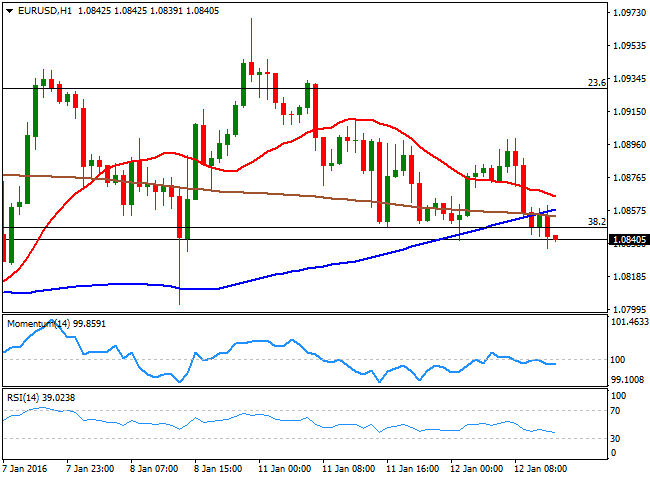

EUR/USD Current Price: 1.0840

View Live Chart for the EUR/USD

The dollar trades generally higher as risk aversion eased and oil´s prices are in recovery mode, and the EUR/USD pair trades at fresh daily lows around 1.0835 ahead of the US opening. There were no macroeconomic releases in the EU, and the calendar will remain light also in the US, meaning that market's will be sentiment, and technically driven. Given that stocks are trading higher amid diminishing risk, the pair may extend its decline further, as in the 1 hour chart, the price is below its moving averages whilst the technical indicators head lower below their mid-lines. Also, the pair is currently trading below a strong Fibonacci level, the 38.2% retracement of the December rally at 1.0845, while in the 4 hours chart, the technical indicators are gaining bearish tone below their mid-lines, still lacking enough momentum to confirm a stepper decline.

Support levels: 1.0800 1.0750 1.0715

Resistance levels: 1..0845 1.0880 1.0925

GBP/USD Current price: 1.4431

View Live Chart for the GBP/USD

The British Pound plunged to a fresh multi-year low against the greenback, down to 1.4413 following the release of poor Industrial and Manufacturing data in the UK. November readings showed that production in the kingdom fell beyond expected, fueling speculation the BOE will remain extremely dovish this week, and that a rate hike will remain out of the table. Technically, the pair is currently oversold, bouncing some from the lows and with the 1 hour chart showing that the technical indicators are aiming higher within extreme levels. In the 4 hours chart, the pair has extended further below a strongly bearish 20 SMA, while the technical indicators are posting tepid bounces in oversold territory, all of which suggests some consolidation for the upcoming hours.

Support levels: 1.4410 1.4380 1.4350

Resistance levels: 1.4470 1.4510 1.4545

USD/JPY Current price: 117.91

View Live Chart for the USD/JPY

Short term bullish, sell at higher levels. The USD/JPY pair hovers around the 118.00 region, still unable to advance beyond it, but trading within positive territory as risk sentiment improved. The 1 hour chart shows that the price is hovering around a bearish 100 SMA, while the technical indicators hold within positive territory, although lacking upward strength. In the 4 hours chart, the technical indicators aim higher, but are still below their mid-lines, whilst the price remains far below its moving averages. The bigger outlook for the pair, however, is still bearish, which means market's players can see rallies as selling opportunities up to the 119.00 region, as only beyond 119.35 the bearish pressure can ease and the pair extend its advance.

Support levels: 1167.60 117.20 116.65

Resistance levels: 118.10 118.50 118.95

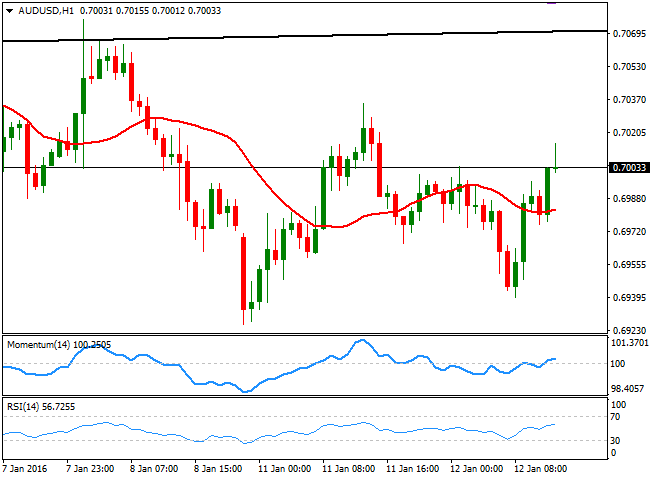

AUD/USD Current price: 0.7003

View Live Chart for the AUD/USD

The Australian dollar recovered some ground, improving alongside with market's sentiment. The AUD/USD pair trades around the 0.7000 level, with a shallow short term bullish tone, as in the 1 hour chart, the price is above its 20 SMA, whilst the technical indicators head slightly higher above their mid-lines. In the 4 hours chart, the price is advancing above its 20 SMA whilst the Momentum indicator is crossing its 100 level towards the upside, anticipating some additional gains towards 0.7040, the immediate resistance.

Support levels: 0.6955 0.6905 0.6870

Resistance levels: 0.7040 0.7075 0.7120

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD holds above 1.2350 after UK PMIs

GBP/USD clings to modest daily gains above 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.