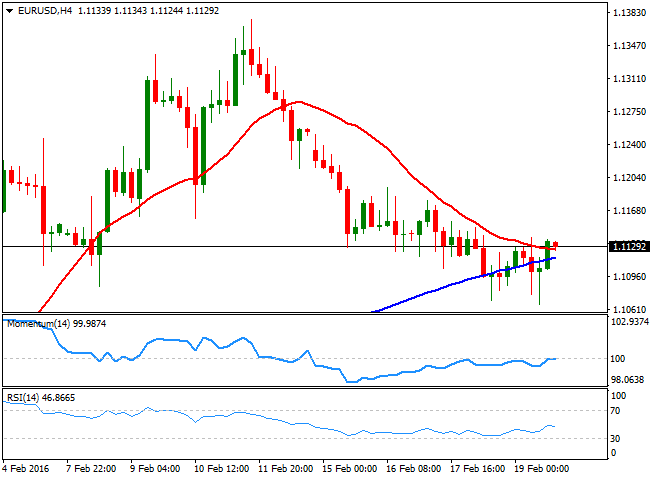

EUR/USD Current Price: 1.1129

View Live Chart for the EUR/USD

Friday began with a firmer American dollar, but the greenback softened as US stocks trimmed losses and investors took some profits out of the table ahead of the close. Stronger US inflation data gave the dollar a lift early in the US session, as US CPI for January came in stronger than expected, with the headline rate unchanged on the month, and the core rate rising by 0.3%mom. Headline inflation in January is now double that in December at 1.4%YoY, with the core rate is now at 2.2%, above the previous 2.1%. In Europe however, things were not that bright. German´s index of producer prices for industrial products fell by 2.4% compared with the corresponding month of the preceding year, and by 0.7% compared to December 2015, while later in the day, data showed that consumer confidence in the Eurozone has plummeted to -8.8 in February from a reading of -6.3 the month before.

Nevertheless, the dollar edged lower and the EUR/USD pair closed the day with gains, after a five-day losing streak. Technically the daily chart shows that the price has managed to hold above a still bullish 20 SMA, yet at the same time, the lower highs daily basis and the fact that the Momentum indicator turned south and nears its 100 level, suggests the risk remains towards the downside for the upcoming week. In the 4 hours chart, the technical picture is quite flat, with the technical indicators heading nowhere around their mid-lines, and the price stuck around a bearish 100 SMA.

Support levels: 1.1080 1.1045 1.1000

Resistance levels: 1.1160 1.1200 1.1245

EUR/JPY Current price: 125.36

View Live Chart for the EUR/JPY

The EUR/JPY pair closed the week at its lowest since June 2013, having extended its decline below the 126.00 level on a run towards safety. The ongoing market turmoil will likely maintain the yen on demand during the upcoming days, which is also supported by the usual March rally in the Japanese currency, ahead of the end of the fiscal year. The downside potential has accelerated during the past week, and the decline seems poised to continue, given that the daily chart shows that, by the end of the week, the technical indicators retained their strong bearish slopes, whilst the price continued retreating from a bearish 100 SMA, currently around 130.65. In the shorter term and according to the 4 hours chart, the bias is also towards the downside, as the technical indicators remain near oversold levels, with no aims of turning higher, whilst the price extended further below its moving averages.

Support levels: 125.00 124.40 123.90

Resistance levels: 125.80 126.40 126.95

GBP/USD Current price: 1.4358

View Live Chart for the GBP/USD

The GBP/USD pair managed to close Friday with gains above the 1.4300 level, but down on the week, weighed by fears over a Brexit. The 28 members of the EU met last Thursday and Friday, to discuss British conditions to remain within the region. Right after the closing bell, European Union leaders reached a deal aimed at keeping the UK in the bloc, Lithuanian President Dalia Grybauskaite said, which may result in the Pound gapping higher at the beginning of the next week. The daily chart shows that Friday's recovery helped the RSI indicator to turn higher, although the indicator remains well below its mid-line, while the Momentum indicator heads lower below its 100 level. In the same chart, the 20 SMA has lost its upward strength around 1.4460, providing a strong resistance in the case of some gains this Monday. In the shorter term, the 4 hours chart shows that the price managed to accelerate beyond a horizontal 20 SMA before beginning to consolidate, leaving the technical indicators with no certain direction, but above their mid-lines, which limits chances of a decline, at least in the short term.

