EUR/USD Current Price: 1.1271

View Live Chart for the EUR/USD

As usual, the week started slowly, with the greenback gaining some ground across the board with London opening, as local share markets opened in the red, whilst commodities slid. But the market quickly took that dollar spike to sell the American currency at higher levels, and the EUR/USD pair trades flat on the day ahead of the US opening. The macroeconomic calendar has been quiet so far today, with the EU releasing its current account result for January 2016 that recorded a surplus of €25.4 billion, below the €26.3 billion expected, and down from a previously revised €28.6B.

Ahead of the release of US Existing Home sales data for February, expected at 5.40 million, below the 5.47M printed in January, the dollar trades mixed across the board, not far from its daily opening. The EUR/USD pair has been unable to advance beyond the 1.1285 level ever since the day started, and the short term picture is neutral-to-bearish, given that in the 1 hour chart, the price is unable to advance beyond a mild bearish 20 SMA, whilst the technical indicators head slightly lower below their mid-lines. In the 4 hours chart, the Momentum indicator heads sharply lower after crossing its 100 level, while the RSI lacks directional strength and consolidates around 58, and the price struggles around a bullish 20 SMA, limiting chances of a downward move. Dollar's broad weakness will likely keep the downside limited, yet a decline down to 1.1200 can't be disregarded, particularly if US data surprises to the upside.

Support levels: 1.1245 1.1200 1.1160

Resistance levels: 1.1285 1.1310 1.1340

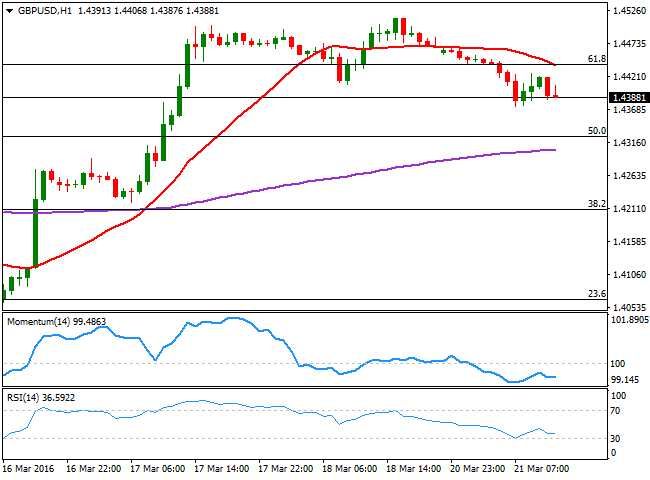

GBP/USD Current price: 1.4388

View Live Chart for the GBP/USD

The GBP/USD pair fell down to a daily low of 1.4374, and failed afterwards to regain the 1.4400, with a short lived spike above it seeing the pair retreating back towards the mentioned low. The pair however, holds on to gains, and buying interest will likely surge on dips towards the 1.4250 region, now the line in the sand, as bulls will maintain the lead as long as the price holds above it. Short term, the 1 hour chart presents a negative tone, given that the price develops below a bearish 20 SMA, now converging with the 61.8% retracement of this year decline at 1.4445, while the technical indicators hold within bearish territory, although turning slightly higher at the time being. In the 4 hours chart, the price has been bouncing from a bullish 20 SMA ever since the day started, but the Momentum indicator heads sharply lower, still above its 100 line, while the RSI holds flat around 52, all of which maintains the downside limited at the time being.

Support levels: 1.4370 1.4325 1.4280

Resistance levels: 1.4410 1.4445 1.4490

USD/JPY Current price: 111.45

View Live Chart for the USD/JPY

Still neutral, but risk remains towards the downside. The USD/JPY trades flat in a tight range this Monday, given that Japan's financial markets have remained closed on a local holiday. Hovering around 111.40, the pair may see some action with US data, but will more likely come back to life after Tuesday's Nikkei opening, In the meantime, the long term bearish dominant trend remains firm in place, as the price consolidates near the lows of its recent range, and far below its 100 and 200 DMAs. Short term, the 1 hour chart shows that the technical indicators hover around their mid-lines with no directional strength, while the 100 SMA has accelerated its decline, and now offers a strong dynamic resistance in the 112.20 region. In the 4 hours chart, the Momentum indicator heads north after recovering above its mid-line, but the RSI indicator keeps heading lower in negative territory, while the price remains below the 111.60 level, the immediate short term resistance, all of which denies the possibility of a steeper advance.

Support levels: 111.05 110.65 110.20

Resistance levels: 111.60 111.90 112.20

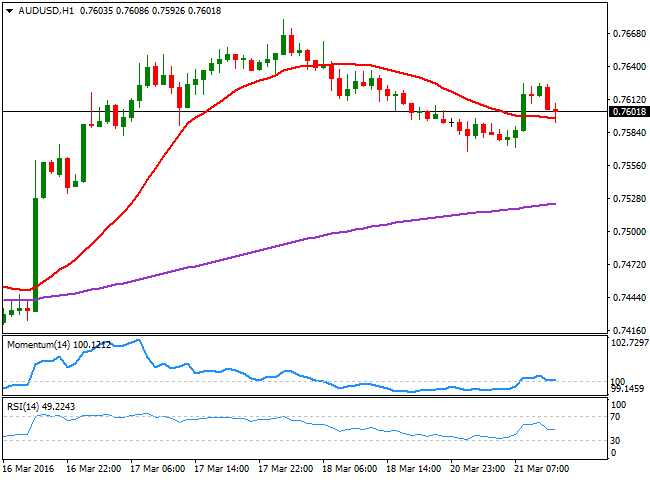

AUD/USD Current price: 0.7601

View Live Chart for the AUD/USD

The Australian dollar trades purely on sentiment this Monday, with the AUD/USD tracking stocks' markets movements. The pair was under pressure during the Asian session and early Europe, but as shares and commodities bounced, it returned back to the 0.7600 level, now struggling to hold above it. The short term technical picture is given little clues on upcoming moves, as the technical indicators hover around their mid-lines, while the price stands above a flat 20 SMA in the 1 hour chart. In the 4 hours chart, the price hovers around a bullish 20 SMA, while the technical indicators are also directionless around their mid-lines, lacking clear directional strength.

Support levels: 0.7565 0.7520 0.7470

Resistance levels: 0.7630 0.7680 0.7720

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.