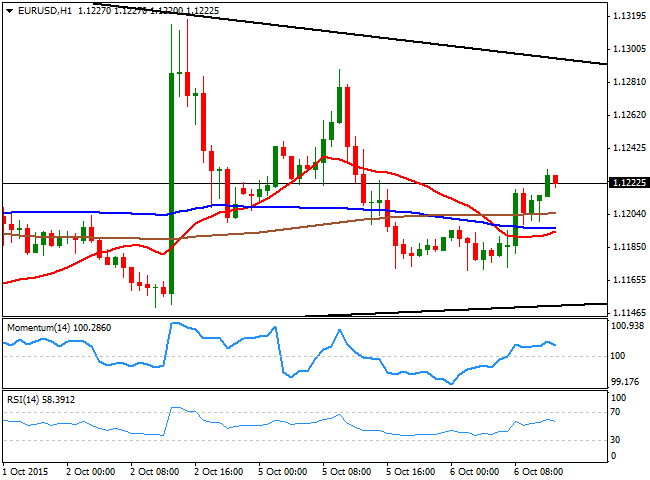

EUR/USD Current price: 1.1222

View Live Chart for the EUR/USD

The dollar trades slightly lower across the forex board this Tuesday, although little action is seen among major pairs. The EUR/USD pair traded as low as 1.1172 during the past Asian session, and up to 1.1230 in the European morning, holding nearby ahead of the US opening. Earlier today, Germany released its Factory Orders figures, showing a sharp decline in August of 1.8% compared to a month before, weighing on the local share market.

Technically, there's little to make out of the pair, as its trading mid-way between the limits of a daily triangle, with the base today at 1.1160 and the roof near 1.1290. The 1 hour chart shows that the price is above its moving averages, whilst the technical indicators have lost their upward strength and turned lower above their mid-lines. In the 4 hours chart, however, the price is above a mild bullish 20 SMA, whilst the technical indicators head higher above their mid-lines, limiting the risk of a stronger decline.

Support levels: 1.1200 1.1160 1.1120

Resistance levels: 1.1245 1.1290 1.1335

GBP/USD Current price: 1.5172

View Live Chart for the GPB/USD

The British Pound trades slightly higher against the greenback, near its daily high of 1.5179, but with the overall dominant bearish trend firm in place, given that the pair is far below the 23.6% retracement of its latest bearish run a 1.5245. Short term, the technical picture supports some intraday gains, as the 1 hour chart shows that the price is above its 20 SMA, while the technical indicators head higher above their mid-lines. Selling interest however, waits around the 1.5200 figure. In the 4 hours chart, the price is moving back and forth around a horizontal 20 SMA whilst the technical indicators also lack directional strength around their mid-lines.

Support levels: 1.5130 1.5100 1.5060

Resistance levels: 1.5210 1.5245 1.5270

USD/JPY Current price: 120.33

View Live Chart for the USD/JPY

Waiting for the BOJ. The USD/JPY pair trades in a 50 pips range ever since the day started, hovering around the 120.35 level, the 50% retracement of its latest weekly decline. For over a month already the USD/JPY has been trading in quite a limited range within Fibonacci levels, which basically means that, when it is finally broken, the movement has high chances of being explosive. There are little chances of seeing the pair moving far away during the upcoming hours, but during the upcoming Asian session, the BOJ will have its monthly economic meeting. There is a good chance that the Central Bank will extend its stimulus plans, which may result in a strong upward rally in the pair. In the meantime, the 1 hour chart shows that the 100 and 200 SMAs stand flat around 120.00, while the technical indicators are stuck in neutral territory. In the 4 hours chart, the technical indicators turned lower around their mid-lines, showing no actual momentum, whilst the price holds above its moving averages that anyway present bearish slopes, limiting chances of a stronger advance as long as the 120.70 static resistance holds.

Support levels: 120.00 119.60 119.35

Resistance levels: 120.70 121.00 121.35

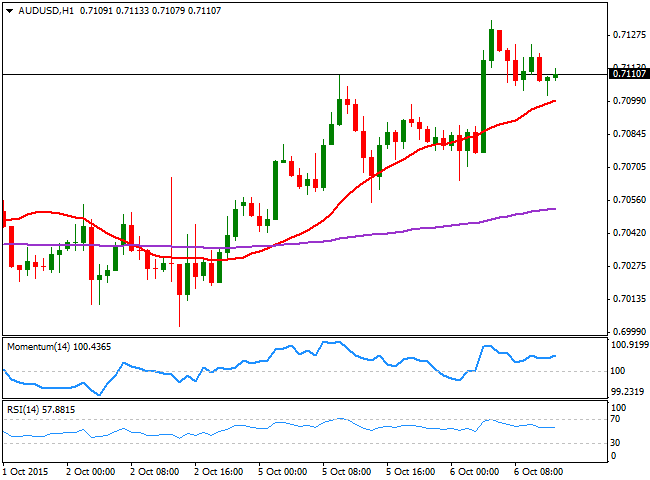

AUD/USD Current price: 0.7110

View Live Chart for the AUD/USD

The AUD/USD pair advanced up to 0.7133 this Tuesday, surging after the latest RBA monetary policy decision, where the Central Bank decided to leave its cash rate unchanged at 2.0%. The following statement from Governor Stevens showed that policy makers are not yet concerned about the economic slowdown in the region, which helped the antipodean currency advancing up to the mentioned high. The 1 hour chart shows that the price has held above a bullish 20 SMA, with intraday buying interest surging around 0.7100, while the technical indicators hold well above their mid-lines, with the Momentum indicator aiming higher. In the 4 hours chart, the price is stuck around its 200 EMA, but well above a bullish 20 SMA and with the technical indicators heading higher above their mid-lines, supporting further advances, particularly on a break above 0.7140.

Support levels: 0.7090 0.7050 0.7020

Resistance levels: 0.7140 0.7190 07230

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.