EUR/USD Current price: 1.1070

View Live Chart for the EUR/USD

US GDP figures missed expectations, with growth in the first quarter sharply lower: the economy grew just 0.2% according to the first reading of the Q1 for 2015, driving the EUR/USD to a fresh monthly high on the 1.1070 area. The pair retreated from the level, but held well above the 1.1000 figure, now looking for fresh highs. Technically, the 1 hour chart shows that the technical indicators head strongly higher, with the RSI in extreme overbought territory, whilst the 20 SMA provides intraday support around 1.0990. In the 4 hours chart, the bias is also higher, despite indicators are in overbought territory, supporting additional advances up to the 1.1120 price zone.

Support levels: 1.1045 1.1000 1.0950

Resistance levels: 1.1085 1.1120 1.1160

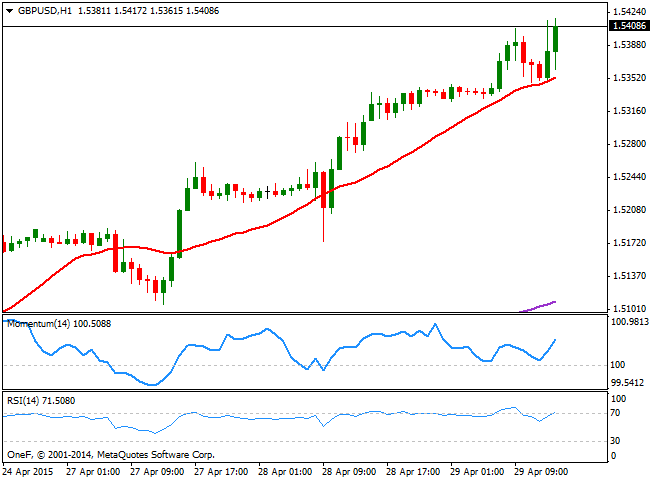

GBP/USD Current price: 1.5409

View Live Chart for the GBP/USD

The GBP/USD extended its early advance to a fresh multi-week high after worse than expected US GDP figures, stabilizing above the 1.5400 level and with the 1 hour chart showing that the 20 SMA has been providing intraday support, now around 1.5350, whilst the technical indicators head sharply higher after correcting overbought levels. In the 4 hours chart the strong upward momentum prevails, with the RSI heading higher around 84 and the Momentum indicator also heading strongly up in overbought levels. The pair can now extend up to 1.5500, a critical resistance level.

Support levels: 1.5385 1.5340 1.5300

Resistance levels: 1.5430 1.5465 1.5500

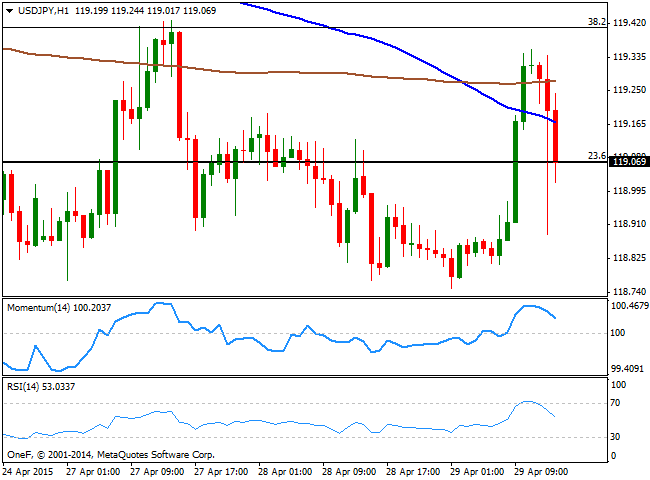

USD/JPY Current price: 118.95

View Live Chart for the USD/JPY

The USD/JPY pair trades around the 119.00 figure, having recovered from a low set at 118.88 following the macroeconomic news. The pair continues to lack directional strength, and the 1 hour chart shows that the price failed to run above its moving averages, whilst the technical indicators head sharply lower after reaching overbought territory. In the 4 hours chart indicators have turned lower around their mid-lines, albeit as long as between 118.50/120.00 playing the range is the only option.

Support levels: 118.50 118.10 117.70

Resistance levels: 119.10 119.50 120.00

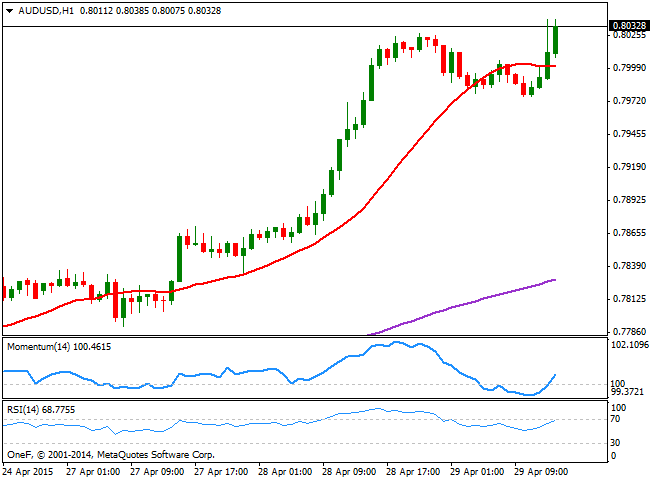

AUD/USD Current price: 0.8032

View Live Chart for the AUD/USD

The AUD/USD trades above the 0.8000 level, maintaining the bullish potential seen earlier this week. The strong comeback in metals, with gold and iron-ore prices sharply higher on Tuesday, are supporting the Aussie, alongside with Chinese stimulus. Technically, the 1 hour chart shows that the price advances above its 20 SMA whilst the technical indicators crossed their mid-lines towards the upside, favoring the ongoing upward strength. In the 4 hours chart the technical indicators are also heading higher despite being in overbought territory, all of which suggest the pair can extend up to 0.8160 during the upcoming sessions, a key midterm resistance level.

Support levels: 0.7990 0.7940 0.7900

Resistance levels: 0.8065 0.8100 0.8130

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.