EUR/USD Current Price: 1.0860

View Live Chart for the EUR/USD

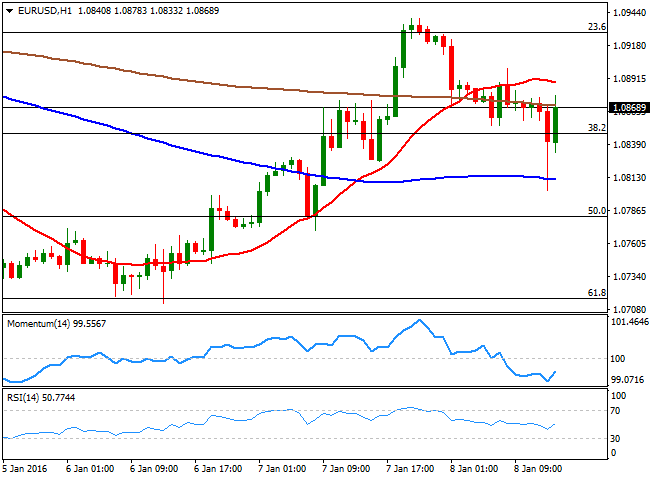

Markets' sentiment improved this Friday, as the PBoC decided to intervene the Yuan, and removed the rule on closing trading at certain level of losses. The decision brought some relief to currencies, and the dollar gained some ground, although markets were on-hold ahead of the release of the US monthly employment report. The December figures were quite encouraging, as the economy added 292K new jobs, while the unemployment rate remained steady at 5.0%. Wages were not so bright with average hourly earnings flat on the month. The dollar gained after the release, but the rally has been somehow limited, with the EUR/USD pair down to 1.0802 before bouncing. Technically, the pair's 1 hour chart shows that the price is so far holding above its 100 SMA, but being capped by the 200 DMA, while the technical indicators turned higher below their mid-lines. In the 4 hours chart, the price bounced sharply from its 20 SMA, while the technical indicators are hovering well above their mid-lines, lacking clear directional strength at the time being.

Support levels: 1.0845 1.0800 1.0750

Resistance levels: 1.0925 1.0960 1.1000

GBP/USD Current price: 1.4572

View Live Chart for the GBP/USD

The GBP/USD fell down to a daily low of 1.4549 following the release of US employment data, bouncing afterwards on a generally weaker lower dollar, but the rally remained well-contained as the bearish trend remains firm in place. Trading within its weekly range, the 1 hour chart for the pair shows that the price is well below its 20 SMA, while the technical indicators are losing their bearish tone, but hold near oversold levels. In the 4 hours chart, the price was once again rejected by a sharply bearish 20 SMA, while the technical indicators maintain their bearish slopes below their mid-lines, in line with the ongoing bearish trend.

Support levels: 1.4570 1.4535 1.4500

Resistance levels: 1.4640 1.4685 1.4730

USD/JPY Current price: 118.01

View Live Chart for the USD/JPY

Bears keep control- The USD/JPY pair saw a short lived spike up to 118.84, but the Japanese currency holds to its recent strength and turned back quickly south. Now pressuring the 118.00 level, the 1 hour chart shows that the price failed to establish above a bearish 100 SMA, while the technical indicators turned lower and are around their mid-lines, in line with another leg south. Nevertheless, it will depend mostly on stocks whether the pair can extend its latest decline or not. In the 4 hours chart, the technical indicators are resuming their declines within bearish territory and following a steep upward corrective move, all of which supports the longer term outlook.

Support levels: 117.90 117.60 117.25

Resistance levels: 118.40 118.80 119.35

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.