EUR/USD Current Price: 1.1023

View Live Chart for the EUR/USD

The EUR/USD pair holds above the 1.1000 region in a dull trading session, with uncertainty over the upcoming ECB decision keeping the common currency subdued. The day started with China triggering some risk aversion, as trade balance data came in much worse than expected, reflecting further slumps both in exports and imports during last February. Nevertheless, European stocks reversed early losses and trade slightly below their daily openings. Data coming from Europe this Tuesday was better-than-expected, with German Industrial Production rising 3.3% monthly basis last January, and the EU GDP ticking up to 1.6% yearly basis, but in line with expectations during the last quarter of 2015, up by 0.3%.

Ahead of the US opening, the 1 hour chart shows that the pair maintains a limited upward potential, as the price hovers around a horizontal 20 SMA and the technical indicators are aiming to recover from neutral territory. In the 4 hours chart, the technical outlook also favors the upside, given that the price is above a bullish 20 SMA and the RSI turned north after a limited downward correction near overbought territory. In this last time frame, however, the Momentum indicator diverges lower, limiting the upside. The pair needs to accelerate beyond the 1.1045 level, where the rallies stalled the last two trading days, to be able to extend its gains up to the 1.1080/1.1120 region.

Support levels: 1.0980 1.0950 1.0920

Resistance levels: 1.1045 1.1080 1.1120

GBP/USD Current price: 1.4197

View Live Chart for the GBP/USD

The GBP/USD pair trades near the 1.4200 level, easing from the 1.4283 posted late Monday. The UK calendar has been quite light this week, but next Wednesday, the release of the latest manufacturing and industrial production figures will offer a clearer picture of the kingdom's health. In the meantime, and despite broad dollar's weakness, the short term picture for the pair is bearish, with the price breaking through the 1.4200 level and the 1 hour chart showing that the price is accelerating below a bearish 20 SMA, whilst the technical indicators head south well below their mid-lines. In the 4 hours chart, the price is now pressuring a bullish 20 SMA after being rejected by the 200 EMA, while the technical indicators head south within positive territory, not yet confirming a stronger decline.

Support levels: 1.4190 1.4150 1.4110

Resistance levels: 1.4220 1.4260 1.4290

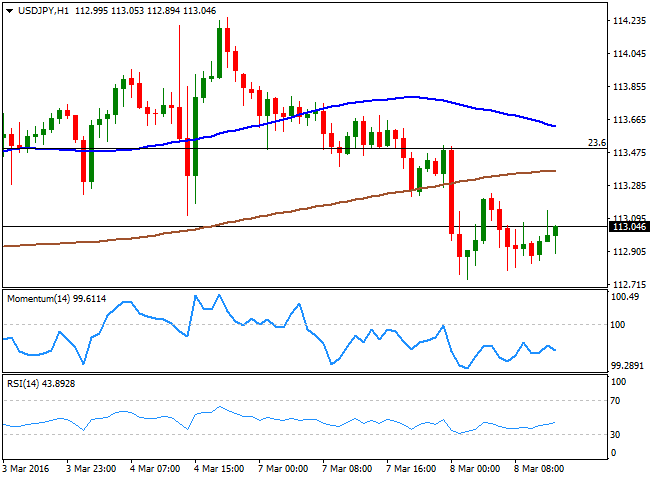

USD/JPY Current price: 113.04

View Live Chart for the USD/JPY

Bearish case improving. The USD/JPY pair fell briefly below the 113.00 level, and currently hovers around it, with the downside limited as stocks trim early losses. Risk aversion has dominated the financial world during the Asian session, with local share markets plummeting on further signs of a Chinese economic slowdown, this time in the form of poor trade balance figures. The negative sentiment however, recede during the European morning, and continues improving ahead of the US opening. Nevertheless, the pair maintains the technical bearish stance, now below the 23.6% retracement of the latest bullish run, at 113.50, and in risk to retest the lows set at 111.00. Short term, the 1 hour chart shows that the price is well below its 100 and 200 SMAs, while the Momentum indicator heads south below the 100 level, and the RSI indicator hovers around 43. In the 4 hours chart, the technical indicators have lost the downward potential within bearish territory, whilst the price is in consolidative mode below the 100 SMA, all of which favors additional declines on a break below 112.70, the immediate support.

Support levels: 112.70 112.35 112.00

Resistance levels: 113.20 113.50 113.95

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.