EUR/USD Current price: 1.1162

View Live Chart for the EUR/USD

The dollar found some limited demand in quite thin trading, higher against most of its rivals in the European morning with London off on holidays. Earlier in the day, European PMIs come out mixed, with German and EU ones beating expectations, but showing an increased slowdown in France, Spain and Greece. Ahead of the US opening, the EUR/USD trades near a daily low set at 1.1122, and the 1 hour chart shows that the price stands below its 20 SMA but bouncing from a bullish 100 SMA, the immediate support around 1.1120. In the same chart, the technical indicators are aiming north well below their mid-lines, and far from suggesting additional gains at the time being. In the 4 hours chart, the pair broke below its 20 SMA, currently around 1.1200, whilst the Momentum indicator heads lower below 100 and the RSI turns flat around 54. The immediate support stands at 1.1120, and the downward risk will remain limited as long as above it, albeit a recovery above 1.1200 is required to see bulls retaking the lead.

Support levels: 1.1120 1.1085 1.1050

Resistance levels: 1.1160 1.1200 1.1245

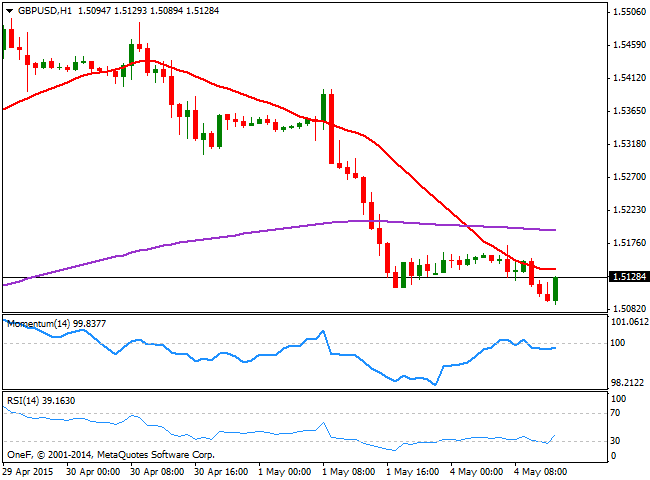

GBP/USD Current price: 1.5128

View Live Chart for the GBP/USD

The GBP/USD pair bounces from 1.5093, its daily low accumulating around 500 pips of steady decline ever since flirting with the 1.5500 level last Thursday. The technical picture continues to favor the downside, despite in the 1 hour chart, the RSI aims higher from oversold territory, as the price stands below its 20 SMA whilst the Momentum indicator heads lower 100. In the 4 hours chart the 20 SMA turned sharply lower well above the current level, whilst the technical indicators are fading its latest upward corrective movement near oversold territory.

Support levels: 1.5060 1.5020 14980

Resistance levels: 1.5130 1.5170 1.5210

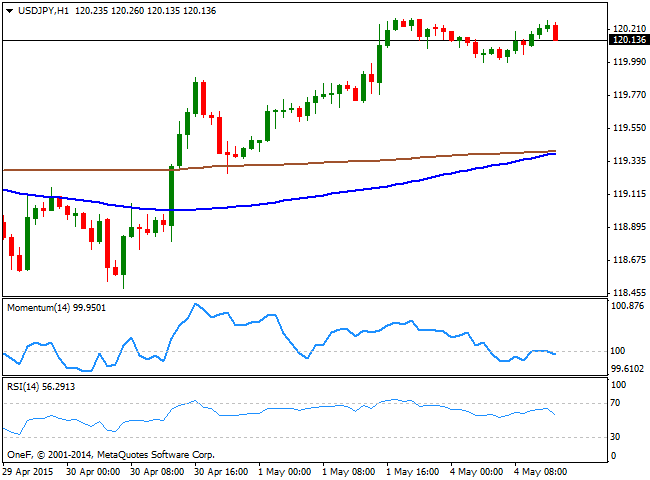

USD/JPY Current price: 120.13

View Live Chart for the USD/JPY

The USD/JPY pair retraces from the highs in the 120.30 price zone, consolidating its recent gains. Having set a daily low at 119.99, the 1 hour chart shows that the technical indicators are turning lower around their mid-lines, whilst the price stands well above its 100 and 200 SMAs, both converging in the 119.40 region. In the 4 hours chart the technical indicators are retracing from overbought territory, but far from suggesting a bearish move, whilst the price holds well above its moving averages, which lack clear directional strength at the time being. The pair needs to break above 120.45 to gain upward momentum, whilst a break below 120.00 should favor additional declines towards the 119.40/60 price zone.

Support levels: 120.00 119.65 119.30

Resistance levels: 120.45 120.85 122.10

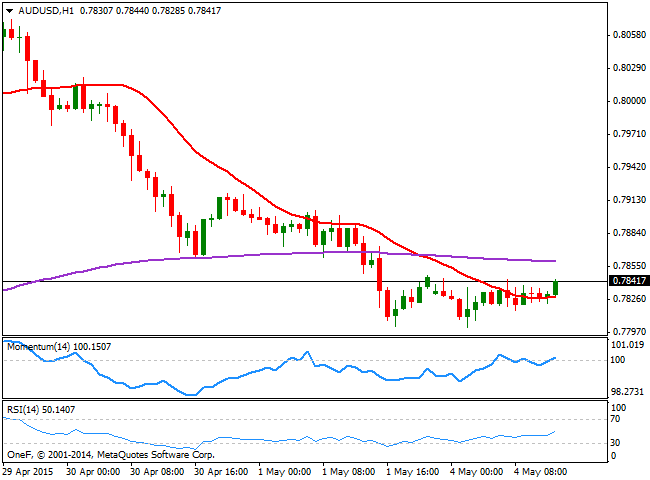

AUD/USD Current price: 0.7804

View Live Chart for the AUD/USD

The AUD/USD pair trades lower in range, consolidating around the 0.7800 figure. The RBA will have its monthly economic policy meeting, and market expects a rate cut coming from Governor Stevens. Technically, the 1 hour chart shows that the technical indicators are aiming higher around their mid-lines, whilst the price stands a few pips above a flat 20 SMA. In the 4 hours chart a mild positive tone comes from the technical indicators that aim higher below their mid-lines, albeit the price stands well below a bearish 20 SMA, currently around the 0.7900 figure.

Support levels: 0.7800 0.7770 70.7730

Resistance levels: 0.7860 0.7900 0.7940

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.