expected Construction PMI figure for March, which printed 54.2, below the 54.3 expected. The 1 hour chart, shows that the price has accelerated after breaking above a bullish 20 SMA, whilst the technical indicators have accelerated their advances, and approach overbought territory. In the 4 hours chart, however, the price is below a bearish 20 SMA, currently around 1.4310, whilst the technical indicators have recovered within bearish territory, but lack enough momentum to confirm additional gains.

Support levels: 1.4260 1.4210 1.4170

Resistance levels: 1.4330 1.4370 1.4410

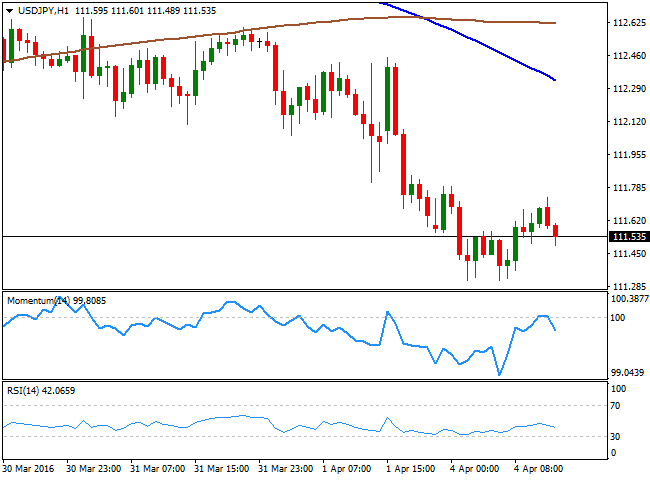

USD/JPY Current price: 111.53

View Live Chart for the USD/JPY

Bearish pressure prevails. The USD/JPY pair remains subdued, having advanced up to 111.73 before turning back south, overall maintaining the negative tone that led the pair for all of this past March. The Nikkei 225 edged slightly lower, having no effects over the pair, whilst the neutral tone in US futures is keeping the pair confined to a limited range. The technical short term picture favors the downside, as in the 1 hour chart, the price is below a bearish 100 SMA that accelerated its decline after breaking below the 200 SMA. In the same chart, the technical indicators are retreating from their mid-lines, suggesting the decline may extend further. In the 4 hours chart, the price is also developing below its 100 and 200 SMA, whilst the technical indicators have turned lower after a limited upward corrective movement from oversold levels, all of which supports the shorter term perspective, particularly on a break below the daily low of 111.31.

Support levels: 111.30 111.00 110.65

Resistance levels: 112.00 112.60 113.10

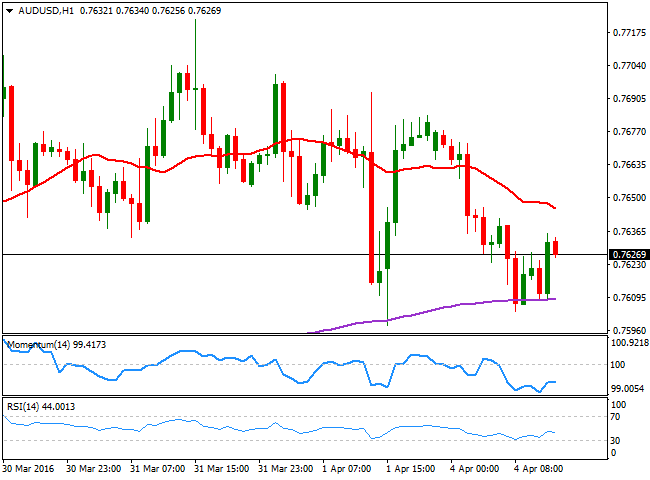

AUD/USD Current price: 0.7626

View Live Chart for the AUD/USD

The AUD/USD pair fell down to 0.7603 this Monday, maintaining a short term negative tone ahead of the US opening, as following bounces have been contained by selling interest around 0.7740. The Aussie downward tone is being blame on commodities' weakness, as both, gold and oil remain trading at Friday's lows. Technically, the 1 hour chart shows that the risk has turned towards the downside with the price developing below a bearish 20 SMA, whilst the technical indicators head lower below their mid-lines. The 4 hours chart also presents a bearish tone, given that the price is below a bearish 20 SMA, whilst the Momentum indicator heads lower below the 100 level, and the RSI indicator hovers around 47.

Support levels: 0.7600 0.7570 0.7540

Resistance levels: 0.7740 0.7775 0.7800

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD rebounds to 1.0650 on renewed USD weakness

EUR/USD gained traction and rose to the 1.0650 area in the early American session on Tuesday. Disappointing housing data from the US seem to be weighing on the US Dollar, helping the pair stretch higher.

GBP/USD climbs above 1.2450 after US data

GBP/USD extended its recovery from the multi-month low it touched near 1.2400 and turned positive on the day above 1.2450. The modest selling pressure surrounding the US Dollar after dismal housing data supports the pair's rebound.

Gold retreats to $2,370 as US yields push higher

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world supported by a strong US labour market.