Support levels: 1.4340 1.4290 1.4240

Resistance levels: 1.4370 1.4410 1.4460

USD/JPY Current price: 112.64

View Live Chart for the USD/JPY

The USD/JPY pair closed a third straight week to the downside, edging lower on Friday on safe-haven demand, and as US crude oil ended the week below $30.00 a barrel. The Japanese currency has appreciated sharply after a short lived decline following BOJ's decision to cut rates into negative territory, and speculation grows that the Central Bank will take action to lower the value of the yen. Nevertheless, the pair keeps falling and the daily chart shows that the latest advance has been just enough for the technical indicators to correct extreme oversold readings. Ahead of a new weekly opening, the RSI indicator has turned back south near 30, while the Momentum aims slightly higher, still far from showing upward strength. In the same chart, the 100 and 200 SMAs are turning south far above the current level, being irrelevant at the time being. In the 4 hours chart, the technical indicators head lower within bearish territory, whilst the moving averages have accelerated their declines, but also remain well above the current level. Should the decline extend beyond 112.10, the pair will likely retest the 111.00 region next week, and even extend its decline towards 110.00.

Support levels: 112.90 112.50 112.10

Resistance levels: 112.85 113.35 113.70

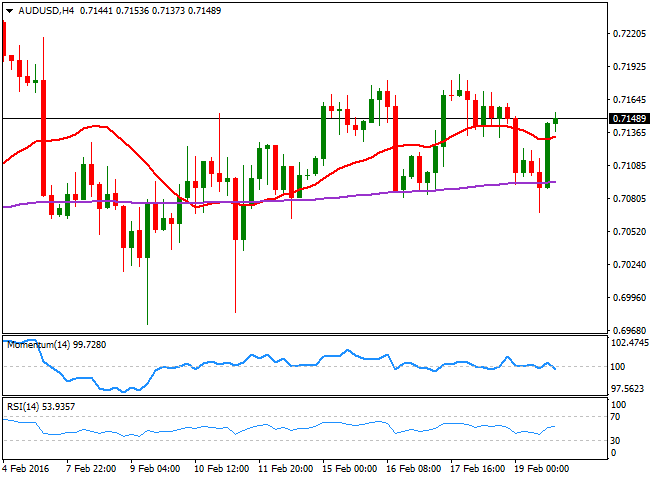

AUD/USD Current price: 0.7148

View Live Chart for the AUD/USD

The Aussie posted a shallow advance against the greenback last week, but it managed to end with gains for a fifth week in-a-row, not far from its year high set at 0.7242 late January. The Australian dollar has been steadily rising ever since bottoming around 0.6830, and is clear that bulls keep controlling the AUD/USD pair, as on Friday, it plummeted to a fresh weekly low before erasing all of its daily losses to close around 0.7150. If something, market turmoil and commodities woes are the reasons why the rallies have been limited. Nevertheless, the technical picture still supports the upside, as in daily chart, the price continues developing well above a bullish 20 SMA, while the technical indicators have turned slightly lower within positive territory, not yet confirming a bearish move. In the 4 hours chart, the pair maintains a neutral stance, given that the technical indicators are unable to grab some directional strength and remain stuck around their mid-lines, whilst the price is moving back and forth around a horizontal 20 SMA. In the same chart, however, declines towards the 200 EMA, currently around 0.7100, have consistently attract buying interest, maintaining the risk towards the upside.

Support levels: 0.7100 0.7070 0.7025

Resistance levels: 0.7190 0.7240 0.7285

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.