EUR/USD Current price: 1.0948

View Live Chart for the EUR/USD

The dollar posted limited advances in the European opening, mostly helped by a slump in commodities, triggered by Chinese Manufacturing PMI, printing a 2-year low of 47.8 in July. In Europe, the release of the local PMI figures showed that manufacturing in the region ticked higher, despite Greek manufacturing PMI resulted at 30.2 in July. The greenback resumed its advance as the session went through, albeit posting limited gains until the release of the US PCE figures. The data showed that personal income climbed 0.4% against 0.3% estimated, whilst spending resulted at 0.2% as expected. The PCE price index ticked higher compared to a year before, resulting at 1.3% whilst monthly basis came out at 0.3%, also slightly above the previous one. It's still pending the release of the US Markit Manufacturing PMI, Construction spending, and a speech from FOMC's Powell. In the meantime, the EUR/USD short term picture is bearish, as the 1 hour chart shows that the price remains near its daily low and below its moving averages, whilst the technical indicators stand below their mid-lines, albeit lacking directional strength. In the 4 hours chart, the technical indicators turned south around their mid-lines, whilst the 20 SMA maintains a strong bearish slope above the current level, supporting additional declines.

Support levels: 1.0920 1.0890 1.0850

Resistance levels: 1.1000 1.1050 1.1080

GBP/USD Current price: 1.5578

View Live Chart for the GPB/USD

The GBP/USD pair triggered some short term stops below the 1.5600 level, and fell down to 1.5565, finding some limited intraday demand around its 4 hours 200 EMA. Earlier in the day, the UK also released its PMI figures, which resulted slightly above expected in July, at 51.9 posting the smallest advance in over a year. Technically, the 1 hour chart shows that the price develops below a bearish 20 SMA, although the technical indicators aim higher in negative territory. In the 4 hours chart however, the risk remains towards the downside as the technical indicators have extended below their mid-lines, whilst the 20 SMA gains bearish slope above the current price. Should the price extend below its 200 EMA, the next bearish target comes at 1.5520, with a break below this last probably fueling the decline towards the 1.5470/80 region.

Support levels: 1.5560 1.5520 1.5475

Resistance levels: 1.5600 1.5635 1.5670

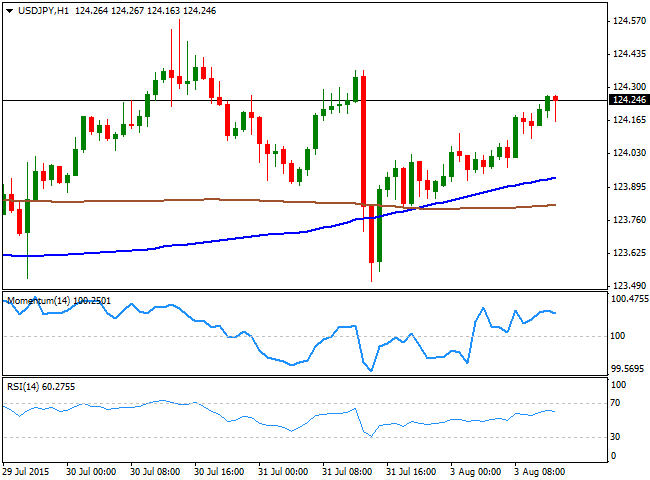

USD/JPY Current price: 124.24

View Live Chart for the USD/JPY

Going nowhere above 124.00. The USD/JPY pair surged above the 124.00 level this Monday, as dollar strengthen against most of its major rivals, even before the release of better-than-expected US PCE inflation figures. The data however, failed to boost the greenback that anyway maintains a positive tone across the board. Technically the 1 hour chart shows that the price has extended further above a bullish 100 SMA that crossed above the 200 SMA, with the shortest capping the downside around 124.00. In the same chart the technical indicators are turning lower near overbought levels, but remain far from suggesting a downward corrective movement underway. In the 4 hours chart, the Momentum indicators diverges from price action, heading lower around its mid-line while the RSI indicator consolidates around 58. A steadier advance above 124.45, the immediate resistance, is required to confirm a stronger advance, but chances are limited at the time being, whilst the downside seems also limited by buying interest around 123.70/124.00.

Support levels: 124.00 123.70 123.30

Resistance levels: 124.45 124.90 125.30

AUD/USD Current price: 0.7265

View Live Chart for the AUD/USD

The AUD/USD broke below the 0.7300 level during the past Asian session, with the Aussie weighed by poor Chinese manufacturing data and falling metals, albeit movements across the board have been quite limited so far in the day. Nevertheless, the bearish bias is clear intraday, as the 1 hour chart shows that the price is well below a strongly bearish 20 SMA, whilst the technical indicators head south below their mid-lines. In the 4 hours chart, the price is also below a bearish 20 SMA while the technical indicators head slightly lower below their mid-lines, supporting a decline towards fresh lows.

Support levels: 0.7250 0.7220 0.7190

Resistance levels: 0.7300 0.7340 0.7375

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.